Plate

December 19, 2021

Hyundai Lowers Offers for Q1 '22 HRC, Sheet Prices Below Plate

Written by Michael Cowden

It’s not just domestic steel prices that are falling rapidly, so too are prices abroad.

Case in point: South Korean steelmaker Hyundai. Its latest offer for hot-rolled coil for February-March shipment to the West Coast is $1,450 per ton DDP to Los Angeles-area ports.

![]() That’s down significantly from prior offers of $1,600-1,640 per ton, according to market participants.

That’s down significantly from prior offers of $1,600-1,640 per ton, according to market participants.

Recall that South Korea agreed to a quota and so is not subject to Section 232 tariffs of 25% that imports from other nations face.

While some expressed frustration that Hyundai was effectively devaluing orders placed earlier in the year, others said it was not unexpected given broad based steel price declines – including in recent offers from U.S. mills.

Steel Market Update does not officially track import prices. But U.S. hot-rolled coil prices currently stand at $1,670 per ton, down 15% from a 2021 high, recorded in early September, of $1,955 per ton.

And most market participants expect sheet prices to continue to decline:

“I have had more unsolicited offers,” one respondent to a recent SMU survey said.

“I don’t believe any mill would turn down a 1,000-ton order,” said another.

“Mills are certainly asking for contract orders earlier than usual,” noted a third.

On the plate side, meanwhile, Hyundai is offering $1,500 per ton delivered DDP Long Beach and $1,470 per ton DPP Houston and New Orleans.

The variation between California prices and Gulf Coast prices is not unusual. West Coast ports are typically more expensive.

What is notable is that Hyundai is charging more for plate than for coil – mirroring a recent trend in the domestic market.

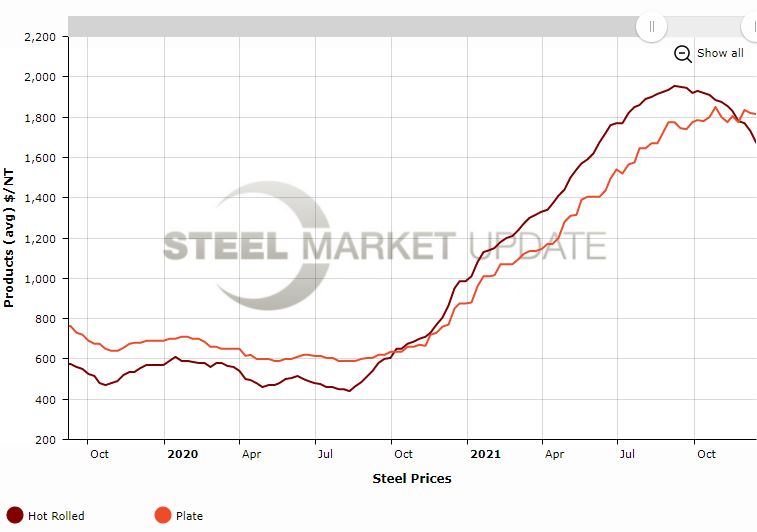

SMU’s U.S. plate price is at $1,815 per ton, or $145 per ton more than hot rolled coil prices. We noted last month that plate was on pace to regain its typical premium over sheet.

And now it has, as the chart below shows. The red line is hot rolled coil prices, and the orange line is plate prices:

You can recreate that chart using our interactive pricing tool.

Our data also reflects recent sentiment from market participants. Prices are down in the sheet market but “NOT in plate products … two separate stories,” a fourth survey respondent said.

By Michael Cowden, Michael@SteelMarketUpdate.com