Friedman earnings fall, lower margins expected

Friedman Industries reported lower earnings in its fiscal fourth quarter, and the company expects first-quarter margins to be lower than Q4 margins due to declining HRC prices.

Friedman Industries reported lower earnings in its fiscal fourth quarter, and the company expects first-quarter margins to be lower than Q4 margins due to declining HRC prices.

Canacero has weighed in on the workers' protest at ArcelorMittal Mexico’s Lazaro Cardenas mill, urging a quick resolution to the dispute.

Steel Market Update’s Steel Demand Index moved up 2.5 points last week, though it remains in contraction territory and at one of the lowest readings in nearly a year, according to our latest survey data.

Olympic Steel is celebrating Executive Chairman Michael D. Siegal's 50th work anniversary and the company’s 70th year in business.

Canadian flat rolled producer Algoma Steel has appointed Erin Oliver to the newly created role of vice president – health and safety.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market events.

Sometimes, words can lead you in interesting directions. Specifically, crosswords. For the last six weeks we have been making steel-themed crosswords in the lead-up to SMU's Steel 101 course in Fort Wayne, Ind., which is taking place today and tomorrow. I’ve learned snippets of steel history and educated myself on the finer points of sponge iron.

Total steel exports rebounded 6% in April, rising to 842,000 short tons (st) according to the latest US Department of Commerce data.

The USMCA is an important trade agreement, as long as the member countries honor its requirements. These were the sentiments echoed by top officials of the Steel Manufacturers Association (SMA) and Metals Service Center Institute (MSCI) during a press conference at their annual meeting last week in Scottsdale, Ariz.

Steel imports fell back in May from April’s recent high but remained elevated compared to the levels seen over the past year. A deeper dive into the data confirms what SMU has been hearing from sources: Coated sheet is driving the recent rise in overall import levels.

U.S. Steel has shut down battery No.15 at its Clairton coke works in Pennsylvania for good, broadcaster CBS reported. The closure is part of an agreement with the local Allegheny County health department after the authority fined the company $2.2 million earlier this year for air emission violations at the plant, and $1.8 million two years ago […]

Mexican steelmaker Deacero recently broke ground on a $600-million mini-mill in Ramos Arizpe, Coahuila, in northern Mexico.

Domestic raw steel production eased last week, falling from an eight-week high down to a four-week low, according to the latest release by the American Iron and Steel Institute (AISI).

Nucor said on Monday that it would lower its weekly hot-rolled (HR) coil price effective immediately. In a letter to customers, the company said its consumer spot price (CSP) for the week of June 10 would be $720 per short ton (st), a $60/st cut vs. the prior week. This is not the first big […]

Where do sheet prices go from here? How is the state of steel demand? And is the dip in prices we've seen just a case of the summer doldrums, or is it something more significant?

Now that June has arrived, the official countdown until SMU’s Steel Summit 2024 – North America’s premier flat-rolled steel conference – has begun. If you haven’t already registered, don’t delay. More than 700 attendees from more than 300 companies have already registered to be in Atlanta this August. In short, it’s poised to be another […]

Oil and gas drilling activity in the US ticked down last week, remaining near a two-year low, according to the latest update from Baker Hughes. In contrast, the Canadian count inched higher and is now at a 10-week high.

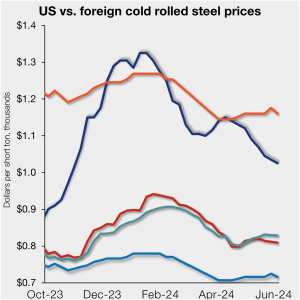

Offshore cold-rolled (CR) coil prices remain notably cheaper than domestic product. That remains the case even as US CR coil prices continue to tick lower.

Steel 101 The final countdown to our Steel 101 course has arrived. Held in Fort Wayne, Ind., on June 11-12, all the main ins and outs of steelmaking will be covered. And there will be a tour of SDI's Butler mill. You can still register here or reach out to us at events@steelmarketupdate.com.

Alacero has named new top leaders to help guide the Latin American steel association through its ongoing transformation and modernization process.

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Historical survey results are also available under that selection. If you need help accessing the survey results, or if your company would like to have your voice heard in our future surveys, contact info@steelmarketupdate.com.

When it comes to steel decarbonization, we do not need to compromise our climate ambition to make the types of demanding steel products needed for our 21st-century economy. Nevertheless, many of the world’s highest-emitting steel producers and their allies would have you believe that one cannot be done without the other. They are wrong. They […]

It feels like the summer doldrums arrived a little earlier than usual this year. I know there had been rumors of a price hike. The prospect of a sharply lower June scrap trade probably didn't help the chances of that actually happening.

Domestic steel shipments ticked up month over month (m/m) in April but were down year over year.

SMU’s Steel Buyers’ Sentiment Indices both rebounded sharply this week, according to our most recent survey data.

Movements in steel mill lead times were mixed this week, according to our latest steel buyers survey results. Service centers and manufacturers reported short to average production times, little changed from our last report.

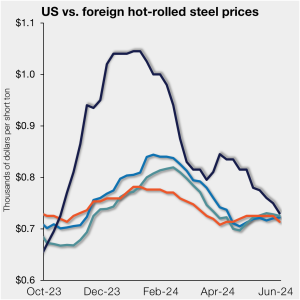

US hot-rolled (HR) coil prices ticked down again this past week, nearly reaching parity with offshore hot band prices on a landed basis. This week, domestic HR coil tags were $730 per short ton (st) on average based on SMU’s latest check of the market on Tuesday, June 4. Domestic HR coil prices are now […]

Steel buyers found mills more willing to negotiate spot pricing this week on all products SMU tracks with the exception of Galvalume, according to our most recent survey data.

Service center group O’Neal Steel has promoted three team members to positions of regional general managers.

The suspense about the drop in ferrous scrap pricing for June has ended with Delta, Ohio-based North Star BlueScope entering the market at significantly lower numbers than most predicted.