Prices

July 27, 2017

Hot Rolled Futures: Pay No Attention to That Man Behind the Curtain

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As the Flack Global Metals director of risk management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website www.FlackGlobalMetals.com.

The Section 232 investigation has dominated the hearts and minds of those attached to the steel industry since being announced in April. The investigation has led to a number of unintended consequences including a short-term boost in imports, a shift to domestic purchasing and a slowing of transactions, to name a few. Three months into it, many of us are exhausted by the indecision, hoping that a resolution, any resolution, will be presented soon.

Last week was “Make America Great Again” week at the White House and optimism grew that an announcement could be made at one of those events. Nothing done. By Friday, many were looking toward the presidential rally to be held on July 25 in Youngstown, Ohio, for an announcement, or at the very least a comment, from President Trump that would clarify when a decision would be made.

Instead, on that Tuesday, President Trump told the Wall Street Journal his administration was “waiting till we get everything finished up between healthcare and taxes and maybe even infrastructure” before making a decision on steel trade policy.

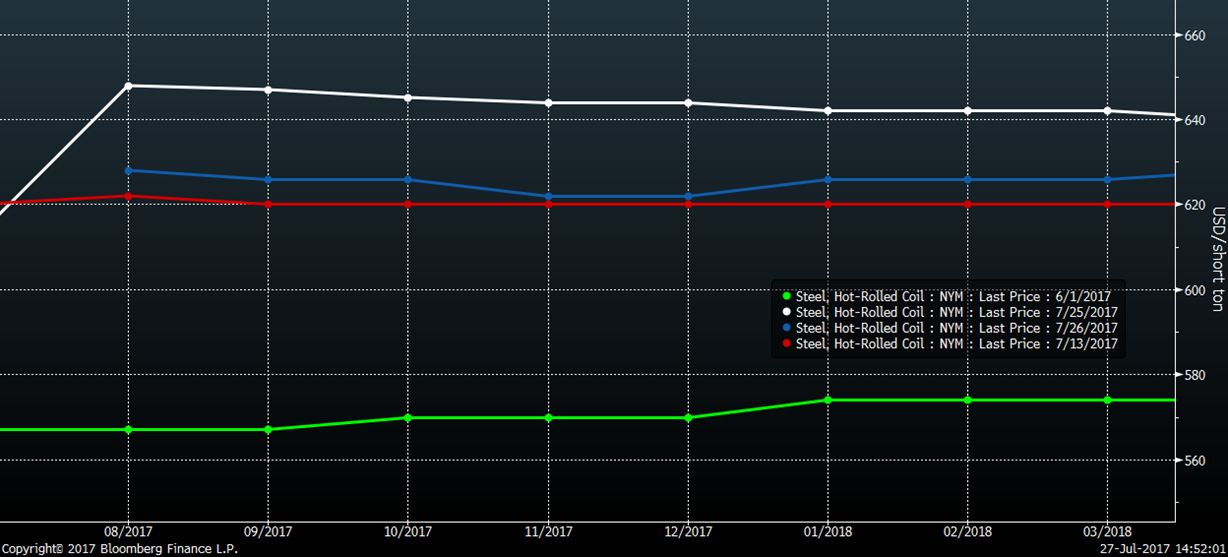

Since the 232 really became a focus, the futures curve has remained pretty flat, rallying from as low as $567 on June 1, when California Steel made the very first price increase announcement of this most recent cycle, to $620 on July 13. Then 232 rhetoric heated up as evidence on a number of fronts emerged that the investigation itself was driving pricing and decisions. Last week, a second round of price increases followed and the futures traded as high as $650. Following Tuesday night’s comments, the curve has been under seige. CME HRC futures have traded as low as $621 since.

CME Midwest HRC Futures Curve

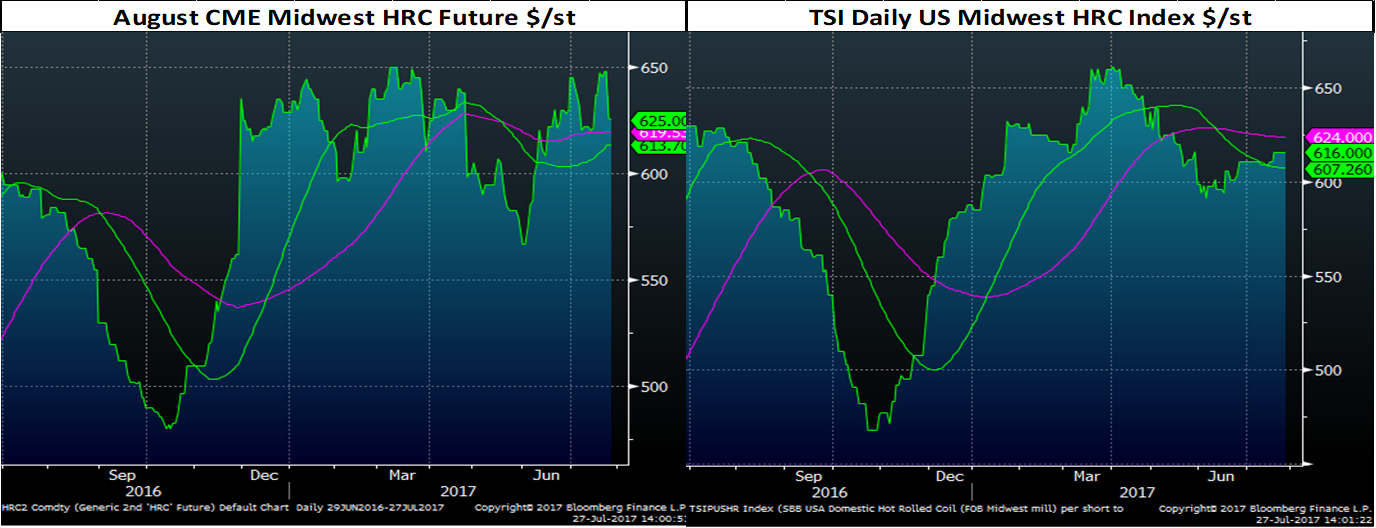

It’s clear that CME HRC futures had priced in a Section 232 premium to the spot price as the upside risk was much greater than the downside risk. The TSI Daily Midwest HRC Index settled today at $616, continuing its slow and steady rally that started in early June.

Keep in mind that while the 232 decision has been postponed perhaps indefinitely, there are plenty of other positive factors at work. Below is an excerpt from AK Steel’s earning conference call from this past Tuesday:

Q: Novid Rassouli: “I just wanted to see if you can help us understand the impetus for the price hikes or what’s driving that?”

A: Roger K. Newport: “The big driver of that is what’s happening on the cost front, what’s happening on the raw material front. That’s going to be the biggest driver. How we look at it is we want to be selling products that are making reasonable margin and as costs go up, the price has to follow.”

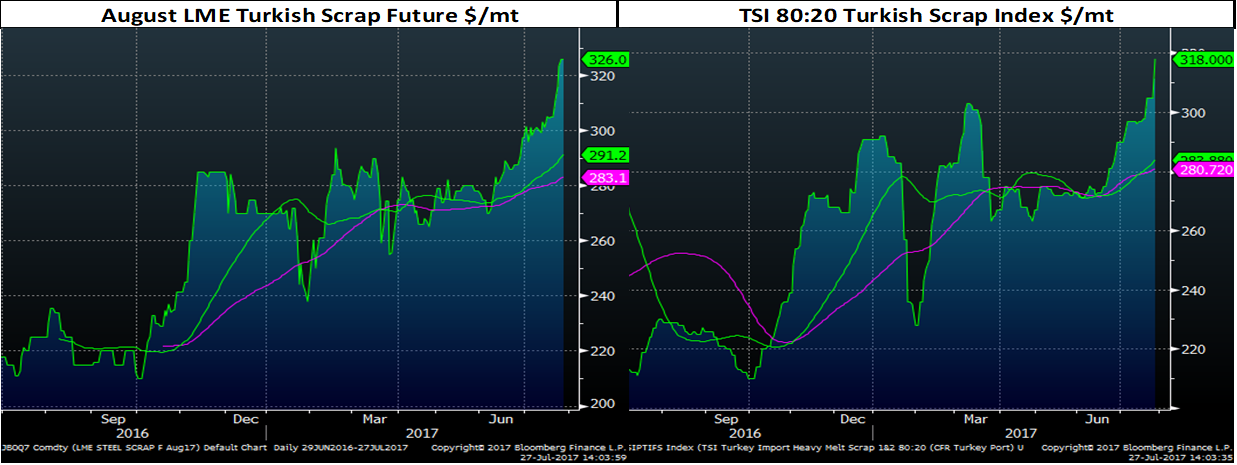

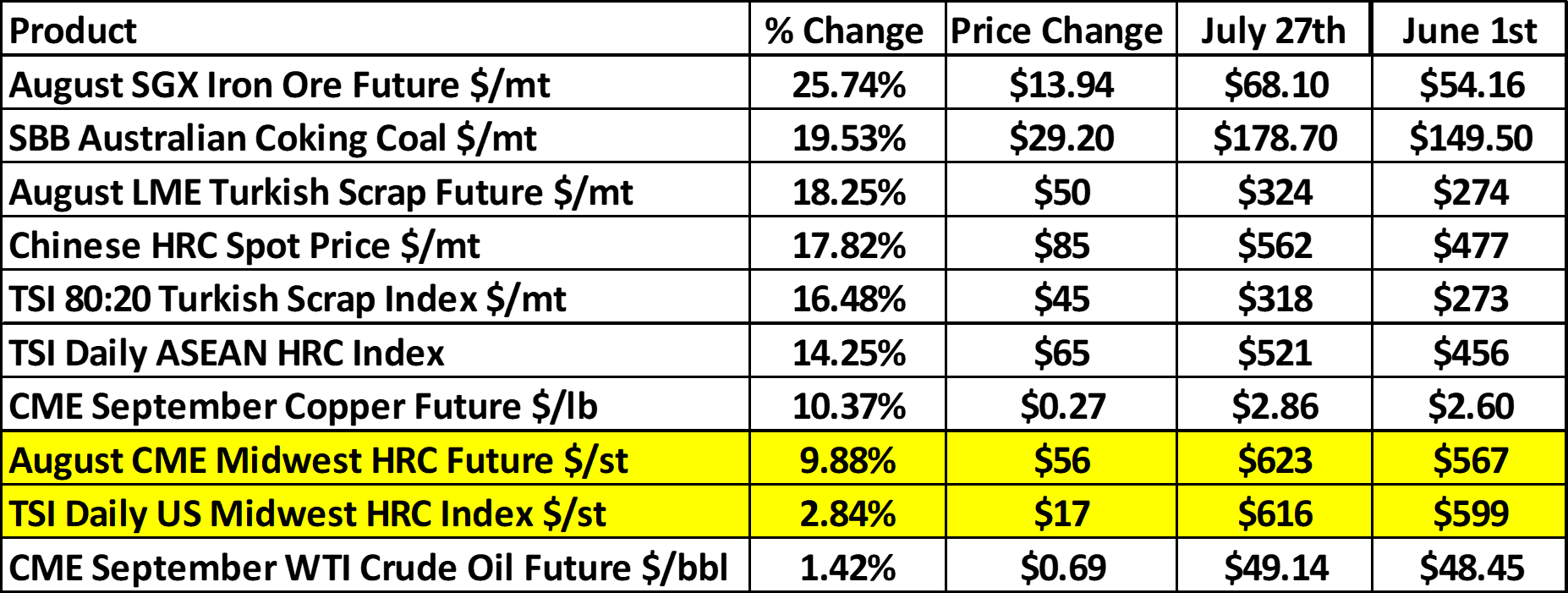

Scrap prices have moved up with the TSI 80:20 Turkish Scrap Index printing $318/t today.

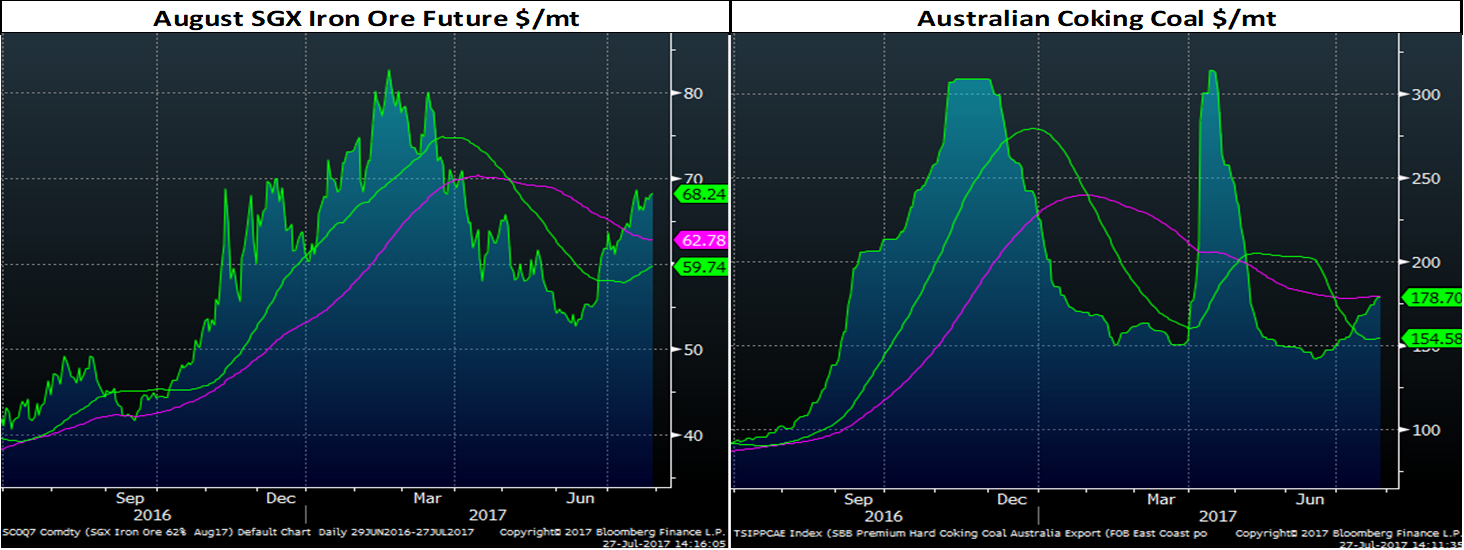

August SGX iron ore settled at $68.24/t while Australian coking coal settled at $178.70/t yesterday.

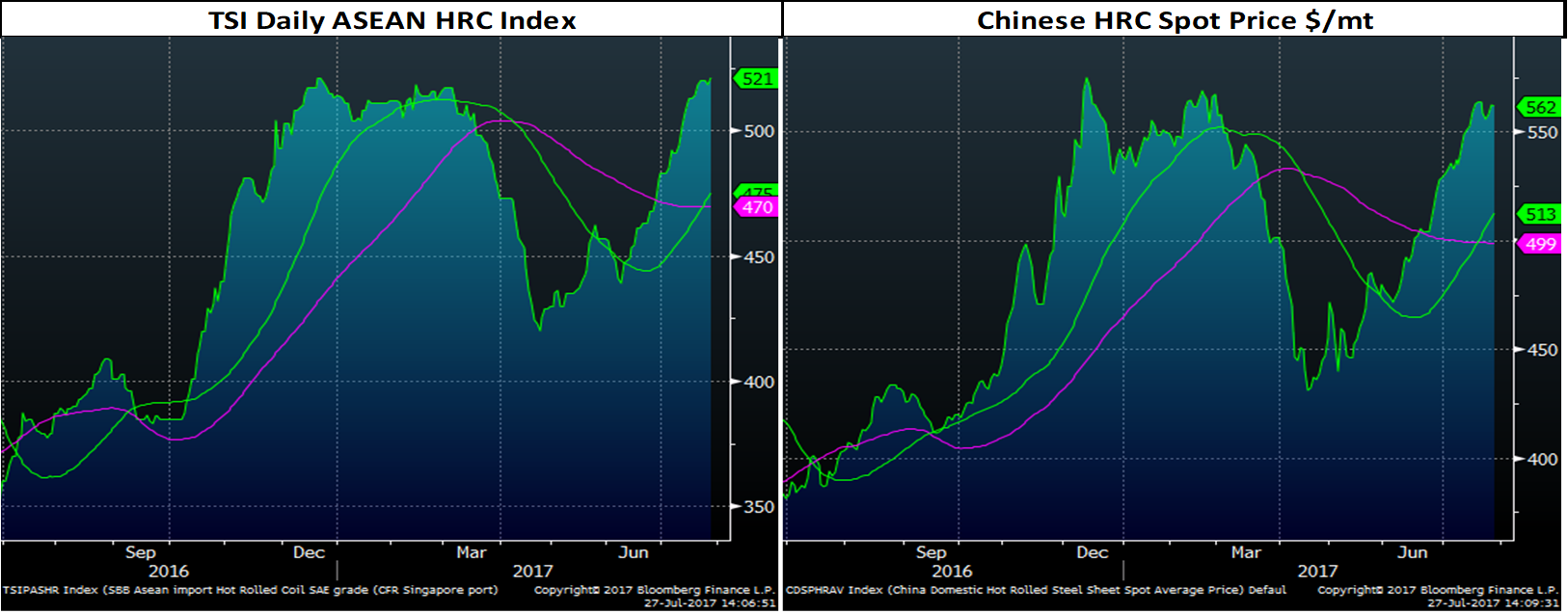

ASEAN and Chinese HRC prices have rallied sharply back to highs seen at the turn of the year.

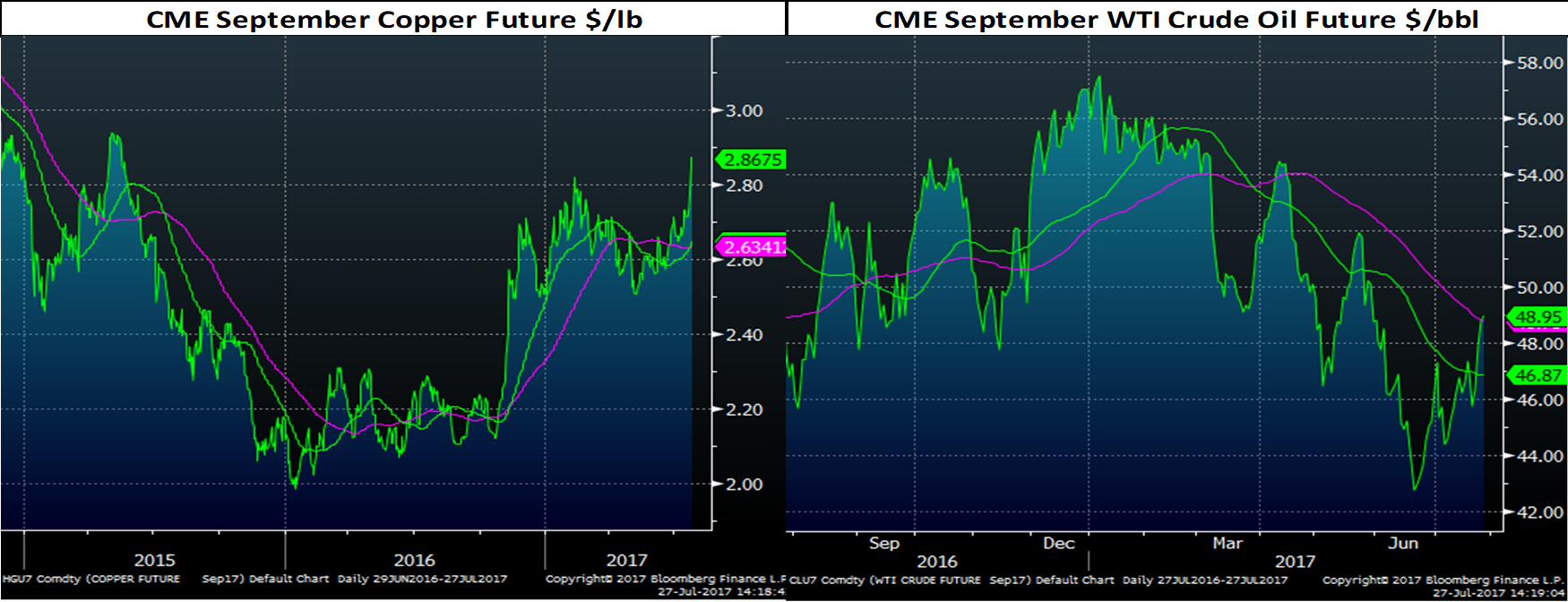

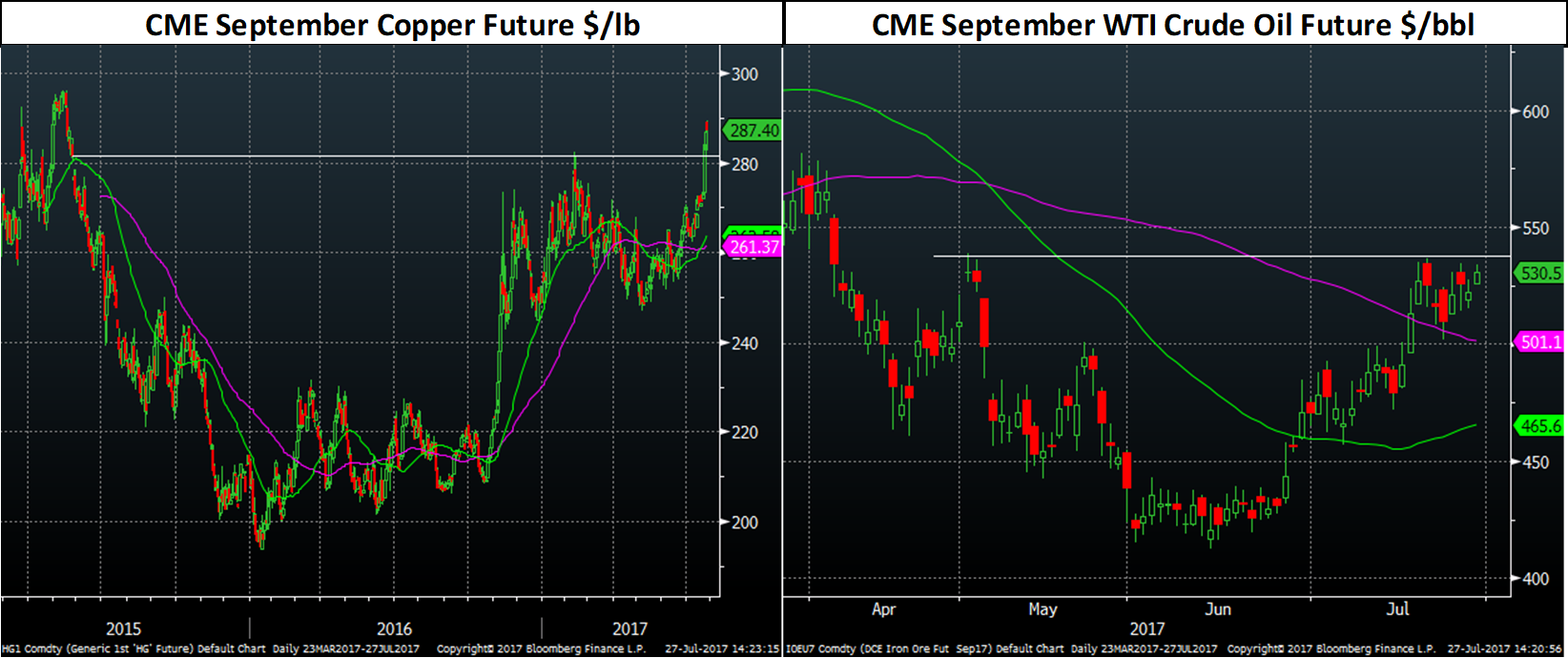

CME September copper future has broken out this week, trading as high as $2.895/lb, while the September WTI crude oil future has rebounded sharply since its late June low of $42.40/bbl to just below $49/bbl late afternoon today.

In fact, when comparing the price changes of all these products since June 1, you’ll see Midwest HRC prices have moved the least relative to the other ferrous related commodities on the list. From this point of view, not only are the price increase announcements justified, but also one can expect that there is room for Midwest HRC to run higher, regardless of the Section 232 outcome.

Technical Corner

Copper and iron ore prices have both formed into a “cup and handle” pattern, which is considered a bullish continuation pattern once the top is broken above and is used to identify buying opportunities. Copper has broken above its resistance level with force. Iron ore remains below its resistance level. Since copper and iron ore are barometers of everything from China’s economy to construction to inflation, it bears watching and the implications for the prices of these products breaking out could be a huge positive for the price of steel and ferrous raw materials.

The opportunity might present itself in HRC futures at any time, so pay close attention to President Trump’s tweets, keep your local broker on speed dial and remember Ferrous Bueller’s philosophy…

“Life moves pretty fast. If you don’t stop and take a look around once in a while, you could miss it.” –