Prices

January 7, 2021

Hot Rolled Futures: Very Strong Move

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

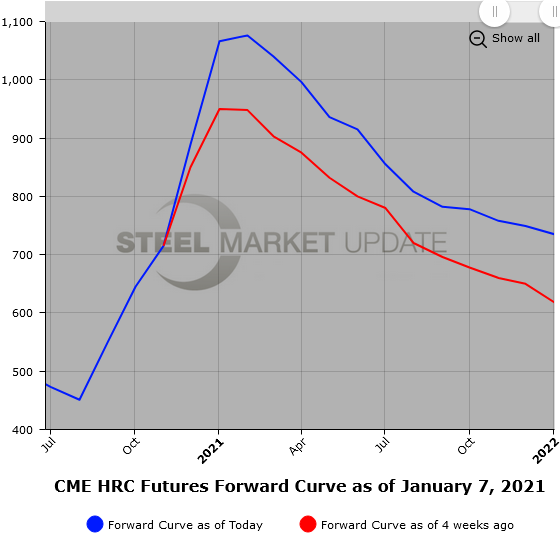

Hot Rolled

HR and scrap prices had a very strong move in the last month. All eyes focus on lead times for a signal that price increases will ease. In the last month, we have witnessed a continuing acceleration in price volatility due to continued tightness in both metallics and finished HR steel. Limited import competition and scarcity of spot HR tons, as well as strong scrap export demand, have helped to drive HR futures prices much, much higher. Making new highs in HR futures. The front HR futures month (Jan’21) climbed $200/ST between Dec. 7, 2020, and today, while the Jan’22 HR futures price climbed almost $120/ST. Based on closing settlements for Jan. 7, 2021, the spread between HR Q1’21 and HR Q2’21 is -$112/ST ($1,061/ST versus $949/ST). The spread between HR Q2’21 and HR Q3’21 is -$134/ST ($949/ST versus $815/ST) and the spread between HR Q3’21 and HR Q4’21 is -$53/ST ($815/ST versus $762/ST). The backwardation in the Jan’21 through Dec’21 curve has steepened by $61/ST as the spread from Jan-Dec moved from a differential of $256/ST to $317/ST. Trading in HR futures was pretty active in the last month including the first few days of 2021 with almost 240,000 ST of HR futures trading. The bulk of the volume coming from the nearest six months.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

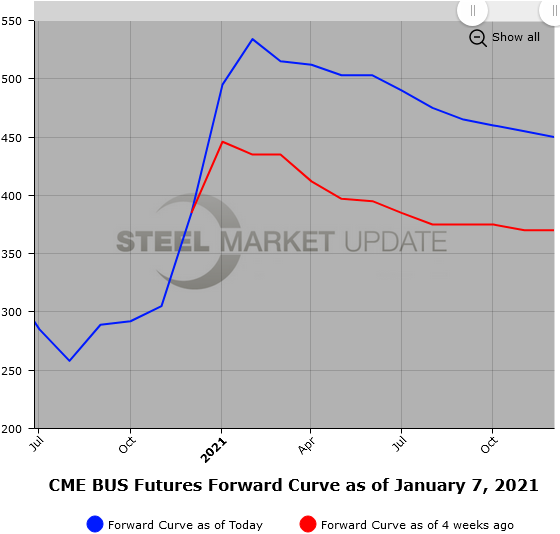

BUS futures have tracked the strong rise in HR futures with the front 12 future months up about $100/GT on average. However the largest move higher in prices in the last month has occurred in the mid-2021 months. Strong export scrap markets and continued supply tightness at yards and from factories that are below their normal run rates due to COVID inefficiencies have driven prices higher. The spot market talk is for a strong move higher for Jan’21 settlement. This morning, Jan’21 BUS futures traded at $500/GT. If this level holds, that would suggest a $115 rise over Dec’20 BUS settle. Expect the market volatility to remain high especially as we enter the winter months and travel logistics become a potentially bigger issue. Also there are some scheduled maintenance outages in the prime scrap alterative pipeline in the not-too-distant future.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.