Prices

April 21, 2022

Hot Rolled Futures: Declining Futures Prices Reflect Rising Interest Rate Concerns

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

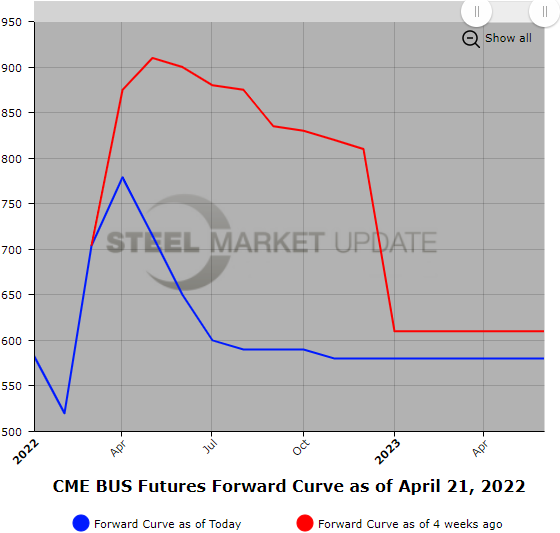

Recent HR spot price increases have continued to decelerate this month as prices near $1,500/ton. Initial market metallic supply concerns related to the impact of the Ukraine/Russia war appear to have abated as better market intelligence is reflected in the HR curve. Month-to-date April, the futures curve prices have steepened and shifted considerably lower even as the spot price rose. The backwardation in the Apr’22 to Dec’22 HR futures has widened by $92/ST (1575/1317 versus 1465/1150) for the period of Apr 1st as compared to Apr 21st. The price shift lower in the HR forward curve from May’22 HR future through Dec’22 HR future represents an average of almost (-$175/ST). Some of this decline reflects some perceived future headwinds: How fast will the Federal Reserve Bank have to increase rates due to the stubbornly high inflation? How much will this dampen future HR demand?

But keep in mind before the outbreak of hostilities, the HR spot and the futures curve was valued at just above $1,030/ST. For reference, on Feb 25th the Q2’22 HR settlement average price was $382/ST lower than today’s settlement, the Q3’22 HR settlement average price was $242/ST lower than today’s settlement, and the Q4’22 HR settlement average was $169/ST lower than today’s settlement. After the initial market movement, calm seems to be returning to the HR markets. Declining import HR prices and an easing of prices paid for export scrap seem to be pointing to less tight markets. The question is, how much longer until we revert to the pre-war prices?

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

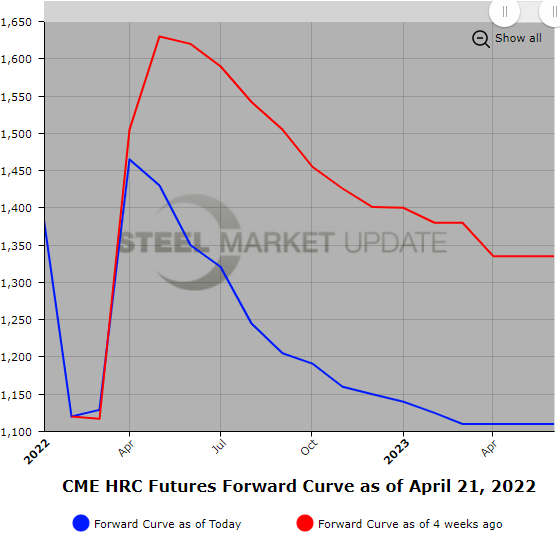

Month-to-date April 2022 BUS futures have retraced most of the war premium built in due to global supply concerns. The latter half of 2022 futures settlements are hovering just shy of $590/GT, which reflects no change when compared to Feb 25th.

May BUS price has declined $165/GT since April 1st and settled today just $95/GT above its close on Feb 25th. News that mills have pig iron through the end of 2023 and softening export scrap prices has reversed the initial BUS price surge.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.