Market Data

April 23, 2018

SMU Service Center Apparent Excess/Deficit Inventories Forecast

Written by Brett Linton

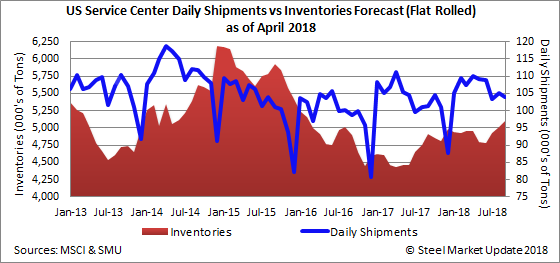

Last month, Steel Market Update forecast flat rolled steel shipments from U.S. service centers would remain steady at 109,565 tons per day in February to 109,594 tons per day in March. The Metals Service Center Institute (MSCI) reported last week that sheet distributors shipped 107,314 tons per day, a decrease over February. Our shipment forecast accuracy continues to be relatively high, off just 50,000 tons overall for the month of March.

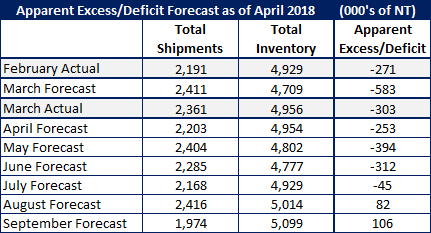

![]() On a monthly basis, our forecast from one month ago called for total shipments to rise from 2,191,300 tons in February to 2,411,100 tons in March. The final figure, according to MSCI data, was 2,360,900 tons.

On a monthly basis, our forecast from one month ago called for total shipments to rise from 2,191,300 tons in February to 2,411,100 tons in March. The final figure, according to MSCI data, was 2,360,900 tons.

Receipts coming into the service centers continues to be harder to predict. SMU forecast daily receipts to fall from 109,210 tons per day in February to 99,631 in March. The actual receipt rate was 108,568 tons. Total receipts were forecast to fall from 2,184,200 tons in February to 2,191,900 tons in March, and MSCI reported them to be 2,388,500 tons.

SMU forecast total inventories would fall from 4,928,500 tons in February to 4,709,300 tons in March. MSCI reported total inventories at 4,956,100 tons in March, just slightly up over the previous month. Our forecast was off primarily due to our underestimation in steel receipts.

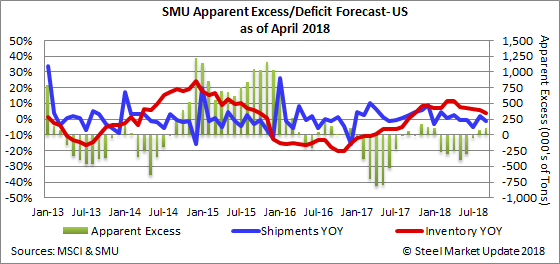

At the end of February, our proprietary model calculated that the domestic flat rolled service centers had an inventory defict of -271,300 tons. We predicted the inventory deficit would grow to -583,000 tons by the end of March. Based on final figures, our proprietary model is showing a -302,800 ton inventory deficit through the end of the month of March. The forecast discrepancy was due to our underestimation in the daily receipts. We have altered our receipts formula for future forecasts.

April Forecast Calls for Inventory Deficit to Linger

Our adjusted forecast calls for a decrease in total U.S. service center shipments to 2,202,500 tons of flat rolled steel during the month of April. We are calling for total inventories to remain steady at 4,953,600 tons in April.

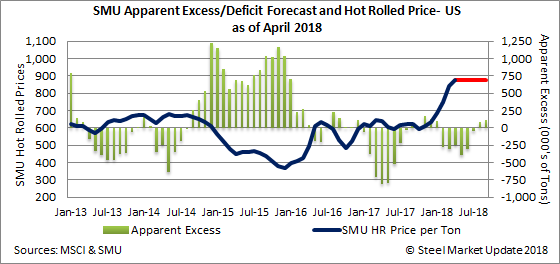

With the change in our model, our new forecast is for U.S. service centers to be holding a deficit of -253,100 tons through the end of April and for that deficit to remain at that level throughout June, before shrinking. We have the service centers returning to “balanced” inventories by the end of July 2018.

Here is what the full forecast looks like through September 2018:

A note to our Premium members. The MSCI is raising their price for the use of their data. We are considering not renewing as we believe the cost to be excessive. However, we do want our Premium clients to weigh in with your opinions as to whether we should continue (or attempt to continue) reporting on the MSCI data. If you have an opinion one way or another, please contact John@SteelMarketUpdate.com

Thank you.