Prices

January 14, 2016

Hot Rolled Futures- Price Hikes: How Long Can the Momentum Last?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer rotates weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

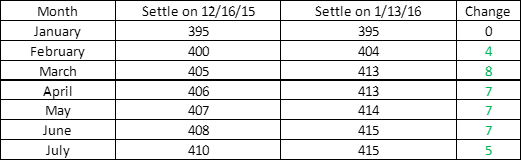

In our last edition, which has been nearly a month ago due to the holiday break, we wondered about whether the price increases announced in December would be enough to turn the tide on crumbling HRC prices. It looks at this point as though we can firmly answer “yes” to that inquiry, but that doesn’t give us much more insight into the really crucial question; does this mini-rally in steel prices have some staying power, or will it fizzle before long? Here is a look at the price action since our last edition, and you will notice that while prices are certainly up, the contango that was already being priced in accounted for a lot of the price increase already. The result is modestly higher Feb-Dec16 valuations:

Since those December price hikes that initially got things moving, we have seen yet another $20-30/ton increase (depending on mill in question) and the thought is that this is likely the move that attempts to shore up the initial increase, hardly an uncommon tactic for the mills. The question we have about these price hikes is how buyers will respond not just given the complete meltdown in EVERY other commodity market (crude oil slipping below $30/bbl, copper prices below $2/lb, etc). This creates a very troublesome backdrop for mils looking to ask buyers for more money, but steel isn’t always too concerned with slumps (or rallies) in outside markets.

While the utter collapse in all other commodity prices may be one issue that could lead to difficulty in sustaining these price hikes, another is the ultimately disappointing results so far on trade cases. The HDG cases saw really only China suffering double-digit penalties of the variety that will cut-off imports, for HDG most other players escaped with minor bruises if not totally unscathed. Preliminary countervailing duty determinations for hot-rolled were not very helpful either, prompting “disappointment” from AK Steel and others who were hoping for a more lethal decision for imports. The fact that Brazil saw only a 7.42 percent countervailing duty margin was noteworthy, but even more painful is likely the news that South Korea and Turkey managed to be spared (with Turkey at least, this was our expectation). ITC final injury determinations are a ways off; July 7th.

So weak results so far on the trade cases, combined with a complete collapse in commodity markets…that doesn’t seem like a recipe for higher prices, and yet here we are, up about $30/ton on a spot index basis since mid-December. We tend to believe this was simply a matter of how low prices had gotten, trading well below their great recession lows, perhaps a bounce was inevitable regardless of the context. But the larger context can’t be ignored, and it will have its effect sooner or later. The risk today for mills is that their price increases (if pushed too hard) will simply push buyers back into the still weak import market. Either that, or demand that was destroyed in the OCTG/energy sector will find its way back in some other form.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

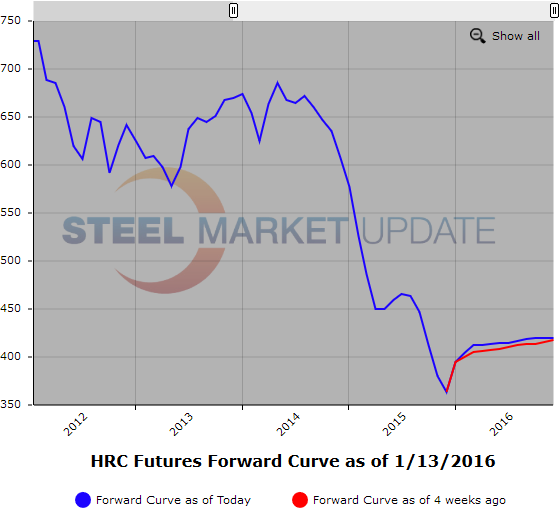

Below is a graphic of the HRC Futures Forward Curve. The interactive capability of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.