Market says cutting interest rates will spur stalled domestic plate demand

Market sources say demand for domestic plate refuses to budge despite stagnating prices.

Market sources say demand for domestic plate refuses to budge despite stagnating prices.

Sheet prices were mixed this week as some mills continued to offer significant discounts to larger buyers while others have shifted toward being more disciplined, market participants said.

Nucor kept hot-rolled (HR) coil prices unchanged this week, according to its latest consumer spot price (CSP) notice on Sept. 8.

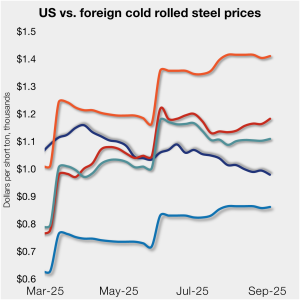

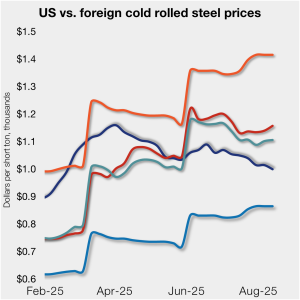

Cold-rolled (CR) coil prices ticked lower in the US this week, while prices in offshore markets diverged and ticked higher.

The Brazilian-US pig iron market has remained quiet, market sources told SMU.

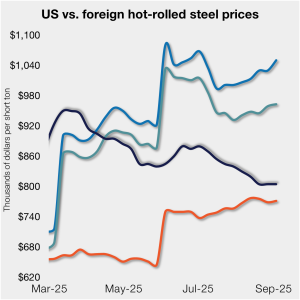

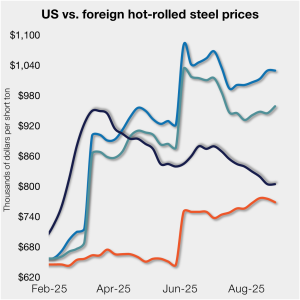

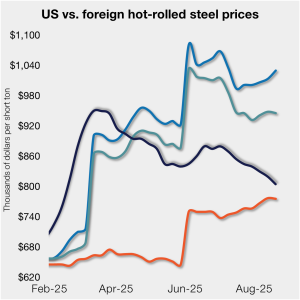

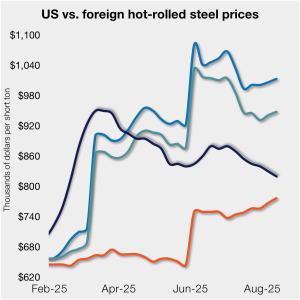

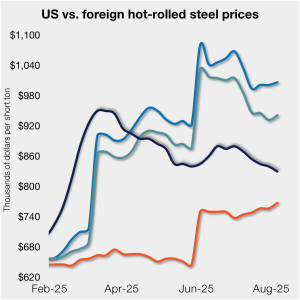

Domestic hot-rolled (HR) coil prices were flat this week for a third straight week. Offshore prices all moved higher w/w, widening the margin between stateside and foreign product.

SMU’s hot-rolled (HR) coil price held steady this week while prices for other sheet and plate products declined.

Nucor kept its weekly list price for hot-rolled (HR) coil unchanged this week, following a price bump of $10 per short ton (st) last week.

Domestic hot-rolled (HR) coil prices were flat this week, while offshore prices varied week over week (w/w). The price margin between stateside and foreign product was little changed as a result.

Most steelmaking raw material prices we track saw little change across the month of August. Iron ore, pig iron, shredded scrap, busheling scrap, zinc, and aluminum prices all held relatively steady,

Steel prices remained largely unchanged this week, staying at or near lows last seen in February. All five sheet and plate products tracked by SMU moved by no more than $5 per short ton (st) from the previous week.

The majority of steel buyers responding to our market survey this week continue to say that mills are negotiable on new spot order prices. Negotiation rates have remained high since May.

HRC prices in the US eroded further last week, while offshore prices varied week over week (w/w), widening the price margin between stateside and foreign product.

Sheet and plate prices were flat or lower again this week on continued concerns about demand and higher production rates among US mills.

Prices remain subdued in US pig iron market, sources said.

Cleveland-Cliffs Inc. has reportedly signed "unusually long" fixed-price supply agreements with multiple US automakers.

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

A tour of the economy as it relates to hot-rolled coil futures.

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices ticked higher again week over week (w/w).

The price spread between prime scrap and hot-rolled coil (HRC) narrowed in August, according to SMU’s most recent pricing data.

All five of SMU's steel sheet and plate price indices declined this week, falling to lows last seen in February.

Sources in the carbon and alloy steel plate market said they are less discouraged by market uncertainty resulting from tariffs or foreign relations, but are instead, eager to see disruption to the flat pricing environment.

Nucor has implemented a double-digit price decrease on spot hot-rolled (HR) coil for the second consecutive week.

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices increased week over week (w/w).

Since the last writing of this article, CME hot-rolled coil (HRC) futures have been largely steady and lifeless, though there’s been some brief bouts of intraday volatility.

Sheet and plate prices were either flat or modestly lower this week on softer demand and increasing domestic capacity.

US plate market participants are not fazed by the constricted nature of the current spot market pricing environment. Right now, they said, mill’s choosing to hold prices from one month to the next makes sense because service centers remain amply supplied and demand is stable. Modest upticks or slips in prices are aligned with most of the participants' expectations right now.

Nucor Plate Group has informed customers that August spot prices will remain flat.

Nucor’s weekly consumer spot price (CSP) for hot-rolled (HR) coil was adjusted $10 per short ton (st) lower this week after holding steady last week.

Prices for four of the seven steelmaking raw materials we track were unchanged from late June through the end of July, while two increased and one declined. Collectively, these material prices rose 1% month over month (m/m), but are down 3% compared to three months ago.