Market Data

October 18, 2017

Service Centers Carbon Flat Rolled Inventories Balanced for 2nd Month

Written by John Packard

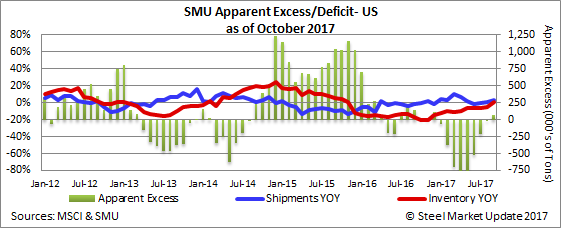

Steel Market Update (SMU) has a proprietary model that analyzes the Metals Service Center Institute (MSCI) carbon flat rolled shipment and inventory data, from which we calculate whether distributor inventories are in Excess/Balance/Deficit. We ended the month of August with steel service center inventories as essentially balanced (-26,000 tons). The month of September saw a mild rise in inventories (which we had correctly forecast), and for the second month, based on our model, inventories are again essentially balanced with a slight excess of +68,000 tons.

How Accurate Was Our Forecast?

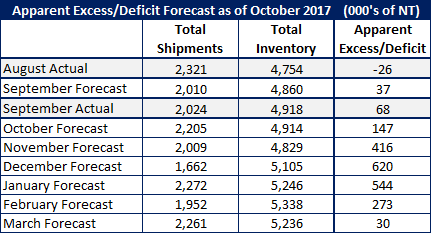

One month ago, SMU forecast shipments of carbon flat rolled would be 2,010,000 tons. According to MSCI, the distributors shipped 2,024,000 tons.

We forecast flat rolled inventories would rise from 4,754,000 tons at the end of August to 4,860,000 tons at the end of September. Again, we were correct in forecasting a rise in inventory levels, although we were off by 58,000 tons.

Our forecast called for distributors to remain relatively balanced moving out of a small deficit to a small excess. Our forecast called for a change from -26,000 tons at the end of August to +37,000 tons at the end of September. The actual “excess” grew to +68,000 tons, which we consider to be a balanced situation for the flat rolled distributors.

October Revised Forecast

We are continuing to use the same model to forecast both shipments and inventories.

Steel Market Update is forecasting shipments to be up from September (which only had 20 shipping days while October has 22) to 2,205,000 tons.

We believe inventories will remain stable at 4,914,000 tons (September ended at 4,918,000 tons).

We anticipate inventories will continue to expand and the service centers will move into an Excessive inventory situation at +147,000 tons.

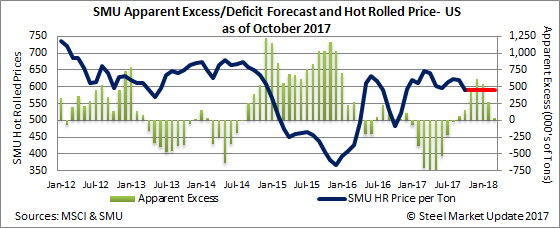

Here is what that looks like and how we believe inventories will continue to grow in the coming months, peaking at the end of December with +620,000 tons.

Again, our model is based on the MSCI data, and we are relying on the MSCI data to be accurate and not wildly over- or under-stated. As many of you know, our own service center months of supply numbers are indicating that service centers are not balanced but over-inventoried.