Prices

October 12, 2017

License Data Indicates Stubborn Import Market

Written by John Packard

The expectation has been for a huge swing lower in the amount of flat rolled foreign steel imports coming into the United States in October. The industry is waiting for the combination of the drying up of the surge of orders placed to “beat” any Section 232 duty and the impact of higher world steel prices, which has made foreign steel less competitive in the U.S.

One of the items that was anticipated was that the Section 232 review on steel recommendations would be provided to President Trump by Department of Commerce Secretary Wilbur Ross at the end of June, and then the announcement on any duties/quotas would be made potentially as early as July 2017. As we all know, the recommendations from Ross and any presidential decision have been put off until after tax reform has been passed by the U.S. Congress.

So, what has been happening with foreign steel imports over the past two years? The data is quite telling.

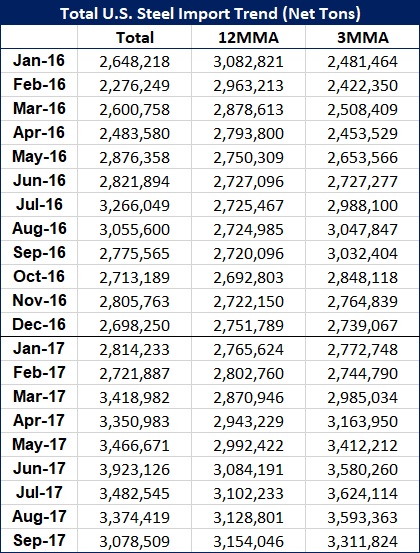

The lowest tonnage of foreign steel imports was for the month of February 2016 when the U.S. received a total of 2,276,249 net tons of steel. We were seeing the Preliminary Determinations being announced on antidumping and countervailing duties during the first and second quarter 2016 and then the Final Determinations shortly thereafter. Those importing foreign steel had a good idea who was being targeted and removed as possible suppliers.

Even so, tonnage began to grow until the July 2016 peak when imports hit 3.2 million net tons. Then imports began tailing off through the balance of the 2016 calendar year.

With the election of President Trump in November, the expectation was that he would be more supportive of the domestic steel industry. Shortly after taking office, he ordered the Department of Commerce to begin the review of steel based on national security concerns (Section 232). The election coupled with his announcement of the Section 232 review had a counter impact on foreign imports, which quickly went well over 3.0 million tons by March and have managed to remain above 3.0 million tons through September 2017 (September being based on license data; the month could come in just under 3.0 million tons when the final census numbers are released).

Since the peak of imports in July (3.9 million net tons), monthly tonnages have been sliding but continue to be above year-over-year levels.

Again, the expectation has been for imports to tumble due to the reaction to Section 232 and due to higher import pricing (as well as the other trade actions against foreign steel, including AD/CVD and circumvention, which will see a preliminary determination next week, and U.S. Steel’s Section 337 filing against China) .

The market is waiting for imports to drop to the levels seen back in February 2016 when imports were only 2.3 million net tons.

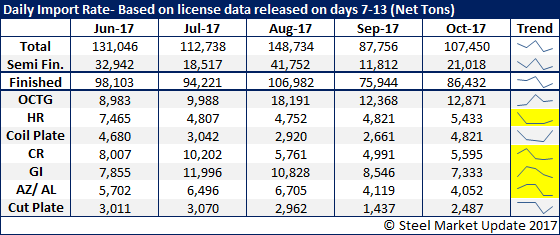

Based on the license data for the first 10 days of October, imports are on pace to once again meet, or exceed, 3.0 million tons. Here is the trend line comparison for October based on 7-13 days of import license data.

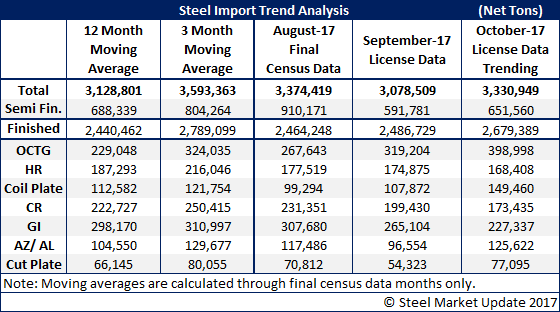

If import licenses for October continue at the current pace, this is what the month is projected to be once the books are closed. (SMU believes the numbers are going to be 200,000-300,000 less than what we are showing below).

Again, the table above is nothing more than a projection of what “might be” should the pace of import licenses continue as they have been during the first 10 days of the month. We will continue to watch license data carefully for the reminder of the month to see if imports tail off as expected.

It is Steel Market Update’s opinion that the high import numbers are working their way into the higher service center inventory numbers that we are collecting from those distributors currently providing data to SMU (see article on inventories in tonight’s issue).