Analysis

June 11, 2025

Apparent steel supply edged lower in April, remains strong

Written by Brett Linton

The amount of finished steel entering the US market in April declined 3% from March but remained at elevated levels, according to SMU’s analysis of US Department of Commerce and American Iron and Steel Institute (AISI) data.

This measure, known as apparent steel supply, is calculated by combining domestic mill shipments and finished US steel imports and subtracting total US exports.

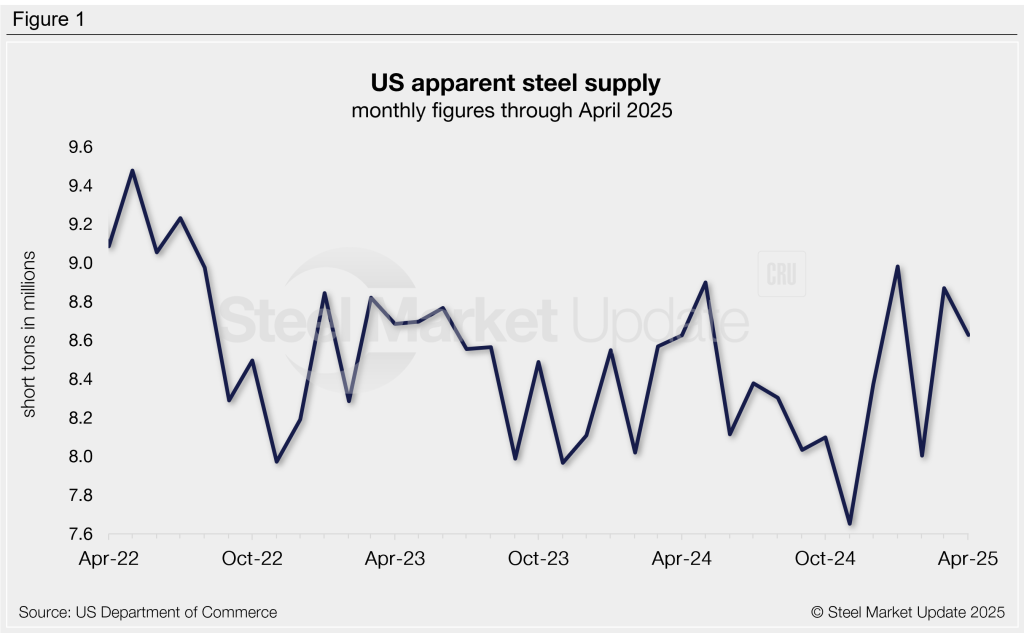

Apparent supply totaled 8.63 million short tons (st) for the month of April, one of the higher monthly volumes seen in the past year. April supply is 4% below the multi-year high witnessed in January and almost identical to the same time last year.

Supply has fluctuated within a stable range over the past three years, averaging 8.49 million st per month during that time (Figure 1). However, we have seen increased volatility in recent months; supply fell to a near four-year low last November (7.65 million st), then rebounded to a two-and-a-half year high in January (8.98 million st). For context, the highest monthly supply in our 15-year data history was 10.90 million st in October 2014, while the lowest was 6.52 million st in April 2020.

Trends

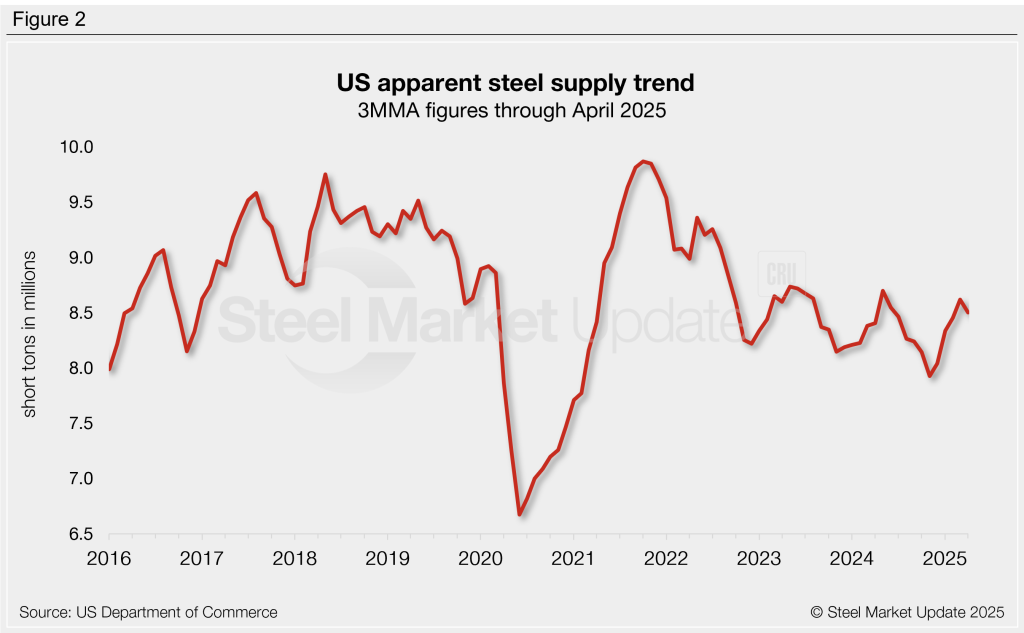

To smooth out monthly fluctuations and better highlight underlying trends, supply can be calculated on a three-month moving average (3MMA), as shown in Figure 2. On this basis, supply has generally trended downward since peaking at 9.87 million st in late-2021. It fell to a four-year low of 7.93 million st last November. Following March’s 10-month high, the 3MMA eased to 8.50 million st through April. In comparison, the 3MMA stood at 8.40 million st one year prior and 8.60 million st two years ago.

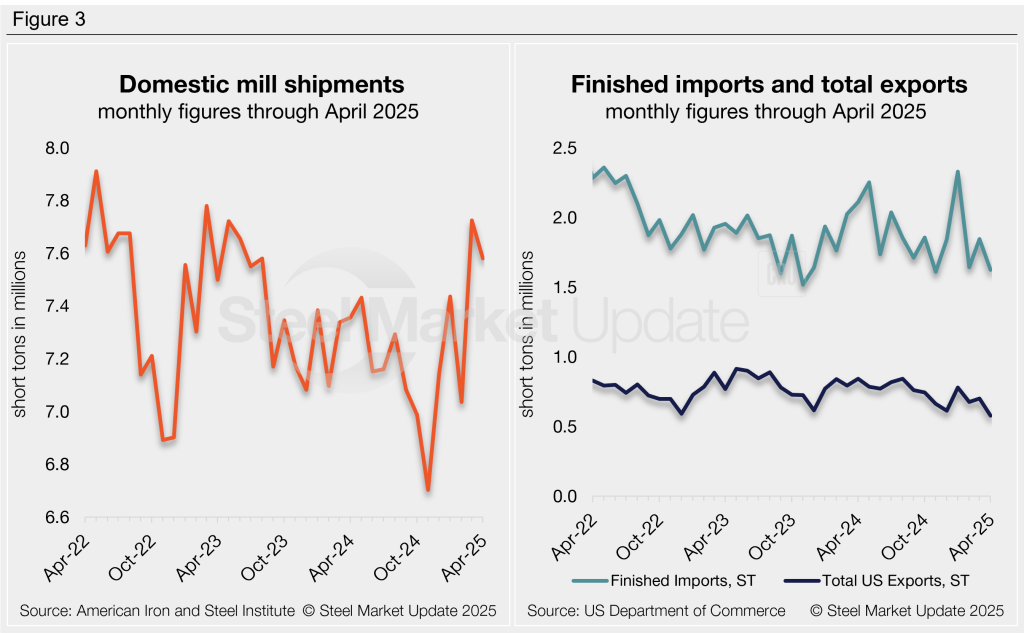

Figure 3 shows the individual components of apparent supply. April’s decline was driven mainly by a drop in finished steel imports, followed by a reduction in domestic shipments. A decrease in exports helped offset the overall decline in supply.

- Domestic shipments fell 2% (145,000 st) in April from March’s two-year high, accounting for 88% of total supply.

- Finished steel imports declined 12% (221,000 st) in April to a five-month low.

- Steel exports tumbled 17% (123,000 st) from March to the lowest rate recorded since July 2020.

- Net imports (finished imports minus exports) made up 12% of April’s supply, down from the previous month (13%) as well as one year ago (15%).

To see an interactive graphic of our apparent steel supply history, click here. If you need any assistance logging into or navigating the website, contact us at info@steelmarketupdate.com.