Market Data

April 6, 2021

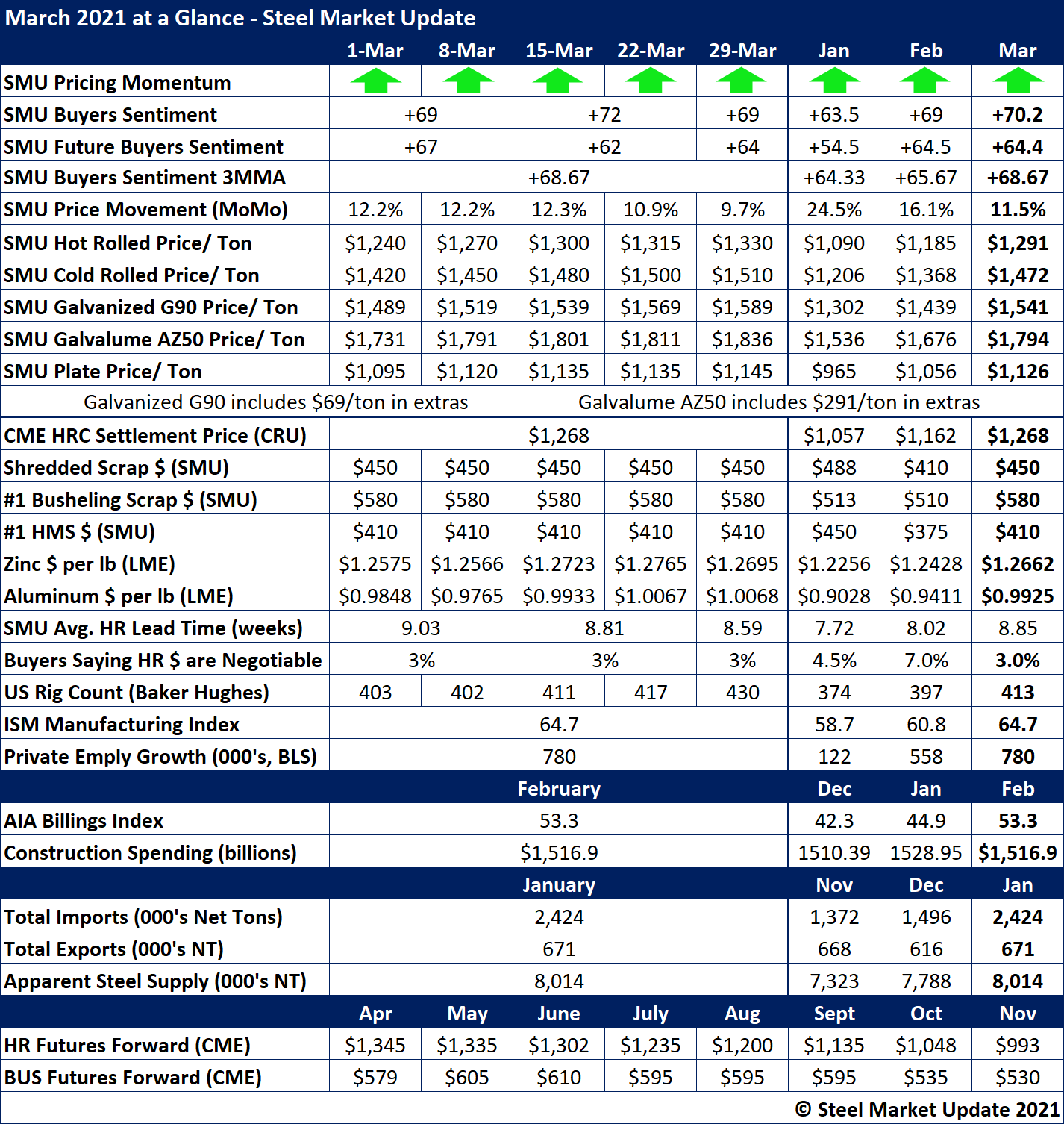

SMU's March At-a-Glance

Written by Brett Linton

For the seventh consecutive month, steel prices rose throughout March, fueled by a continuation of strong demand and limited supply. Hot rolled steel prices averaged $1,300 per ton by the middle of the month, far exceeding any historical price record, and reached $1,330 by the last week of March. The SMU Price Momentum Indicator has remained unchanged since the August 2020 adjustment to Higher, indicating prices are expected to rise further in the short term.

March scrap prices rose 9-14% over February, with busheling up $70 per ton, shred up $40 and HMS up $35. Zinc prices were relatively flat throughout the month, while aluminum prices increased 3% and reached a multi-year high in the fourth week of March.

The SMU Buyers Sentiment Index continues to show a high level of optimism, ending the month at +69. The three-month moving average reached +68.67 as of last Thursday, the highest reading in three years.

Hot rolled lead times extended further, peaking at a record 9.03 weeks in early-March, while the percentage of buyers reporting mills willing to negotiate on HR prices remained at a tiny 3% all month.

Key indicators of steel demand overall remained positive. The ISM Manufacturing Index indicated further expansion in the economy for the 10th consecutive month, and the AIA Billings Index recovered for the second month in a row. Construction spending remained strong in February. Total U.S. steel imports and apparent steel supply both have shown gains in the past months.

See the chart below for other key metrics in the month of March:

By Brett Linton, Brett@SteelMarketUpdate.com