Long Products

April 9, 2019

CRU: Rising Imports Combine with High Inventories to Pressure Long Products Prices

Written by Tim Triplett

By CRU North America Analyst Ryan McKinley

U.S. long product prices have come under downward pressure, driven primarily by persistently high inventory levels. This inventory build-up has been compounded by an increase in import levels in March relative to the prior month, and consistently wet weather in many regions of the U.S. has delayed any pickup in demand from the construction sector. Still, beam prices have found support from the recent announcement of a trade case on prefabricated steel products, and merchant bar has been supported as mills held their ground against prior month imports from Mexico.

Wire rod buyers continue to buy limited volumes in an effort to work down their inventories. At the same time, some buyers expect softening scrap prices, and possibly lower global prices to keep domestic U.S. prices at levels similar to or lower than they are currently. This has reduced the incentive to buy large quantities. Mill lead times continue to average around 3-4 weeks.

Imports too have risen and piled on to downward price pressure for wire rod. U.S. Census Bureau data show a 23 percent rise in wire rod imports from February to March, but the March 76,700t import total is still well below totals in late Q4 and early Q1. Notably, about 20,000t is expected from Malaysia, the first shipment from that country in at least a year.

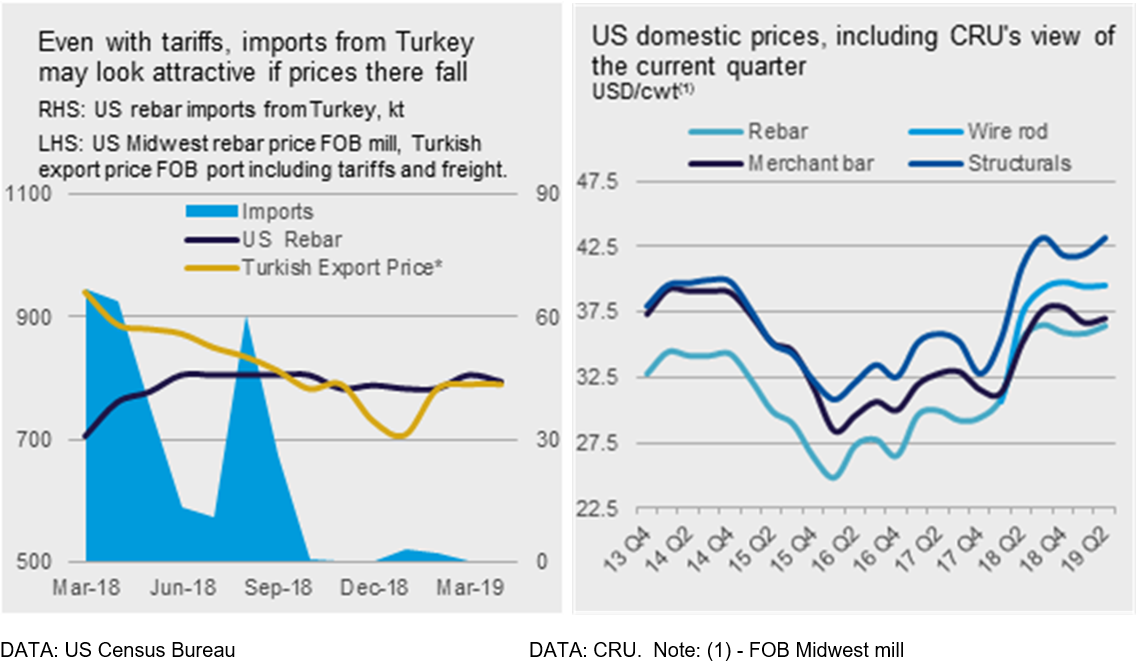

Competitive import offers have also affected rebar prices. Mills that increased prices by $1.00/cwt have met limited success in some instances as import offers came in near $34.00/cwt loaded truck in the Gulf Coast. March import volumes nearly tripled from the prior month to 95,700t, the bulk of which arrived from Europe. Market participants said that Turkish exporters are becoming more aggressive with offers amid a declining lira, with some offers as low as $705/t ($32.00/cwt). These offers may result in imports arriving from Turkey despite a tariff of more than 50 percent being currently in place.

Domestic pressures also played a role in weakening U.S. rebar prices. Mill inventories have strengthened as the pace of shipments has slowed due to suppressed demand from the construction sector. Still, market participants expect construction demand to return as the weather becomes milder.

Market participants said that lower price offers from Mexico have slowed and become more localized, supporting somewhat higher prices. Prices for beams were unchanged from the prior month, although import prices were led higher following the announcement of a trade case on prefabricated steel products.

Outlook: Longs Prices Unlikely to Find Support from Scrap Market, But Order Backlogs are Strong

Mill outages and little change in export prices are poised to keep scrap prices either unchanged or $10-20/ l.ton lower in April than in March. Meanwhile, the weather has been warm enough to keep scrap flowing into dealer and mill yards, which will help offset issues on the Mississippi River system that is preventing scrap from moving from Chicago to the south. Indeed, some mills have already cancelled outstanding March orders. This means that longs prices in the U.S. are unlikely to find a boost from scrap prices in the second quarter of 2019.

Construction demand will likely return in April and help boost some longs prices, but a deteriorating lira may put Turkish exporters in a competitive position in the U.S. market (see chart). Still, market participants report solid backlogs from construction end-users, especially for rebar, which is expected to boost prices as the weather improves.

Explore this topic further with CRU.