Prices

March 3, 2022

Hot Rolled Futures: Strong Near-Term Price Reversal in HR; How Long Will it Last?

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

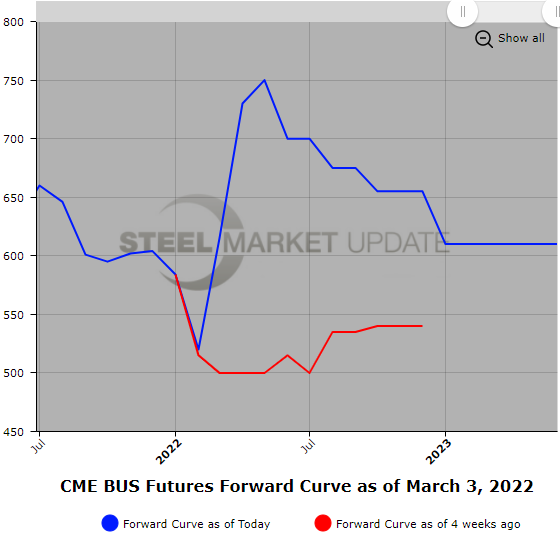

In spite of a large drop in the HR index this past week (sub $950/ST), the forward curve in HR continued to spike higher on the Russia invasion of Ukraine. As of yesterday’s close, both Q2’22 and Q3’22 HR average prices were up over $310/ST since settlements at the beginning of February 2022. Yesterday’s average price Q2’22 settlement was $1,278/ST and average price Q3’22 settlement was $1,250/ST.

Recent price increases announced by various steel mills have added to the price uncertainty as folks try to gauge the availability of future spot tons due to the global ferrous supply disruptions resulting from the war. For those who missed selling HR initially on the price move down, this interruption has given them another opportunity to sell at much better levels than early February. Recent HR futures activity suggests the market expects elevated prices to remain through Q2’22 based on recent Calendar spreads in Q2’22 versus further out quarters

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

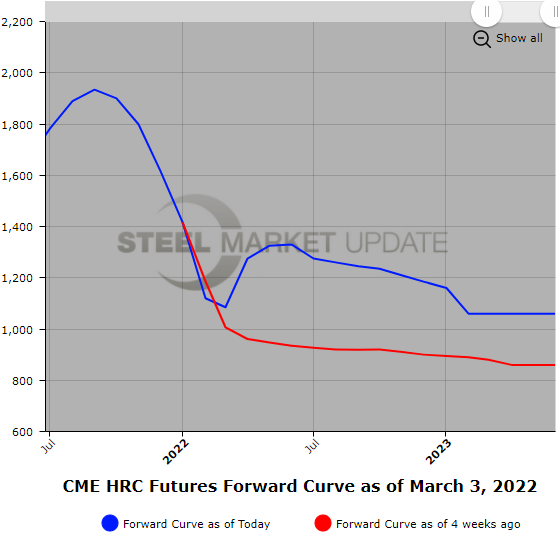

The war news has affected BUS prices due to expectations of a supply pinch in metallics cargoes coming out of the Black Sea. U.S. export scrap prices are expected to be $50-$70/ ton higher.

Beginning of February 2H’22 BUS settles were at $535/GT and traded yesterday at $655/GT, up $120/GT in just one month. The uncertainty regarding the war’s outcome has boosted nearby BUS months even more as mid $700 prices are trading in May’22. The talk was of up $60-80/GT for March BUS, but some have even suggested higher. Today the Mar’22 BUS traded as high as $615/GT, which signals up $95/GT.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.