Prices

May 7, 2020

Hot Rolled Futures: HR Market Values Uneven During Covid-19 Shutdowns

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

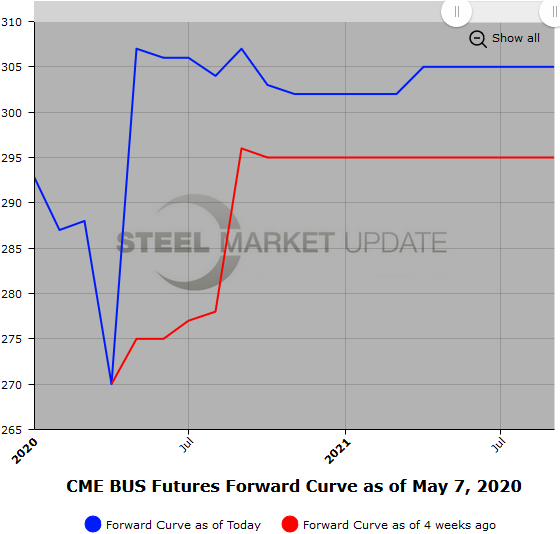

A large drop in the HR index used to settle the CME HR contract last week helped push April to settle $66/ST below the March settlement ($572/ST). However, looking forward, the sub $450/ST HR physical trading was quickly curtailed by the mills announcing a price increase to near the $500/ST level. This gave the HR curve a bid tone with both Q3’20 and Q4’20 rising by $11/ST and $14/ST going into the beginning of this week. A softer than expected HR index this Wednesday saw a return of some selling and lower settlements in the Q3’20 and Q4’20. Interestingly, today the market feels bid again. However, the contango we see in the HR futures curve has been very muted with just $10/ST between Jun’20 and Q1’21 values and less than $5/ST between Q3’20 and Q4’20. The waffling nature of values and the flat curve clearly point to a market without much price conviction. However, with the tight scrap markets and higher scrap prices expected, market participants will likely be looking for additional mill price increases. Given low current manufacturing capacity utilization, forecasting the timing of demand will prove to be potentially very tricky and likely lead to additional HR futures price volatility.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

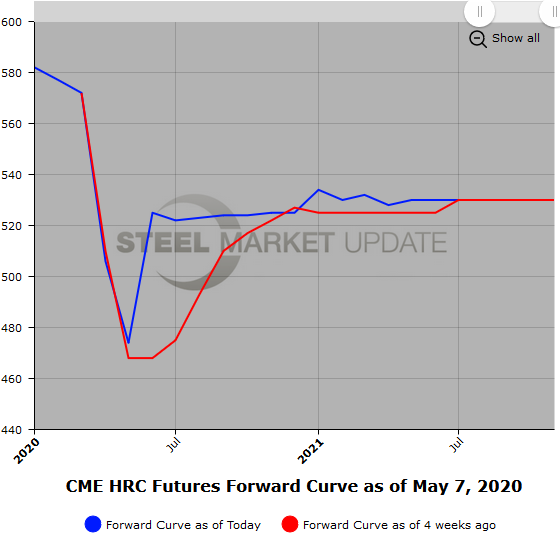

Scrap

The scarcity of scrap has finally surfaced as we go into the May’20 BUS settlement. Participants are expecting BUS prices to be up $35-40 for May’20. Today May’20 and Jun’20 BUS were $307/GT bid and offered at $315/GT. We have noticed significant buying the last few weeks for BUS futures and it has not abated yet. The curve is slightly backwardated with Q1’21 BUS trading at about a $10-12 discount to the near date futures.

Markets are trying to get a handle on how long it will take to get stocks back up. With a lot of states starting to open their economies back up, we should start to see some of the pressure ease on supplies. However, it will likely be another month or so before supplies improve. A lot will depend on how quickly steel buying ramps back up. We are in uncharted territory as far as forecasting goes in the Covid-19 environment. To add to the murkiness of market values, obsolete scrap supplies have also been impacted by state closures as well as overseas inquiries. It seems scrap is scarce globally.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.