Analysis

June 16, 2025

May service center shipments and inventories report

Written by Estelle Tran

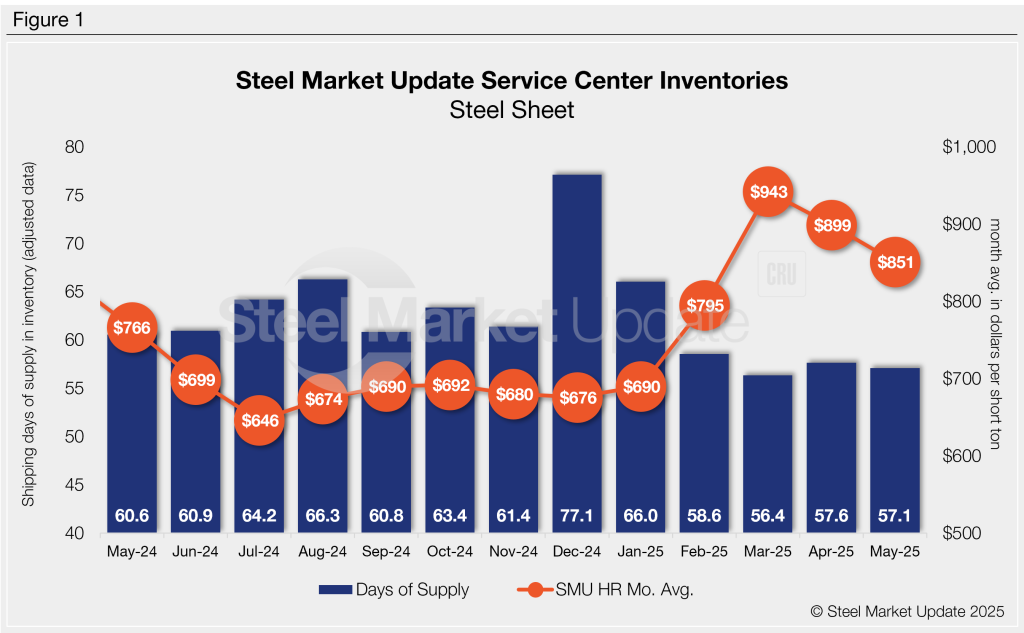

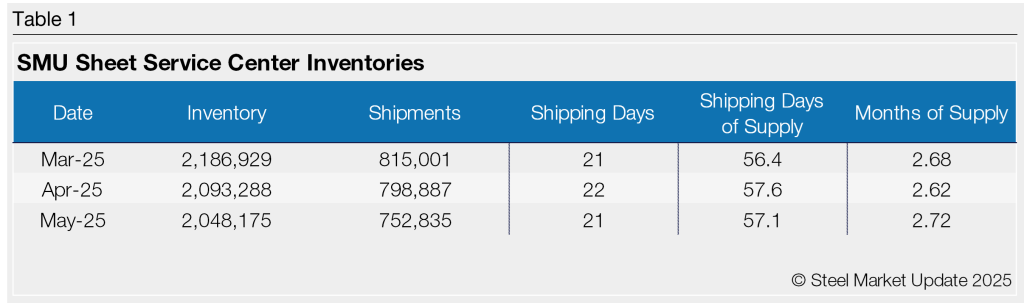

Flat rolled = 57.1 shipping days of supply

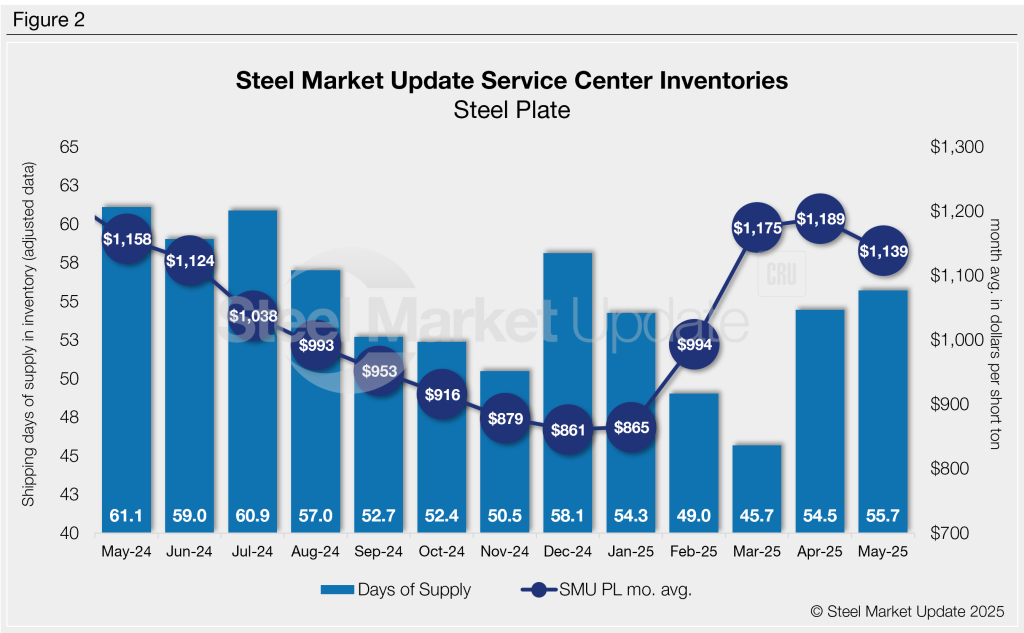

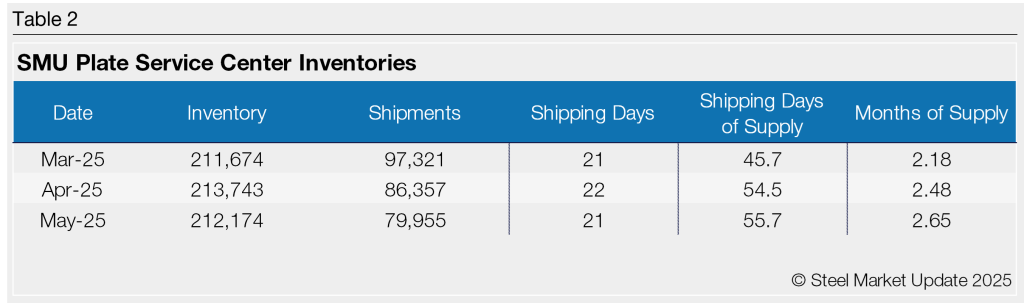

Plate = 55.7 shipping days of supply

Flat rolled

US service centers reined in flat roll supply in May, coinciding with declining shipments. At the end of May, service centers carried 57.1 shipping days of supply, according to adjusted SMU data. That’s down slightly from 57.6 shipping days in April. Flat roll inventories represented 2.72 months of supply, up from 2.62 months in April.

May had 21 shipping days, compared to April’s 22. Shipments continued to decrease month over month, as end-users fulfilled their needs with the additional buying before tariffs hit. In the latest SMU survey published May 30, 55% of service centers reported manufacturing customers were reducing orders, compared to 25% a month prior. The survey also found that 65% of service centers said their customer releases were down compared to a year ago.

With moderate demand expectations and ongoing pricing uncertainty in the domestic and import markets, service centers remained focused on cutting or maintaining inventory levels.

At the end of May, 35% of service centers said they were reducing inventory and 65% were maintaining inventory. A month before, 14% of service centers said they were reducing inventory, and 86% of service centers said they were maintaining inventory. Service centers cut back on new orders. At the end of May, service centers fewer shipping days of supply on order vs. April.

Despite the slight reduction in inventories, flat-rolled steel supply remains higher than the historical average of 55 shipping days of supply. With a surplus of inventory, material on order edged lower in May. Flat roll on order at the end of May represented 37 shipping days of supply, down from 38.7 shipping days in April. The scaling back of new orders is evident in lead times. SMU’s end-of-May survey found hot-rolled coil lead times were 4.2 weeks, down from 5.11 weeks the month before.

This trend of reducing new orders may be turning around with the doubling of Section 232 steel tariffs on June 4 boosting orders.

Plate

US service center plate supply edged up slightly month on month, though inventories remain lean. At the end of May, service centers carried 55.7 shipping days of supply on an adjusted basis, up from 54.5 shipping days of supply in April. Months of supply rose to 2.65 in May from 2.48 in April.

The modest rise in supply reflects lower shipments, while total inventories were relatively flat. Shipments slowed in May with the daily shipping rate dropping 3% m/m. This reflects sufficient customer inventories and uncertain outlooks for demand.

Still, supply is significantly lower than last year in May, when service centers carried 61.1 shipping days of supply. Plate supply last month was more comparable to May 2023 levels, when service centers carried 55.4 shipping days of supply and 2.52 months of supply. May 2023 was also the high point for the year for plate prices, according to CRU data.

Lead times contracted in May, reflecting lower buying interest. At the end of May, plate mill lead times were 5.15 weeks, according to SMU data, down from 5.88 weeks the month before.

Plate inventory and shipments remain in balance, which has helped to support plate prices. Material on order also remained flat vs. April shipping days of supply on order, an indication of further stability for service center plate inventories.