Market Data

May 31, 2016

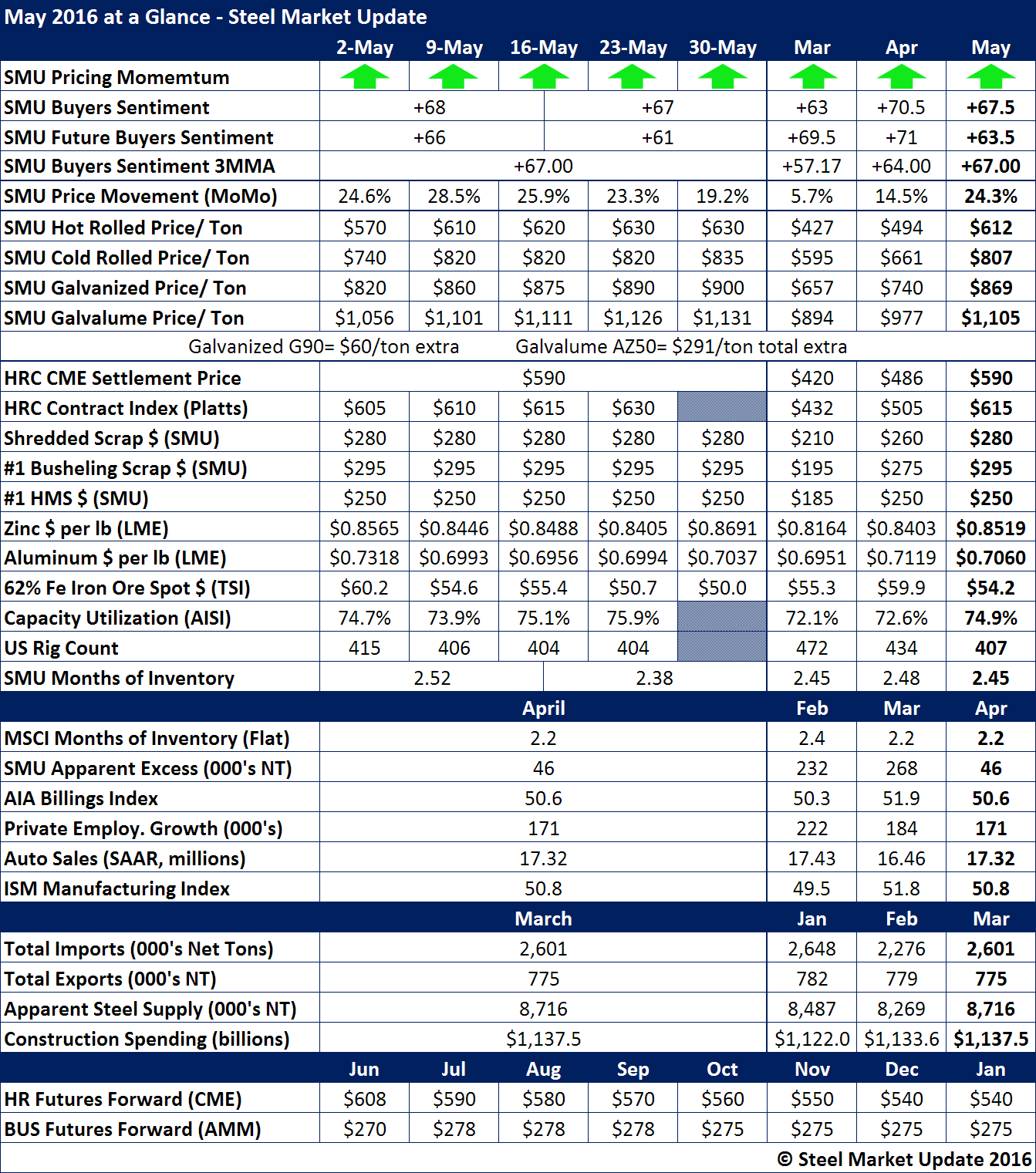

May 2016 at a Glance

Written by Brett Linton

SMU Price Momentum continues to reflect the strength of steel mills as we expect prices to continue to rise over the next 30 days. Our Price Momentum Indicator has been pointing toward higher prices since early December 2015 (6 months and counting).

Although our Steel Buyers Sentiment Index took a hit in May for both Current Sentiment (how buyers and sellers of flat rolled steel feel about their company’s ability to be successful in the existing market environment) and our Future Sentiment (three to six months out into the future), our three month moving average (3MMA) continues to trend higher, up +3 points from our April average.

Flat rolled prices soared during the month of May finishing the month at $630 per ton. Our average, at $612 per ton, was $22 per ton higher than the CME settlement for the month and was $3 lower than Platts average over the same time period.

Scrap prices rose, as did zinc and capacity utilization rates.

Aluminum, iron ore, rig counts, apparent excess, service center inventories (a Premium product), AIA Billings Index, and the ISM Mfg Index all fell.

It will be interesting to watch the CME HRC futures markets as hot rolled prices are expected to rise slightly during June ($590 to $608) before dropping back and settling in the mid $500’s.