Prices

October 20, 2016

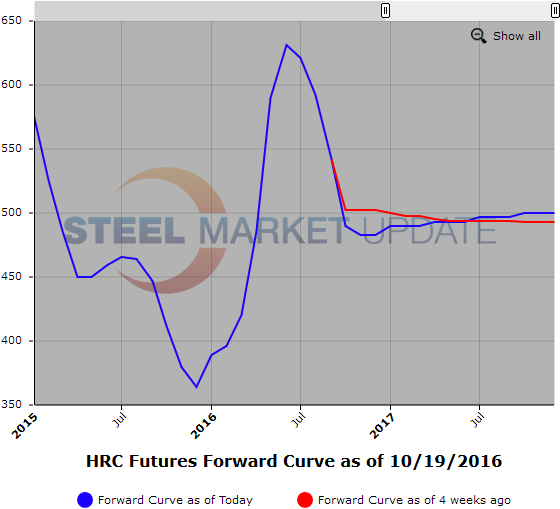

Hot Rolled Futures Calling a Price Move Higher?

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

What a difference a week makes. Last week we were flush with HR offers but buyers were scarce this week the market view appears to have shifted as we have a good bid interest and offers are now scarce. It is interesting that in spite of a $13/ST drop in the Index that the CME uses to settle their HR contract that Cal’17 value has risen $15/ST from last Wednesday (average of $485/ST) to $500/ST today.

It has been an active week in HR futures as 44,760 ST have traded. With the exception of our first Cal’18 HR trade, $500/ST on 500 ST per month executed last Thursday most HR transactions since have been in the nearby months (Nov/Dec’16) spread against Cal’17 periods. The trades reflect a shift as we move from a flat curve last week to one with some contango this week.

Here is a breakdown of trading by period:

Nov/Dec’16 traded 17,900 ST from $480/ST to $487/ST; Dec’16 traded $490 and $494/ST;

Feb’17 traded 100 ST at $495/ST;

Q1’17 traded 3,960 ST from $480/ST to $505/ST;

Q2’17 traded 3,000 ST at $483/ST;

2H’17 traded 7,560 ST from $485/ST to $490/ST;

Cal’17 traded 6,240 ST from $485/ST to $500/ST;

Cal’18 traded 6,000 ST at $500/ST;

Scrap

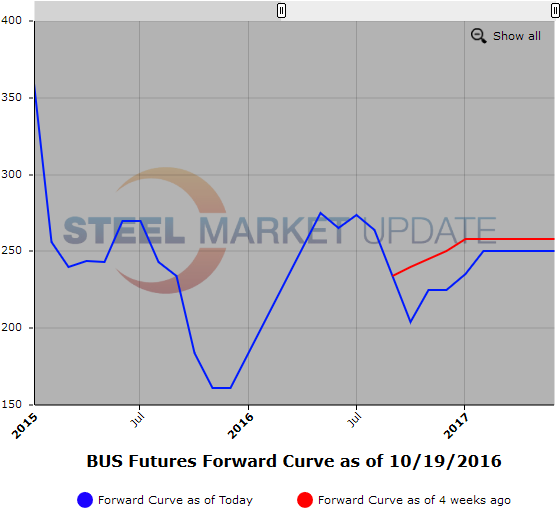

-Nov/Dec’16 BUS traded $225/GT this week , $20 plus above latest spot. Early chatter has BUS moving sideways for November with participants split on whether demand will pick up between now and year end. We have seen Cal’17 BUS interest in the 245/255 range of late.

-The CFR Turkish Scrap market continues to grind higher as demand picks up in part due to higher coking coal prices which have increased scrap demand from Turkey as well as India. CFR T spot prices have been trading in a $220 to $227 range this week.

The metal margin spread for Cal’17 could present some opportunity. Historically $240 to $260 metal margin spread (ST – GT) for mills would represent pretty good value. However compared to current spot which currently sits between $281/$291 [HR $483/ST minus BUS $204/GT or HR $495/ST minus $204/GT] it seems light. If your view is that the spread will revert to its mean or lower in Cal’17, as these two markets find their equilibrium, you might consider locking in the spread. You could bid $250/GT Cal’17 BUS and Offer Cal’17 HR at $500/ST (value) and lock in a $250 per ST/GT metal margin.

Below are two graphs showing the history of the hot rolled and busheling scrap futures forward curves. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.