Prices

June 23, 2022

Ferrous Futures: HRC & Bush Test February’s Lows

Written by David Feldstein

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. Rock provides customers attached to the steel industry with commodity price risk management services and market intelligence. RTA is registered with the National Futures Association as a Commodity Trade Advisor. David has over 20 years of professional trading experience and has been active in the ferrous derivatives space since 2012.

At last week’s Federal Open Market Committee press conference, Fed Chair Jerome Powell said: “This is an extraordinarily uncertain environment.”

This comment was not said specifically about the Midwest flat-rolled steel market, or was it?

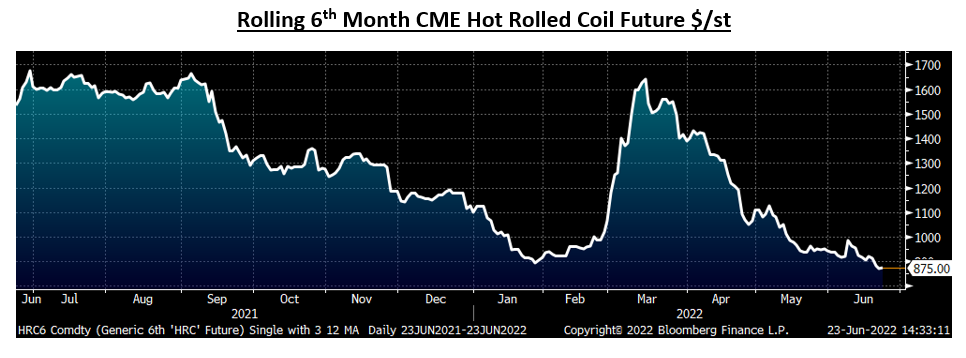

I would caution anyone feeling overconfident in their ability to reliably predict where Midwest HRC prices are headed by simply showing them the price swings in the rolling 6th month CME HRC future over the past ten months. Last September, the 6th mo. future, then February, was trading $1,640. Three months later, the 6th month contract (May) was trading around $1,200. Sixty days after that, the July future was trading $923. Thirty days after that, the August future was at $1,600, and two months later it was at $1,038. Today, the 6th month future, now November, settled at $875. Some folks believe the futures to be a dependable tool for predicting the future. I respectfully disagree.

Rolling 6th Month CME Hot Rolled Coil Future $/st

The Commodity Futures Trading Commission (CFTC) categorizes market participants into three categories: commercial hedgers, speculators, and financial intermediaries. The first group has a physical interest, the second are investors or traders looking for a return on their capital, and the third group is mostly made up of large banks with trading desks facilitating their customer’s orders. In recent years, the number of market participants in the CME Midwest HRC futures market has grown exponentially. During that time, those considered to be speculators and financial intermediaries have grown their share of the futures market dramatically. These participants bring with them incentives sometimes very different from the commercial hedging crowd. This is a big win for all as it facilitates a diverse group of interests that provides the collective with increased liquidity. However, it also brings with it price action that might have nothing to do with the physical market.

A number of the non-commercial market participants are based in London due to the legacy of the London Metals Exchange (LME). This group also trades in derivatives markets related to global ferrous raw materials, such as iron ore and Turkish scrap, as well as other metals and commodities. This was the HRC futures market on Monday morning of this week.

The market was already down a good clip when Americans were waking up on Monday morning. These trades below occurred early Monday morning. And based on the time of the trades, the assumption is they were made by traders based in London.

When the US-based commercial steel industry woke up and looked at the HRC futures, they saw another day of sharply lower prices right out the gate. Did this influence physical sentiment at all?

Why were the London traders hitting bids so aggressively? Maybe they are just really bearish on HR? Or do they know something we don’t? Perhaps. However, also trading in Asia and Europe, overnight in the US, was iron ore and LME Turkish scrap. Iron ore was down over $10 or 8.5% just during Monday’s trading session! Perhaps the London financial intermediaries, traders, speculators, etc., were buying iron ore futures, either by choice or because of the order flow being sent to their desks – and started selling the untouched Midwest HRC futures to offset some of their risk or because they saw the spread to be at an attractive value.

Rolling 2nd Month Iron Ore Future $/mt

Perhaps what they know is simply they want to own iron ore at $110/t and sell short Midwest HRC at $900/t. Could those buyers of physical HR using futures market for guidance be misunderstanding the price action? Could this be influencing their decision making to buy physical tons?

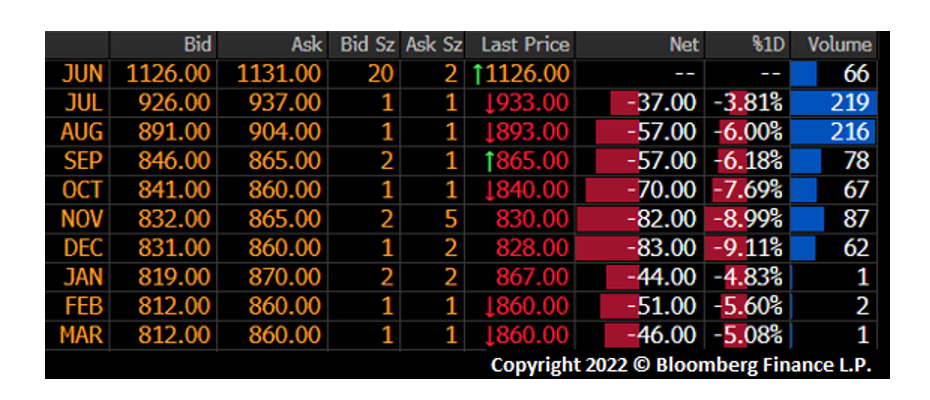

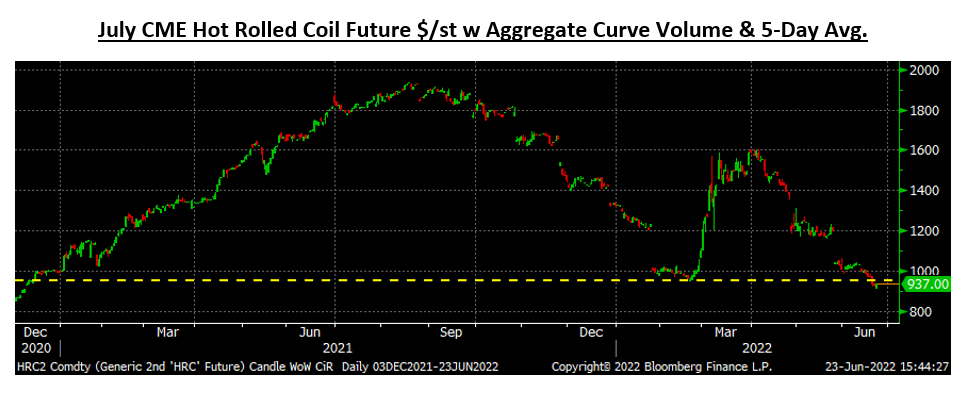

Volume in HR and busheling futures has picked up over the last two few weeks while prices have fallen.

July CME Hot Rolled Coil Future $/st w Aggregate Curve Volume & 5-Day Avg.

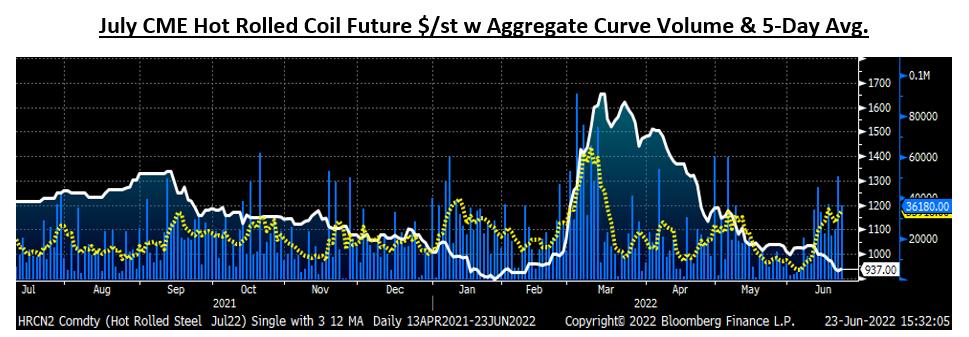

The HRC futures curve has flattened dramatically with declines around $120 in August and September outpacing the other months. The curve similarly flattens into a tight range in mid-February, right before the epic rally that peaked in March.

CME Hot Rolled Coil Futures Curve $/st

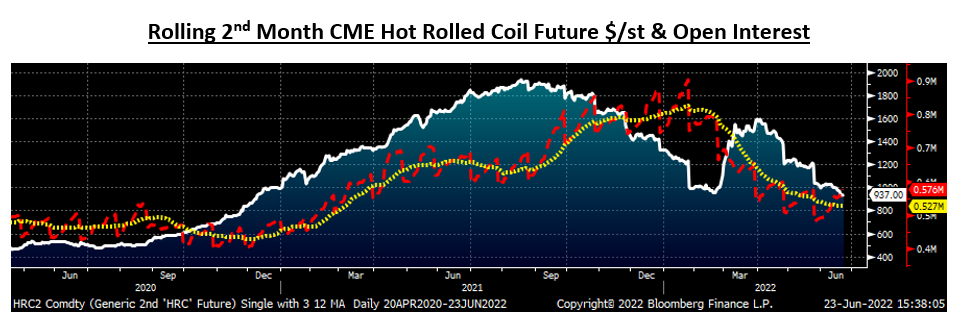

However, open interest continues to trend lower and is about 4k tons higher than it was in May with four trading days left before expiration indicating a flattish outcome. Open interest is the number of outstanding futures contracts, or tons in this case. However, keep in mind that with open interest across the entire futures curve at 576k tons, it is something like 1% of annual domestic flat rolled consumption. By definition, the futures are the tail wagging the dog.

Rolling 2nd Month CME Hot Rolled Coil Future $/st & Open Interest

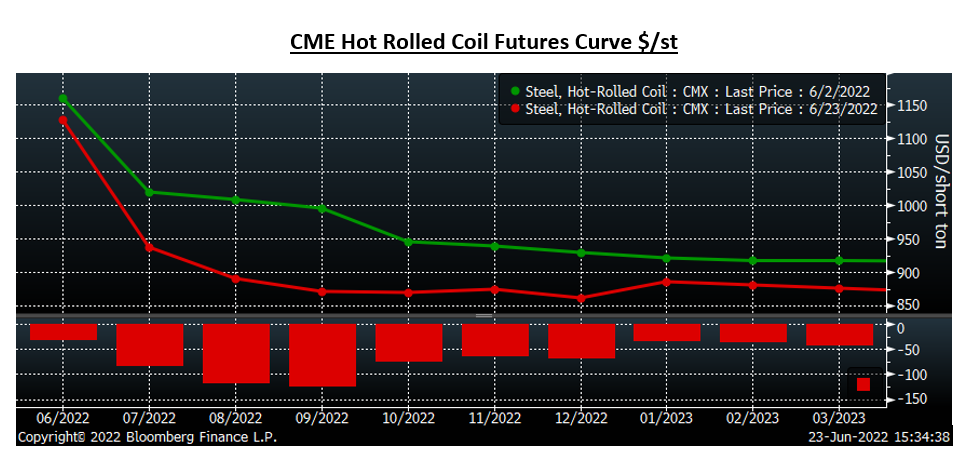

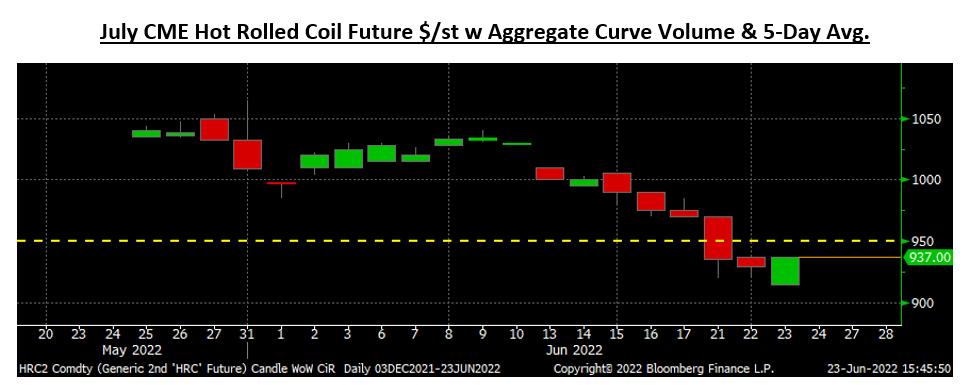

In the chart of the rolling 2nd month future below, the yellow dashed line drawn at $950 represents support as it was the low established in February before prices exploded back above $1,600.

July CME Hot Rolled Coil Future $/st w Aggregate Curve Volume & 5-Day Avg.

This $950 area is where the battle in the futures market is being played out. Here we zoom in closer and see that the July future has now settled for three days below the support level. With the financial market professionals comes a lot of game theory and algorithms including ones that seek out these simplistic technical levels, push pricing below them in an effort to trigger a cascade of stop orders, which these same individuals gladly scoop up and then take the market right back up. However, HRC futures remain too illiquid for most to even enter stop orders. Nonetheless, this brief dip below might not be convincing enough just yet that the support won’t hold. With HRC futures trading $100 – $175 below the latest physical indices, will buyers be enticed to step in at these levels and lock in prices for the back half of ‘22? Trading volume has jumped over the past two days to a combined 86k tons, yet there has been little change in settlements with some green on the screen today. Does that mean support is holding?

July CME Hot Rolled Coil Future $/st w Aggregate Curve Volume & 5-Day Avg.

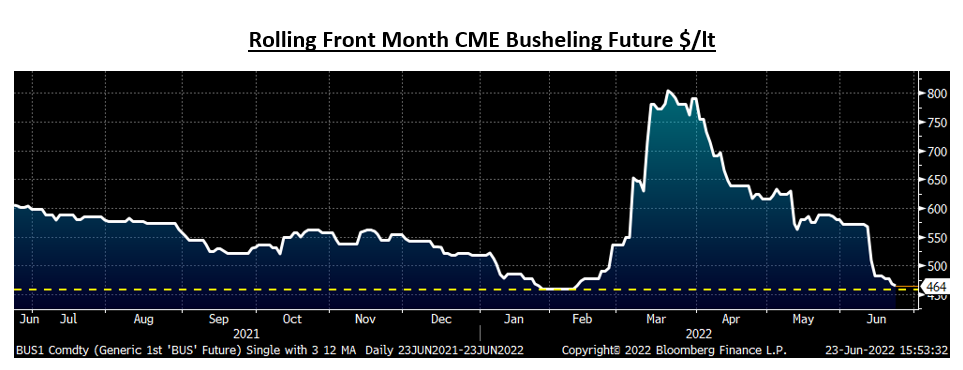

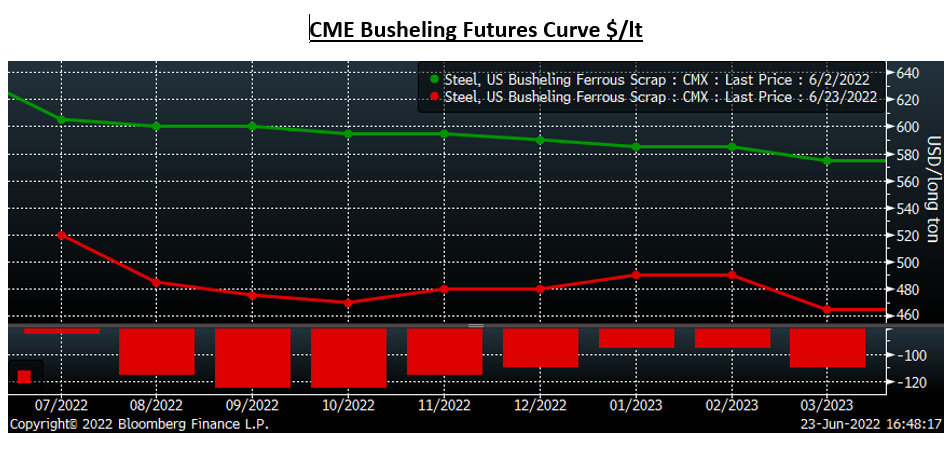

Interestingly, CME busheling is also at its same February support level. The plot thickens.

Rolling Front Month CME Busheling Future $/lt

CME Busheling Futures Curve $/lt

The charts indicate its about to get real in HRC and busheling futures in one direction or the other. Either their mutual support levels will hold and futures will rally, or support will break and then look out below. It is a very interesting time in the ferrous markets so keep a close eye on the levels shown above. And remember: “This is an extraordinarily uncertain environment”

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.