Analysis

October 4, 2022

Final Thoughts

Written by David Schollaert

The ongoing trend for steel sheet prices has remained mostly flat over the past several weeks, and this week was really no exception.

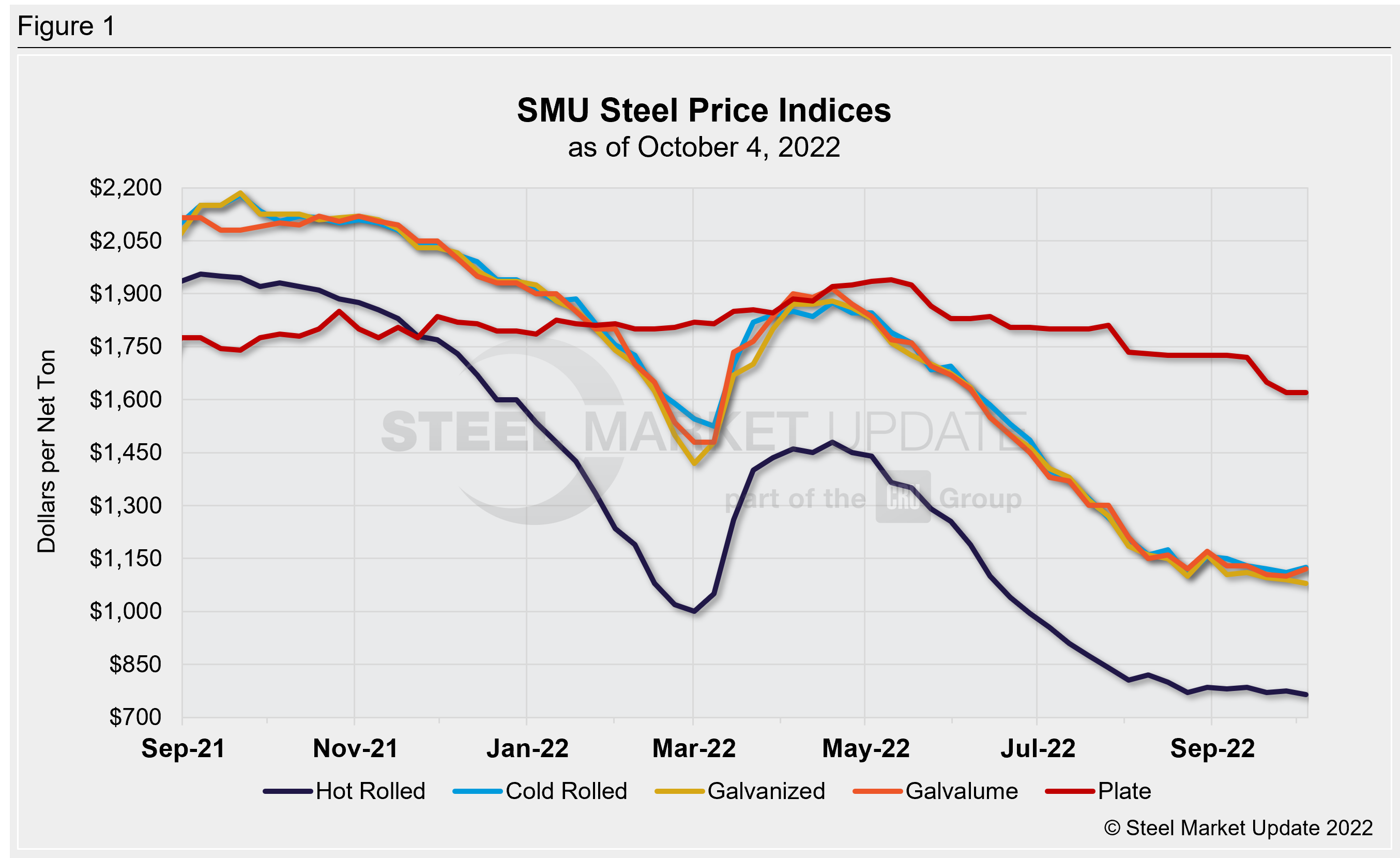

We’ve seen a tightening of spreads between hot-rolled coil prices and those for cold rolled, galvanized, Galvalume. And the trend of narrowing spreads is even more pronounced when it comes to plate. That said, steel sheet prices in general have been modestly up or down from one week to the next – without a sustained movement in either direction.

This trend couldn’t be more evident than in the ebb and flow HRC has seen over the past eight weeks. Over that span, prices have fluctuated no more than $25 per ton, running between $765 per ton and $885 per ton since mid-August.

Though stability is typically a good thing, sentiment across the sector is uneasy. Many, if not most, wonder when the other shoe will drop, questioning whether this unprecedented stability (given the volatility of the last two years) is just the calm before the storm.

Is the market being set up for a price shakeup – a surprise left hook for a knockout? Or will we grind along for 12 rounds?

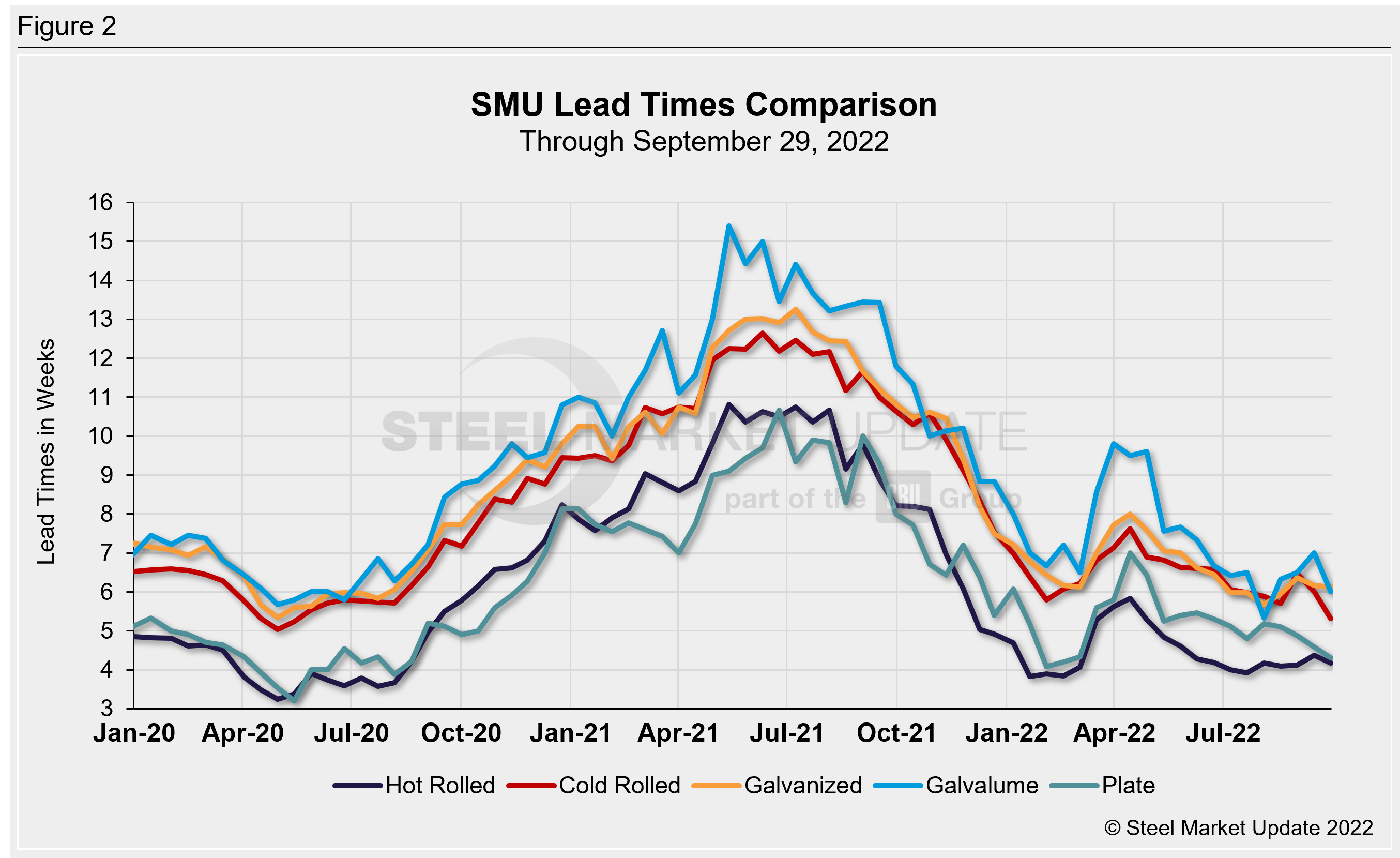

Lead times have also been mostly sideways over the same period. HRC lead times have been fluctuating in the low end of the four-week mark, most recently at 4.18 weeks, down slightly from 4.37 in mid-September. In general, lead times have been easing, potentially setting the stage for lower prices in the near-term.

See these dynamics illustrated in Figure 1 and Figure 2 below.

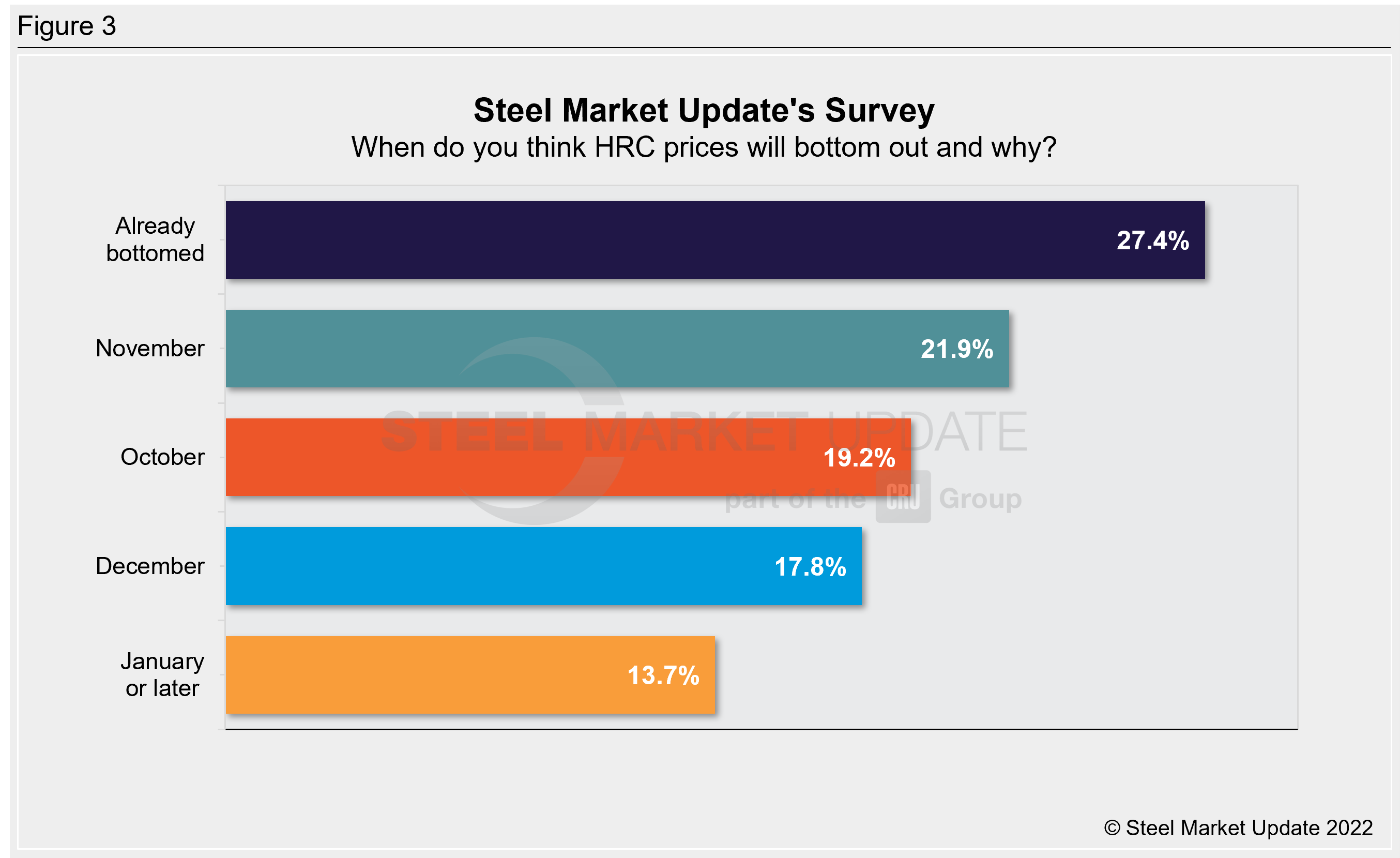

Our most recent survey results further highlight the market’s uncertainty.

In Steel Market Update’s survey on September 26-27, we asked: When do you think HRC prices will bottom out and why? Not surprisingly results were a mixed bag (Figure 3). The majority – just about 28% – of the service center and manufacturing executives who responded said they think prices have already bottomed. But that’s by no means a large majority. The remaining results were divided – with answers spanning from October to January, and even beyond.

Here’s what a few had to say:

“I think we bottomed now for a couple of weeks. But come late November and early December, lead time and pricing will drop again.”

“Price may be near the bottom but confidence in it is not.”

“November-December seasonal slowdown.”

“Lack of demand.”

“The market will remain weak into Q1 2023.”

“Mill downtime till Dec will be taking lots of material out of the market, elections will be over, and the New Year will start on an up note.”

“I feel fundamentals are in balance for the next 45-60 days.”

“Buyers will come back after trying to reduce for year-end.”

“December is historically slow in the metal building industry.”

“I’m not sure we’ve seen demand hit the floor.”

“Demand is low”

“Demand curve vs available capacity – in particular, increased EAF tonnage.”

“I think we’re getting close, but to my surprise/chagrin, we’re probably not quite there yet.”

“I don’t think the mills want pricing any lower during the quoting season.”

“Mill order book starting to fill out. The first sign of a price shakeup.”

“December spot buys will pull the market down for a few weeks.”

“Leveling off now, room to fall when lead times hit the floor at the end of the year”

In short, demand continues to cool. Buyers are working through inventories and only sourcing to fill gaps. Ultimately, only time will tell if the latest lull is just a pause ahead of more significant price or whether the stability can continue. Most indications seem to point toward lower price tags into fourth quarter as market conditions slow.

As always, we appreciate your business.

By David Schollaert, David@SteelMarketUpdate.com