Prices

February 2, 2021

SMU Price Ranges & Indices: Prices Still Rising, For Now

Written by Brett Linton

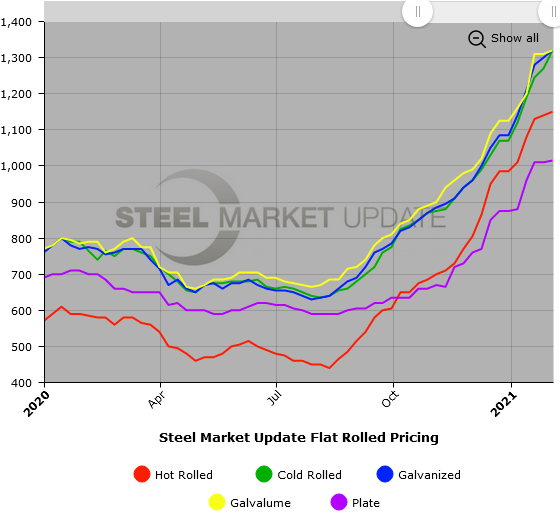

U.S. flat-rolled steel prices remain on the rise thanks to strong demand, thin spot supplies and limited short-term competition from imports. While some sources think imports could send domestic prices lower, others note that foreign steel suffers from the late deliveries that have plagued customers of domestic mills. “Too much risk ordering foreign steel with lead times into the summer as well as the ship shortages and huge port delays,” said one respondent to Steel Market Update’s check of the market this week. In short, peak pricing might be in sight. But the U.S. steel market isn’t there yet. “I believe we are 20-30 days away from mills beginning to negotiate,” another survey respondent said. SMU’s hot-rolled coil price in the meantime averages $1,150 per ton ($57.50/cwt)–up $10 per ton from last week and marking a new all-time high for U.S. HRC prices for the fourth consecutive week. And the latest gains come despite increasing fears of a correction in the weeks ahead. Steel Market Update’s Price Momentum Indicators continue to point toward higher prices in the short term, but perhaps not for much longer.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,100-$1,200 per net ton ($55.00-$60.00/cwt) with an average of $1,150 per ton ($57.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $10 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-10 weeks

Cold Rolled Coil: SMU price range is $1,280-$1,360 per net ton ($64.00-$68.00/cwt) with an average of $1,320 per ton ($66.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end increased $60. Our overall average is up $50 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $1,280-$1,360 per net ton ($64.00-$68.00/cwt) with an average of $1,320 per ton ($66.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to one week ago. Our overall average is up $20 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,349-$1,429 per ton with an average of $1,389 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-12 weeks

Galvalume Coil: SMU price range is $1,280-$1,360 per net ton ($64.00-$68.00/cwt) with an average of $1,320 per ton ($66.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $10 from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,571-$1,651 per ton with an average of $1,611 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $1,000-$1,030 per net ton ($50.00-$51.50/cwt) with an average of $1,015 per ton ($50.75/cwt) FOB mill. The lower end of our range increased $60 per ton compared to one week ago, while the upper end decreased $50. Our overall average is up $5 compared to last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.