Market Data

April 2, 2025

SMU Survey: Mills unlikely to budge on price, buyers say

Written by Brett Linton

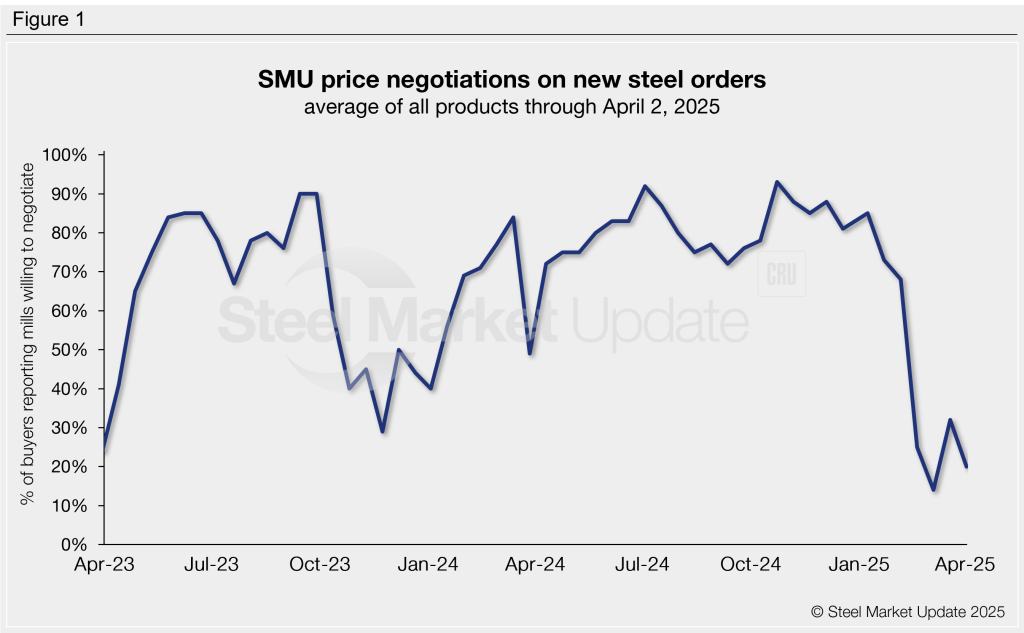

Four out of every five steel buyers who responded to our latest market survey say domestic mills are unwilling to negotiate on new order spot pricing. Mills have shown little flexibility on pricing for nearly two months.

Up until January, buyers had held the bargaining power for nearly a year. That changed in February when President Trump’s tariff plans were announced, and domestic steel prices began to climb. Negotiation rates declined from there, reaching a near-two-year low by early March. While we saw a slight uptick two weeks ago, negotiation rates have since fallen again.

Every other week, SMU surveys thousands of steel buyers asking if domestic mills are negotiable on new order pricing. This week, only 20% of our respondents said mills were flexible on pricing (Figure 1). This is down 12 percentage points from our mid-March survey and one of the lowest levels recorded across the past two years.

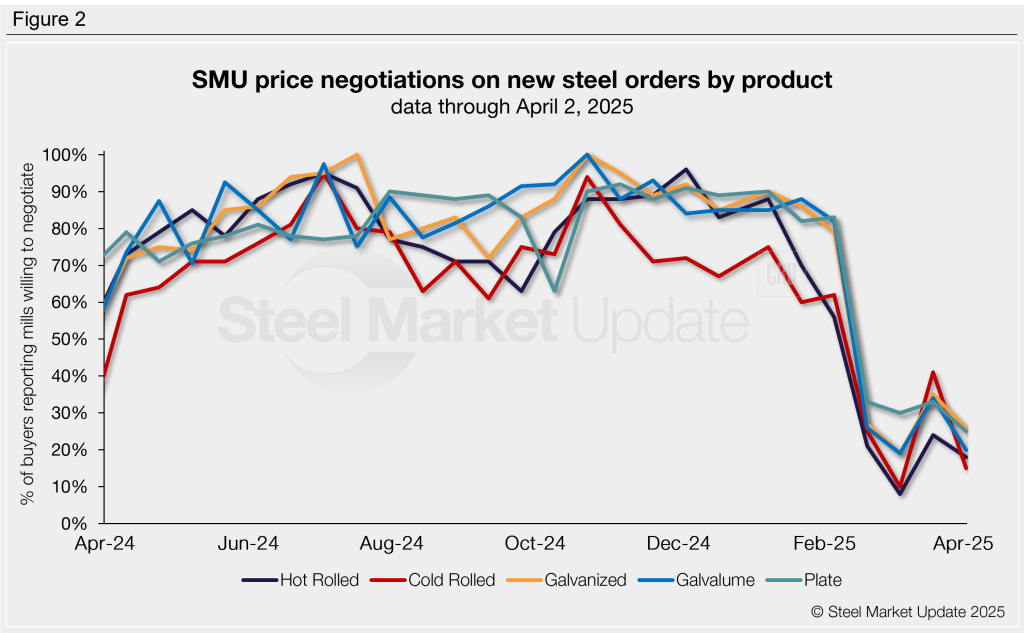

Negotiation rates by product

Negotiation rates were lowest this week for cold-rolled and hot-rolled products. Just a month ago, rates for all sheet and plate products we measure fell to lows not seen in over a year (Figure 2). Negotiation rates this week are as follows:

- Hot rolled: 18%, down six percentage points from mid-March. Compare this to the three-and-a-half-year low of 8% recorded in early March.

- Cold rolled: 15%, down 26 percentage points, marking the second-lowest rate seen in the past year.

- Galvanized: 26%, down nine percentage points, now at the second-lowest rate seen in the last 18 months.

- Galvalume: 20%, down 14 percentage points, just above a 16-month low.

- Plate: 25%, down eight percentage points, now the lowest rate recorded in two years.

Buyer remarks:

“Not negotiable on hot and cold rolled. The price is the price, but tons are readily available.”

“Mills are negotiable, they are reaching out to offer [hot-rolled] tons/availability.”

“Sparse spot galvanized availability, mills are slow in quoting.”

“More tons will help [galvanized] pricing.”

“We aren’t bringing in much mill direct [plate] right now, but they all certainly seem hungry again.”

“Mills aren’t quoting new plate business.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.