Product

March 11, 2013

January Preliminary Imports

Written by John Packard

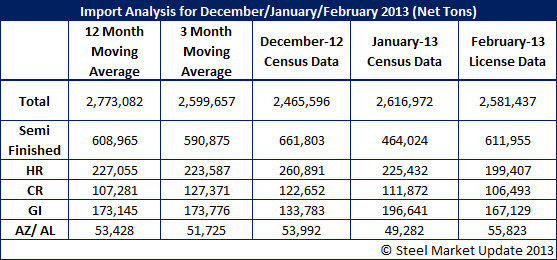

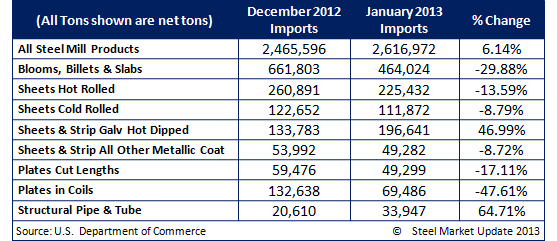

The U.S. Department of Commerce has released final January import data (Census Data) and Preliminary License data for the month of February 2013. January imports grew by 6 percent over the previous month. When looking at the data closer SMU notes – only two products (of those we follow closely) were significantly higher than the prior month – galvanized and structural pipe and tube. All of the other items – slabs, hot rolled, cold rolled, Galvalume and plates in both cut length and coils – were lower.

January 2013 imports were also lower than those received during January 2012. Imports were down 197,553 net tons during January 2013 versus the prior year.

Based on preliminary licenses data (not final yet), February imports appear that they will be about very similar to January 2013 import levels – but should be below both the 3 month moving average and 12 month moving average for imports. If the license data numbers hold up when the final census data is released, February 2013 imports should be 140,000 net tons below the 2012 import levels.

Semi-finished (slabs & billets) imports came back in February closer to both the 3 month and 12 month moving averages. Hot rolled, cold rolled and galvanized all appear as those they will be lower and below both the 3 month and 12 month moving averages. Only Galvalume came in at, or above, the averages.