CRU

April 25, 2025

CRU: Chinese steel export prices mixed, although local buying improves

Written by Anton Perevezentsev & Linda Lin & Puneet Paliwal

Chinese export prices for longs were almost steady this week, while those for flats generally declined as producers cut prices to secure deals.

Export prices for longs were either stable or up marginally, tracking a small rally in domestic prices. The rally followed Trump’s remarks this week about a likely significant reduction for tariffs on Chinese products.

A shortage of rebar of certain specification was observed thanks to improved local sales especially after a Wednesday rally in futures prices. Rebar supply may further tighten in May, if considering strong billet export orders received by Chinese longs producers, according to market sources.

Other than Southeast Asia, the Middle East was also among the main export destinations for Chinese billets. Turkey and Saudi Arabia recently saw growing demand for Chinese billets, with deals of several cargoes reported at about $460/tons CFR in the past two to three weeks.

Among flat products, hot-rolled (HR) coil dipped by 0.2% week over week (w/w), while cold-rolled (CR) coil, hot-dip galvanized (HDG) and medium plate dropped by 0.9%-1.6% w/w. Overseas demand for CR coil and HDG was lukewarm over the past week. Abnormally high spread between CR coil and HR coil started to narrow amid restrained demand for CR coil and rising domestic inventories.

Domestically, overall demand saw some improvement. According to the weekly mill survey conducted by CRU, 89% of respondents noted better local sales w/w, compared with previous reading of just 33%. But it remained unclear whether this will be sustained, due to uncertainties around the tariff war and Chinese economic policies.

Indian mills focus more on domestic sales

Indian HR coil export offers stayed unchanged w/w at $495/t FOB as no new deals were reported. Domestic demand is stable and market participants expect it to increase as the 12% safeguard duty on flat steel imports came into effect from April 21, for a 200-day period.

Domestic HR coil prices are at a significant premium to export prices, particularly to the Middle East. Thus, mills have been allocating more of their volumes to the local market.

CRU market contacts suggest that one Indian mill resumed offering HR coil to the European market at an increase of $40–$50 /t over the last deal price. Importers in the EU are unwilling to accept this price hike as demand conditions have not yet improved in the region, while lead times being offered by Indian suppliers are quite stretched.

Turkish prices fell amid weak demand and lower scrap prices

Turkish HR coil export prices reduced by $5/t w/w to $570/t as purchasing activity softened in the past two weeks. Uncertainty around the US tariff policy continued to impact activity across different markets.

While Turkish sheet was relatively attractive in the European market, buying interest among consumers remained limited amid low real demand and sufficient stocks that entered the market with the opening of Q2 safeguard quota on April 1.

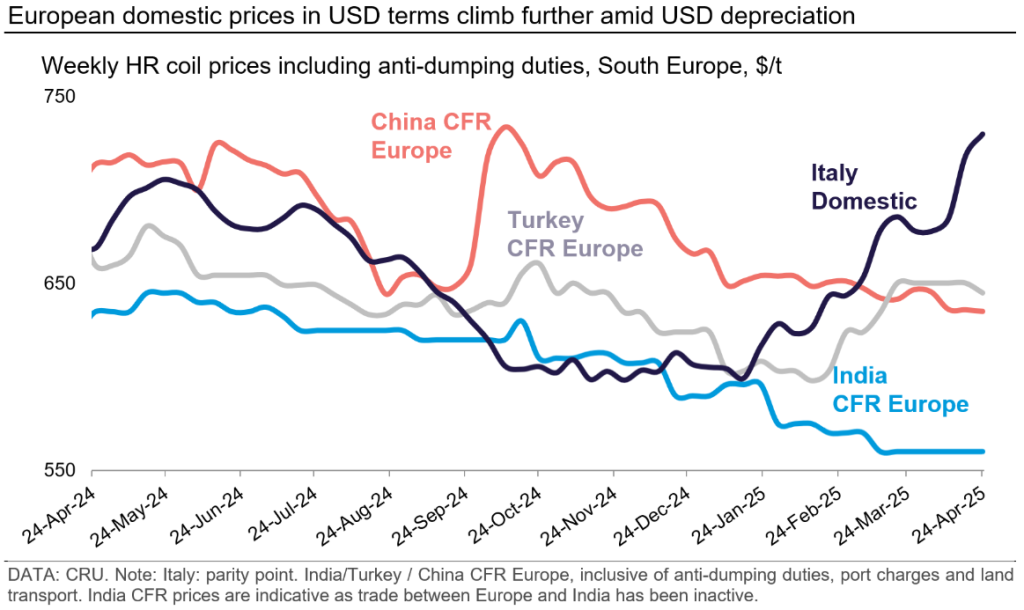

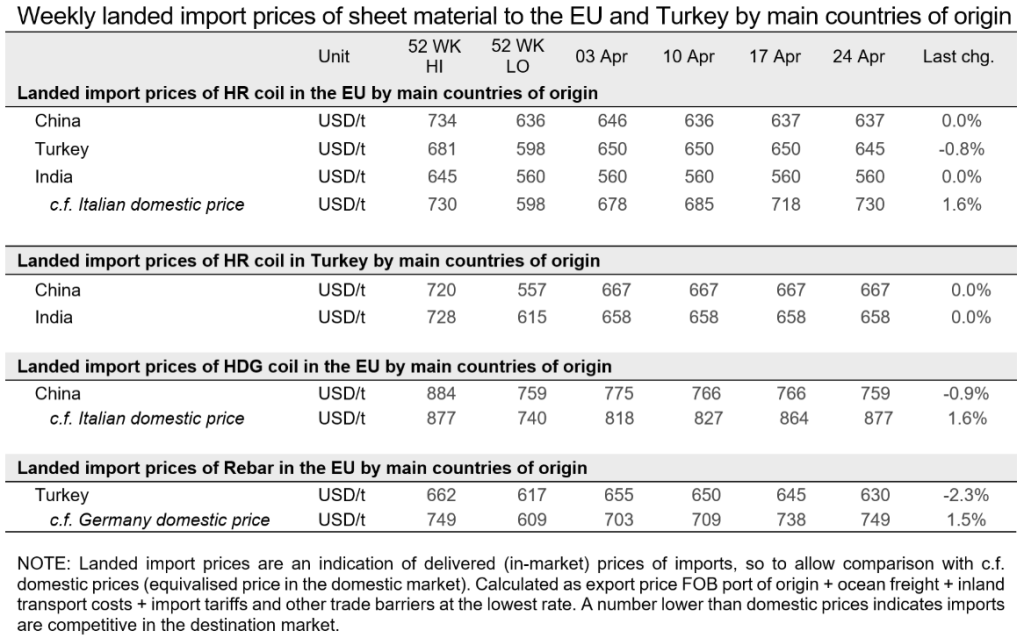

Turkish HR coil delivered to Southern Europe was at a discount of around $80/t this week, duties included, compared to the locally supplied material.

Turkish rebar export prices dropped further by $15/t w/w to $560/t. The downtrend was attributed to a sharp fall in import scrap prices, observed over the past two weeks. Buying interest has continued to come from Yemen, Southeast Europe and East Africa, however, export sales have been slow as buyers have been expecting further price drops.

China price detail

HR coil: An average of nine price points for HR coil were collected daily during the week. On Thursday, seven offers for SS400 3mm gauge HR coil and one deal price were included in the final calculation. CRU set the spread between offer and bid at $10/t this week to reflect the actual market level.

Rebar: A total of 12 price points were collected for the weekly assessment, including 10 offers, one deal price and one indication. Eight offers and one deal price were included in the final calculation, with the rest excluded for standard or shipment date not in line with CRU’s definition for this price. The indication was collected for reference but not included in the final calculation according to CRU’s methodology for this price. The offer/bid spread was unchanged at a normal level of $10/t to reflect actual market level.

CR coil: A total of 21 price points for SPCC 1.0mm gauge CR coil were collected over the past week, 16 offers and four deal prices were included in the final calculation. The rest were for CR coil prices out of date, therefore were excluded from the final assessment according to CRU’s methodology for this price. CRU set the spread between offers and bids at $10/t to reflect the actual market level.

HDG coil: A total of 13 price points for SGCC 1.0mm gauge HDG coil were collected over the week, among which seven offers were included in the final calculation. The remaining were for HDG coil with coating different from Z120 or for other grade or beyond main-streaming market levels, therefore were not in line with CRU’s definition for the price. CRU set the spread between offers and bids at $10/t to reflect the actual market level.

Medium plate: A total of 16 price points were collected to assess the weekly price, including five price points and two indicative price points and nine offers. One deal price was excluded as it was not representative. Two indicative price points were excluded given CRU’s methodology for this price. The offer/bid was set at $5 to reflect the actual market level.

Structurals: A total of 12 price points were collected to assess the weekly prices, including six offers, five indicative prices and one deal price. The five indicative prices were excluded from the final calculations given CRU’s methodology for the prices, three offers were excluded for being above market levels. The offer/bid spread was set at $10 for UK grade H-beam and $8 for Japanese grade H-beam to reflect actual market levels.

Low carbon wire rod: A total of 19 price points were collected for the weekly assessment, including 14 offers, four deal prices and one indication. Thirteen offers and three deal prices were included in the final calculation, with the rest excluded for not being representative of the prevailing market levels by using expert judgement or being outdated numbers. The indication was collected for reference but not included in the final calculation according to CRU’s methodology for this price. The offer/bid spread stayed unchanged at a normal level of $5/t to reflect actual market levels.