Distributors/Service Centers

May 6, 2021

Russel Metals Posts Strong Q1 Following Q4 Loss

Written by David Schollaert

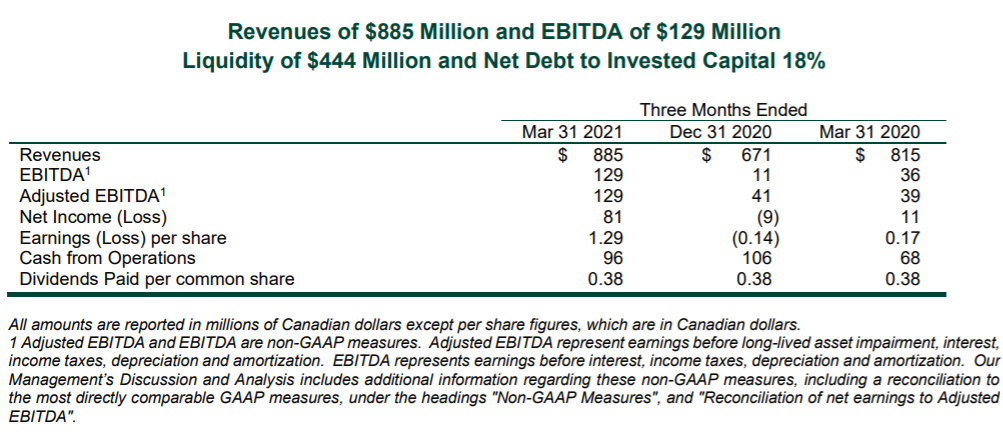

Russel Metals reported strong operating profits thanks to “favorable market conditions” across all business segments in the first quarter of 2021. The Canadian metals processor and distributor posted net earnings of $81 million in Q1, up from a loss of $9.0 million in Q4 2020 and up from $11 million year on year (all figures are in Canadian dollars).

Russel’s revenues through the first quarter totaled $885 million, up from $671 million in the prior quarter, while gross margins improved to 28.8% in Q1 compared to year-ago margins of 18.7%. The advances were directly related to improving market conditions and rising steel prices that have pushed results beyond pre-pandemic levels, the company said.

“Higher input costs are still continuing to come in, but we have been able to maintain our margins in service centers and steel distributors while keeping up with compressed timelines and rising demand,” said John Reid, President and CEO of Russel Metals. “There will be some normalization in the future, but we are very bullish on Q2 remaining strong and are very optimistic on the business outlook.”

Russel Metals’ service center shipments were up 10% compared to the previous quarter–exceeding pre-pandemic volume–and were up 4% year on year. As steel prices rose substantially in late 2020 and early 2021, the selling price per ton also increased, up 26% quarter on quarter, and up 28% year on year. The company added that their service centers and distribution operations are continuing to experience improving demand and pricing into the second quarter. As steel prices have soared, the company said, the delta between average inventory costs and average selling costs has been maintained.

“Price realizations are following steel costs. Margins were moving in the early part of Q1 and are holding as we continue into Q2,” said Martin Luravsky, Executive VP and CFO of Russel Metals. “We are a cost-plus business, so although we have tight inventories, we are turning them quickly. Given the nature of demand right now, costs are basically flowing into our end markets.”

Although demand in energy production has begun to recover, it remains below pre-pandemic levels, company executives said. Russel Metals has reduced its OCTG and line pipe inventories by $99 million since July 2020, ahead of the December 2021 goal, including $34 million in the first quarter of 2021.

Russel Metals is contributing assets of approximately $111 million to their OCTG/line pipe businesses partnership with Marubeni-Itochu Tubulars America, Inc., and will receive near-term cash realization of approximately $138 million and a 50% equity interest in TriMark. Following the completion of this transaction, Russel’s remaining OCTG and line pipe business will be in the U.S. and will continue orderly liquidation of the remaining inventory. Current U.S.-based inventory totaled approximately $40 million as of March 31, 2021, the company said.

(Editor’s note: All dollar amounts are Canadian; 1 CAD $ = 0.82 USD $)

By David Schollaert, David@SteelMarketUpdate.com