Market Segment

February 20, 2018

MSCI: U.S. Service Center Shipments Start Strong in 2018

Written by Tim Triplett

The new year got off to a strong start for U.S. service centers, which reported over a 4 percent increase in carbon steel shipments and a 6 percent increase in carbon steel inventories in January, according to the Metals Service Center Institute’s January Metals Activity Report. Service center shipments of carbon plate saw a big jump in January, while flat roll and tubular products saw small increases compared to last year.

U.S. service centers shipped 3.484 million tons of steel products in January, an increase of 4.3 percent over January 2017, and a 31.2 percent jump over December, according to the Metals Service Center Institute’s January Metals Activity Report.

U.S. service center inventories at the end of January totaled 7.734 million tons or 2.2 months on hand. That’s a 6.0 percent increase from the 7.297 million in inventory at this time last year, but about the same at 2.2 months on hand. Tons shipped per day in January totaled 158,400, up from 132,800 in December.

Carbon Flat Rolled

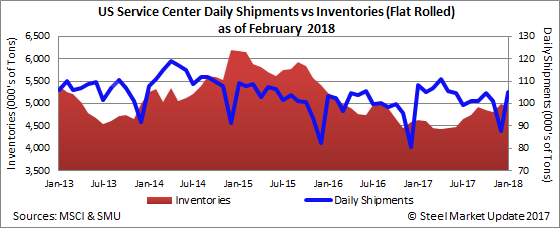

Looking at shipments by product category, U.S. service centers shipped 2.312 million tons of carbon flat roll in January, a 1.7 percent increase over January 2017. Flat roll shipments jumped by 31.7 percent compared with the prior month.

Tons shipped per day in January averaged 105,100, with 22 shipping days in the month, up from 87,800 in December last year, with 20 shipping days.

Service centers’ flat rolled inventory on hand at the end of January totaled 4.936 million tons, or 2.1 months on hand, up 6.7 percent from January 2017.

Carbon Plate

U.S. service centers shipped 346,600 tons of carbon plate in January, an 18.1 percent increase over the 291,800 tons in January last year. January shipments of carbon plate increased by 40.2 percent over the prior month. Tons shipped per day in January, with 22 shipping days, averaged 15,800 tons, up from 12,400 tons in 20 shipping days in December.

Plate inventory on hand at the end of January totaled 804,800 tons, or 2.3 months of supply, 9.1 percent more than the 737,400 tons, or 2.5 months of supply, at the end of January 2017.

Pipe and Tube

U.S. service centers shipped 195,700 tons of pipe and tube products in January, a 0.5 percent increase from the 194,800 tons the prior year. January shipments of pipe and tube increased by 30.5 percent from the prior month. Tons shipped per day in January averaged 8,900 with 22 shipping days versus 9,300 last January with 20 shipping days.

Pipe and tube inventory on hand at the end of January totaled 459,700 tons or 2.3 months of supply. That’s 2.5 percent less than the 471,500 tons or 2.4 months of supply at the end of January 2017.