Analysis

April 4, 2025

Scrap market chatter this month

Written by Ethan Bernard

In the final week in March, SMU polled scrap buyers on an array of topics, including market prices, demand, tariff policies, logistics, etc.

Rather than summarizing the comments we collected, we are sharing them in each buyer’s own words, as well as providing you with a sampling of the survey results analysis available here.

Want to have your voice heard? Contact david@steelmarketupdate.com to be included in our market questionnaires. Already in its third month, the scrap market survey continues to gain steam. We can’t wait to hear from you.

Note that these responses all came in pre-Liberation Day. Grab some popcorn and tune in next month to see what happens next!

Where will busheling prices be in April?

“Demand, tariff fears.”

“Mills would be silly to push scrap down if they want to maintain current, finished pricing.”

“Expecting the market to be down $15-20 for April.”

“All other commodities dropping and mill outages.”

“Spring melt will free up scrap. Slowed auto production could still push the number for primes a little higher. Some strength to the iron ore market could also lend to stabilizing prices.”

“I think signals are mixed right now and overall uncertainty will have things volatile, but within certain parameters.”

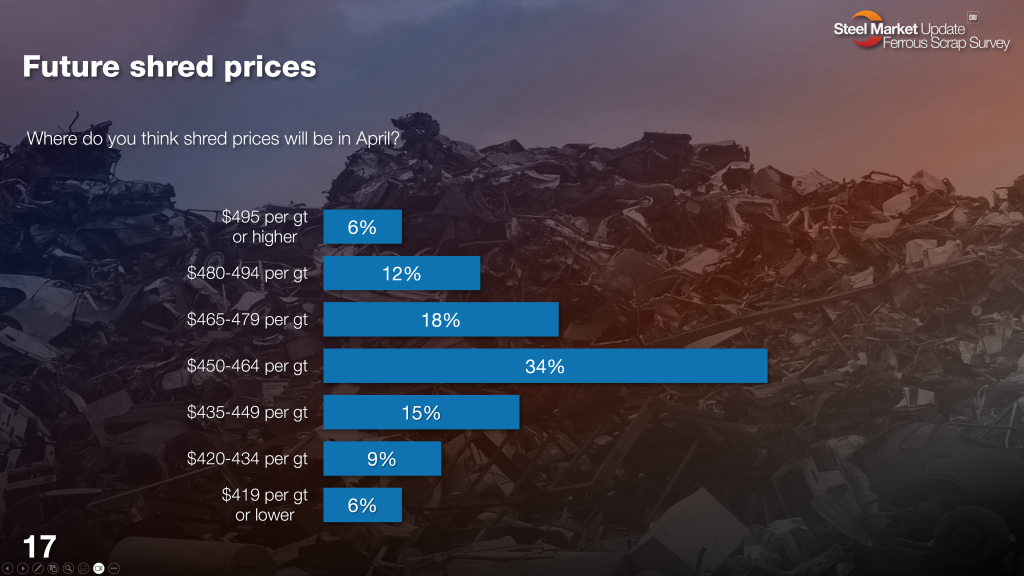

Where will shred prices be in April?

“Increased supply and flow of obsolete scrap.”

“Shred will fall $10 more than prime.”

“Oversupplied.”

“Impact of tariffs and less automotive scrap due to slowdown in manufacturing.”

“Feedstock flowing and shredders dropping prices to get back a bit of margin from first two months of the year. Mills, I believe, know this and will try to take advantage. New steel on decline.”

Where will HMS prices be in April?

“Prices have already dropped.”

“Will follow shred.”

“Hearing down $20 for obsolete grades in multiple places. Exports are slow.”

“Not as much movement as primes.”

“HMS will be close to sideways. P&S will, however, drop because of oversupply.”

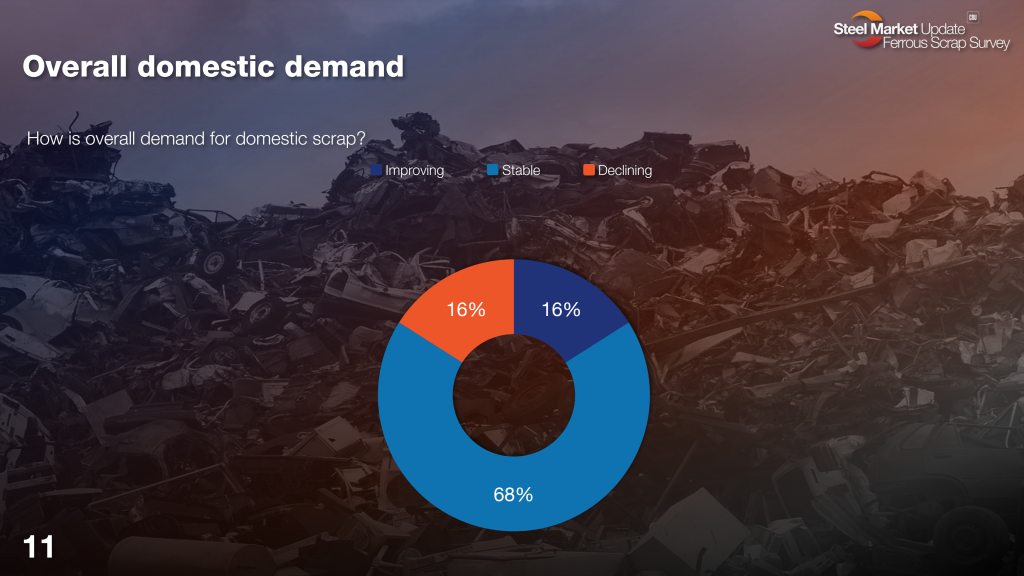

How is overall demand for domestic scrap?

“Stable to down. Will be dependent on what happens with overall tariffs.”

“Depends on level of imported scrap and level of exports.”

“Correction. Reflecting stability.”

“Tariffs.”