Prices

July 9, 2025

Trump increases Brazil tariff to 50%, sparking questions about pig iron prices

Written by Michael Cowden

President Donald Trump on Wednesday said he would increase the “reciprocal” tariff on imports from Brazil to 50% effective Aug. 1.

The South American nation, like most other countries, had previously been subject to a 10% tariff.

“Please understand that the 50% number is far less than what is needed to have the Level Playing Field we must have with your Country,” Trump wrote in a letter addressed to current Brazilian President Luiz Inacio Lula da Silva.

“If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 50% that we charge,” Trump added.

Trump blamed the tariff escalation on what he characterized as a “Witch Hunt” against former Brazilian President Jair Bolsonaro, a right-wing populist who stands accused of staging a coup. He also insisted that Brazil’s barriers to US exports amounted to a threat to US national security.

What does it mean for pig iron?

Brazilian finished steel and semi-finished steel (notably slab) had already been subject to a 50% Section 232 tariff. The S232 tariff, however, did not apply to raw materials such as pig iron.

Brazilian pig iron prices were approximately $401 per metric ton (mt) FOB “and under pressure” in June, said Thais Terzian, principal analyst, steel, at SMU’s parent company, CRU.

“So, there is little room for big discounts on the Brazilian side to accommodate the additional tariff,” she added.

One trader told SMU that no pig iron would be sold to the US after Aug. 1. He added that prices could surge for material delivered prior to that date.

A precedent in slabs?

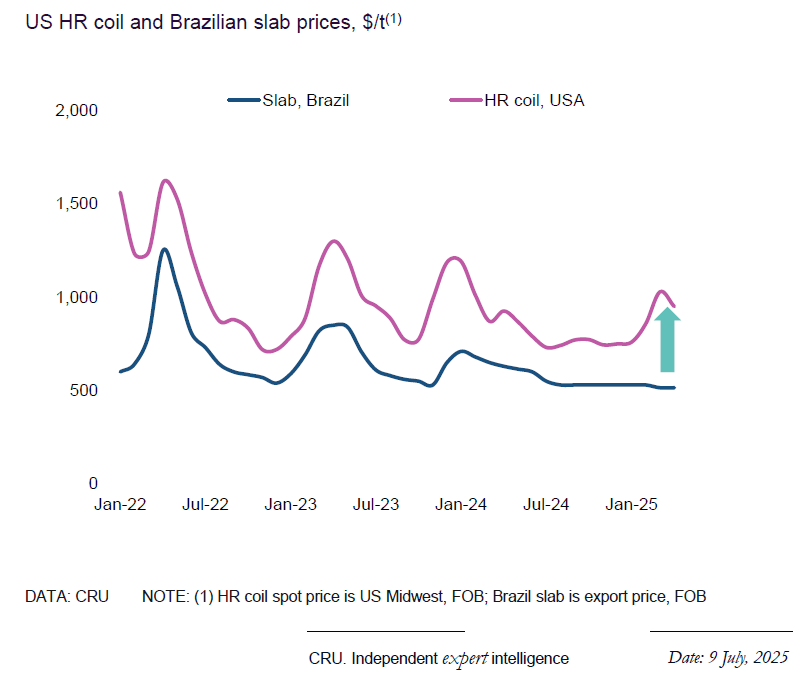

Terzian noted during an SMU Community Chat webinar earlier in the day that S232 tariffs had effectively decoupled US hot-rolled (HR) coil prices from the Brazilian slab prices. (Editor’s note: You can find a recording of the webinar here along with the slide deck.)

Recall that Brazilian steel had since 2018 been subject to a S232 quota rather than the 25% tariff that many other nations faced. During that time, prices for Brazilian slab an US HR moved up and down together.

When Trump imposed across-the-board S232 25% tariffs in March, US steel prices rallied but Brazilian slab prices remained stable at low levels, Terzian noted in her presentation. (See image below.) The 50% S232 tariff – implemented in June – could force Brazilian slab prices to move even lower. It could also make slabs from other nations more attractive to US buyers, she said.

Why Brazil matters so much to steel

Brazil (4.08 million mt) was the second biggest supplier of foreign steel to the US market in 2024, behind only Canada (5.95 million mt). And that trend has held to date in 2025, according to Commerce Department figures. Slabs accounted for most of that volume.

Brazilian pig iron has also become increasingly important for US electric-arc furnace (EAF) steelmakers since Russia’s full-scale invasion of Ukraine in 2022. Brazil, Russia, and Ukraine had each accounted for approximately one-third of US pig iron requirements. The balance tilted heavily toward Brazil following the full-scale war.