Analysis

July 24, 2025

SMU Survey: Most buyers say mills are open to negotiating prices

Written by Brett Linton

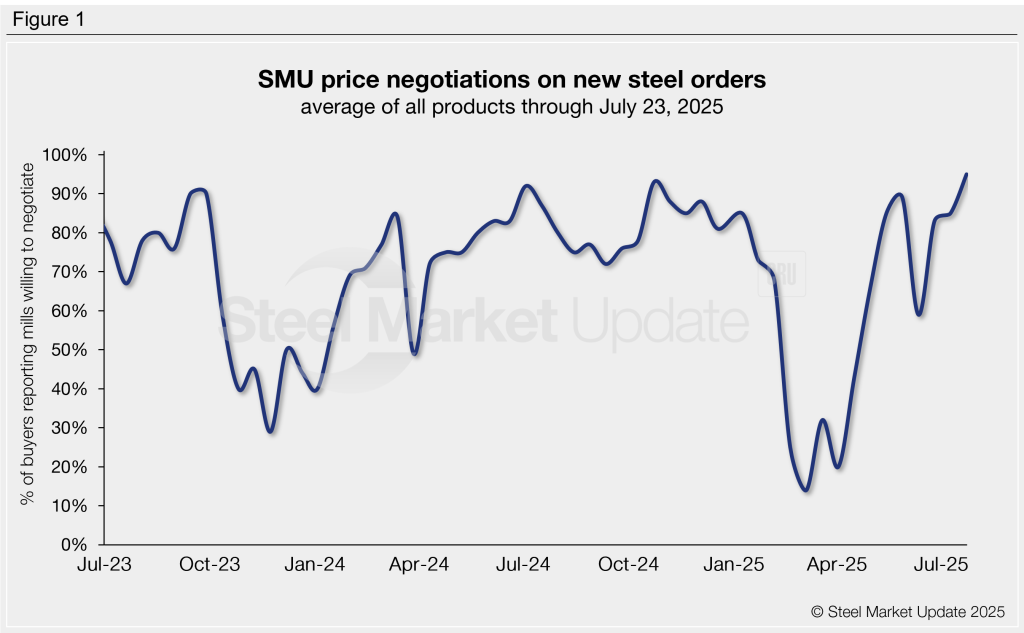

More than nine out of every ten steel buyers polled by SMU this week reported that mills are willing to negotiate prices for new orders. Negotiation rates have risen in each of our last three surveys, following an early-June lull, and reached record highs this week.

Every other week, SMU polls thousands of buyers to ask if domestic mills are open to negotiating prices on new spot orders. This week, 95% of respondents said mills were willing to talk price to secure an order, up 10 percentage points from our previous survey, to the highest rate seen in our 13-year data history (Figure 1).

Earlier this year, from February to March, mills held pricing power as tariff headlines drove the market higher. However, this advantage shifted to buyers in April and May and has largely remained there since. The only notable exception was in mid-June, when renewed tariff headlines briefly allowed mills to adopt a slightly firmer pricing stance. Over the past month, negotiating power has severely shifted back in favor of buyers.

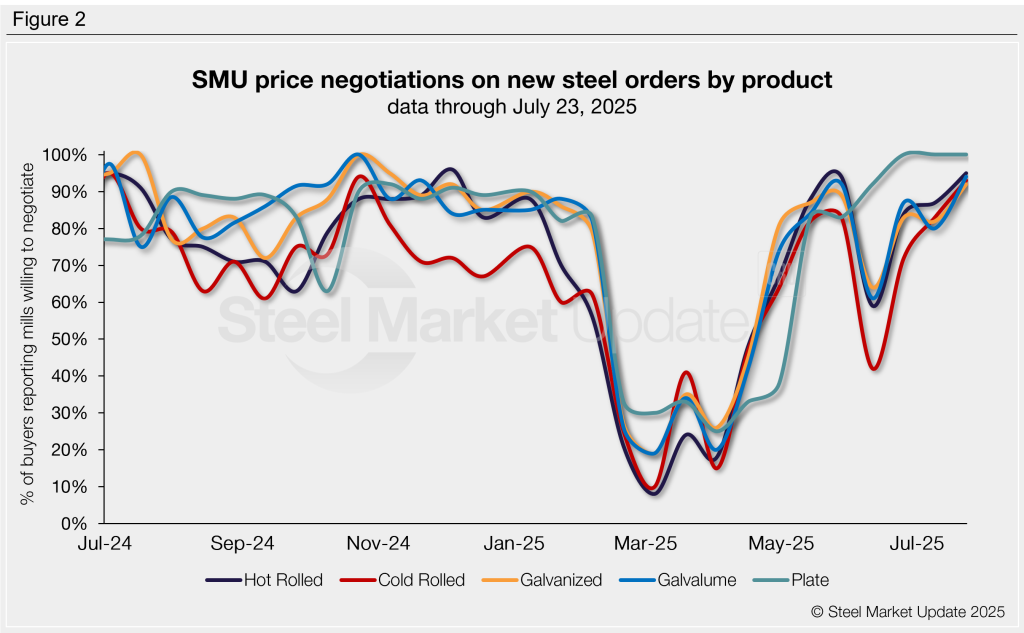

Negotiation rates by product

Negotiation rates rose this week for all four sheet products we track, now at the highest rates recorded this year. Plate negotiation rates have remained historically strong for two consecutive months (Figure 2). Current rates are:

- Hot rolled: 95% of buyers said mills are negotiable on price, up eight percentage points from two weeks ago to a seven-month high.

- Cold rolled: 93%, up 10 points to an eight-month high.

- Galvanized: 92%, up 10 points to a seven-month high.

- Galvalume: 94%, up 14 points to an eight-month high.

- Plate: holding at 100% for the third consecutive survey.

Steel buyer remarks:

“Big tons can do better [sheet].”

“Large [hot rolled] inquiries get a few cents off.”

“Negotiable [on plate] with tons.”

“Depends on the mill [cold rolled].”

“We still aren’t bringing in mill quantities [of hot rolled], so we’re relying on service centers, but the mills we talk to are certainly hungry and lowering their pricing.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiation rates data.