Market Data

February 20, 2025

SMU Survey: Mills slam door on buyers looking to talk price

Written by Ethan Bernard

Mills’ flexibility on prices for spot orders has taken a nosedive to levels not seen in nearly two years.

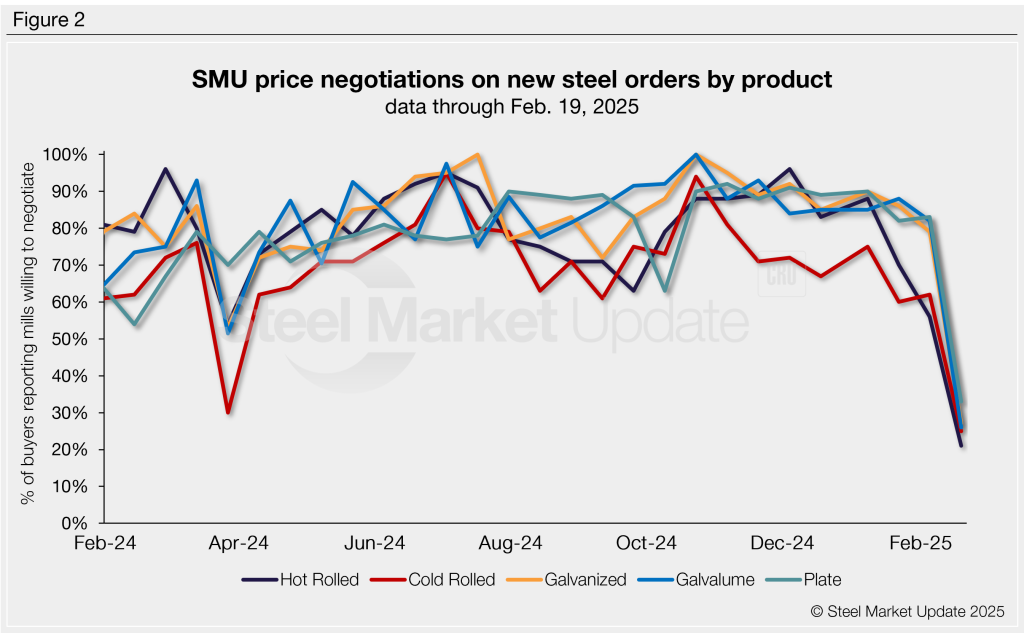

Negotiation rates have crashed for all of the steel products SMU covers, according to our latest survey data. Galvanized, Galvalume, and plate all notched declines of 50+ percentage points.

We saw in our pricing article this week that President Trump’s tariff actions are having an effect on the market. Along with the higher prices, mills’ flexibility on tags often goes down in tandem. This week, there has been a stunning drop in the negotiation rate compared to our previous survey two weeks ago.

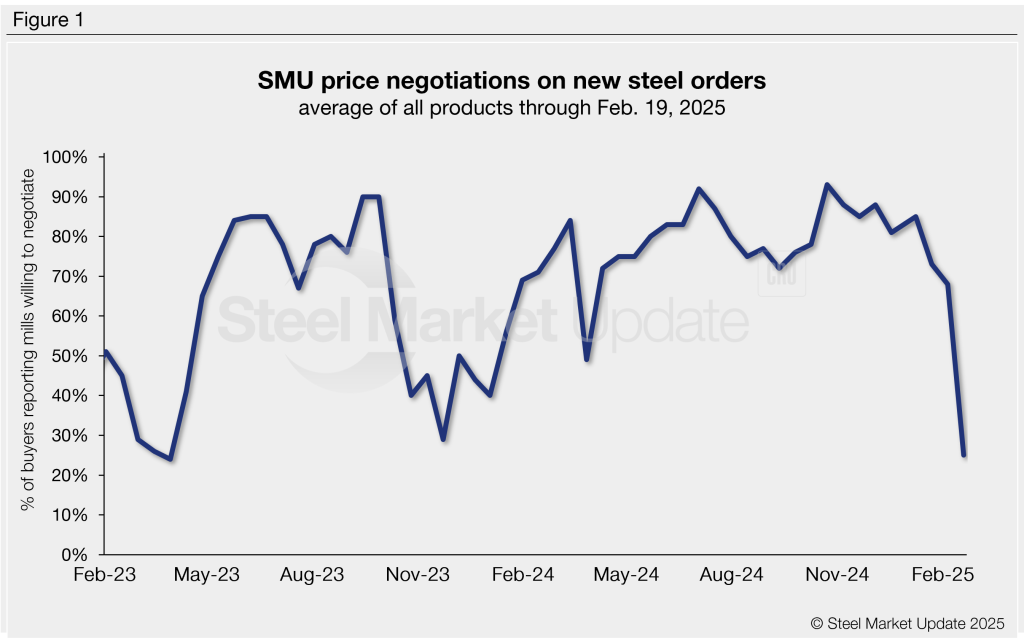

Every other week, SMU polls buyers, asking if domestic mills are willing to negotiate lower spot pricing on new orders. As shown in Figure 1, 25% of the participants surveyed this week said mills were willing to talk price on new orders. This is down a whopping 43 percentage points from our last survey and the lowest rate since March 31, 2023, when it registered 24%. For comparison, the lowest negotiation rate in 2024 was 40% in January last year.

Negotiation rates by product

As noted, negotiation rates plummeted for all the products our survey covers (Figure 2). Negotiation rates by product this week are:

- Hot rolled: 21%, down 35 percentage points from Feb. 5 and the lowest rate since the end of March 2022. Recall that this was at the starting phase of the Russian invasion of Ukraine.

- Cold rolled: 25%, down 37 percentage points.

- Galvanized: 27%, down 52 percentage points.

- Galvalume: 26%, down 56 percentage points.

- Plate: 33%, down 50 percentage points.

Steel buyer remarks:

“Order books have yet to open (on HR) for April at some mills, while others have capacity, but the number is the number.”

“Most mills are holding off on offers (on HR and CR). Expecting they will open once they announce increases.”

“They were willing to lock in pricing (on HR) for Q2.”

“Can’t get quotes (on HR, CR, and galv).”

“Received multiple letters last week announcing price increases are coming (on HR).”

“Every (plate) mill has totally flipped – they went from begging for orders to not even answering quotes.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website for an interactive history of our steel mill negotiations data.