Analysis

October 25, 2022

Final Thoughts

Written by David Schollaert

Don’t look now but sheet price erosion continues, with tags across all flat-rolled products inching lower this week, according to SMU’s latest check of the market.

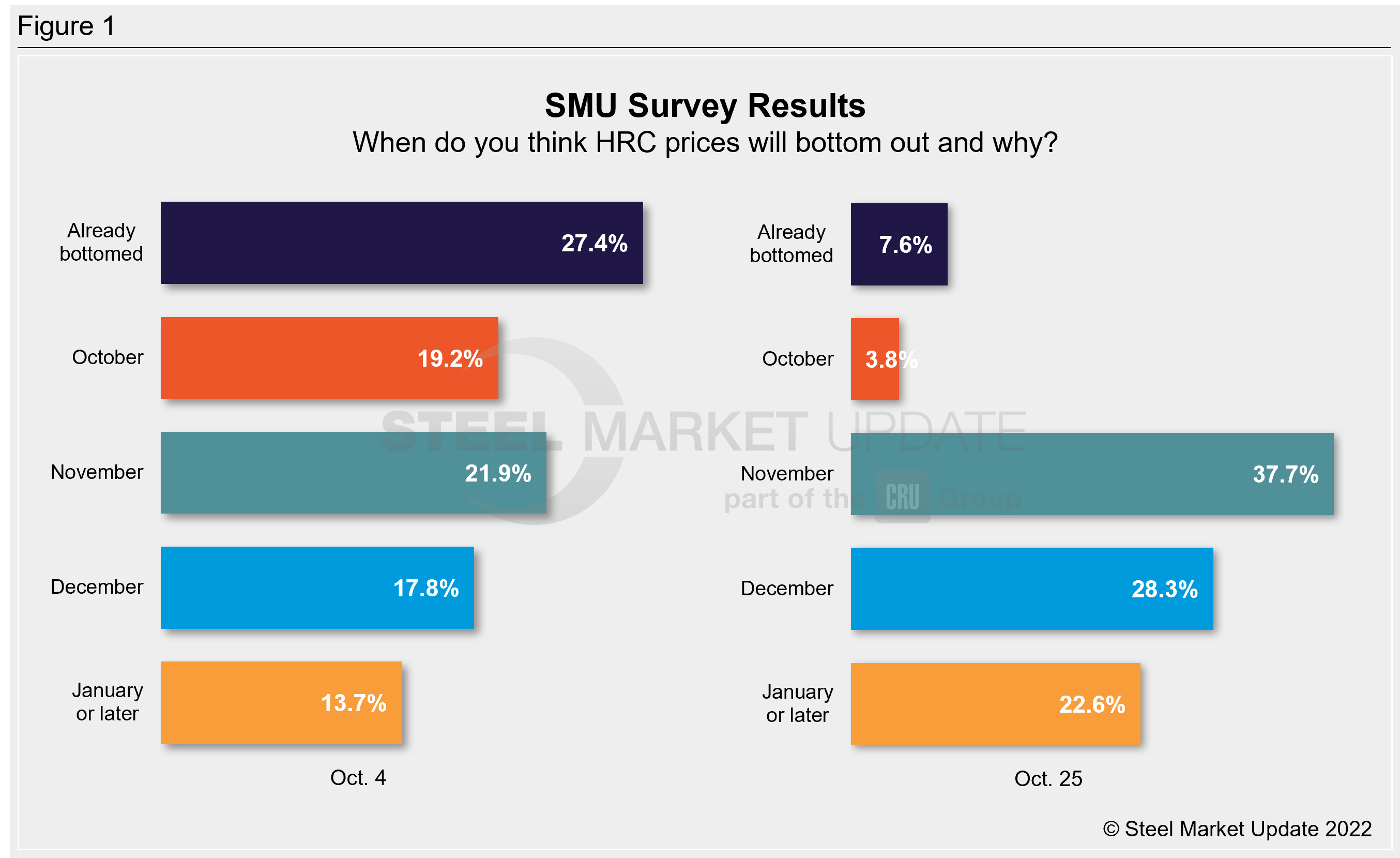

For some time now we’ve been trying to gauge SMU survey respondents’ sentiment and their sense of market direction by asking when they think HRC prices will bottom out and why?

We won’t release full survey results until Friday afternoon. But the preliminary data below provide an early look at which way things are trending.

So when do people think prices will bottom? About 38% of the service center and manufacturing executives who participated in this week’s survey said they think prices will bottom next month. But just a few weeks ago, many thought prices had already bottomed.

Many leading indicators point to a more bearish market over the near term. Buying remains focused on fulfilling contractual requirements and gap filling. Market participants are focused on right-sizing inventory positions, especially given that mill lead times remain short.

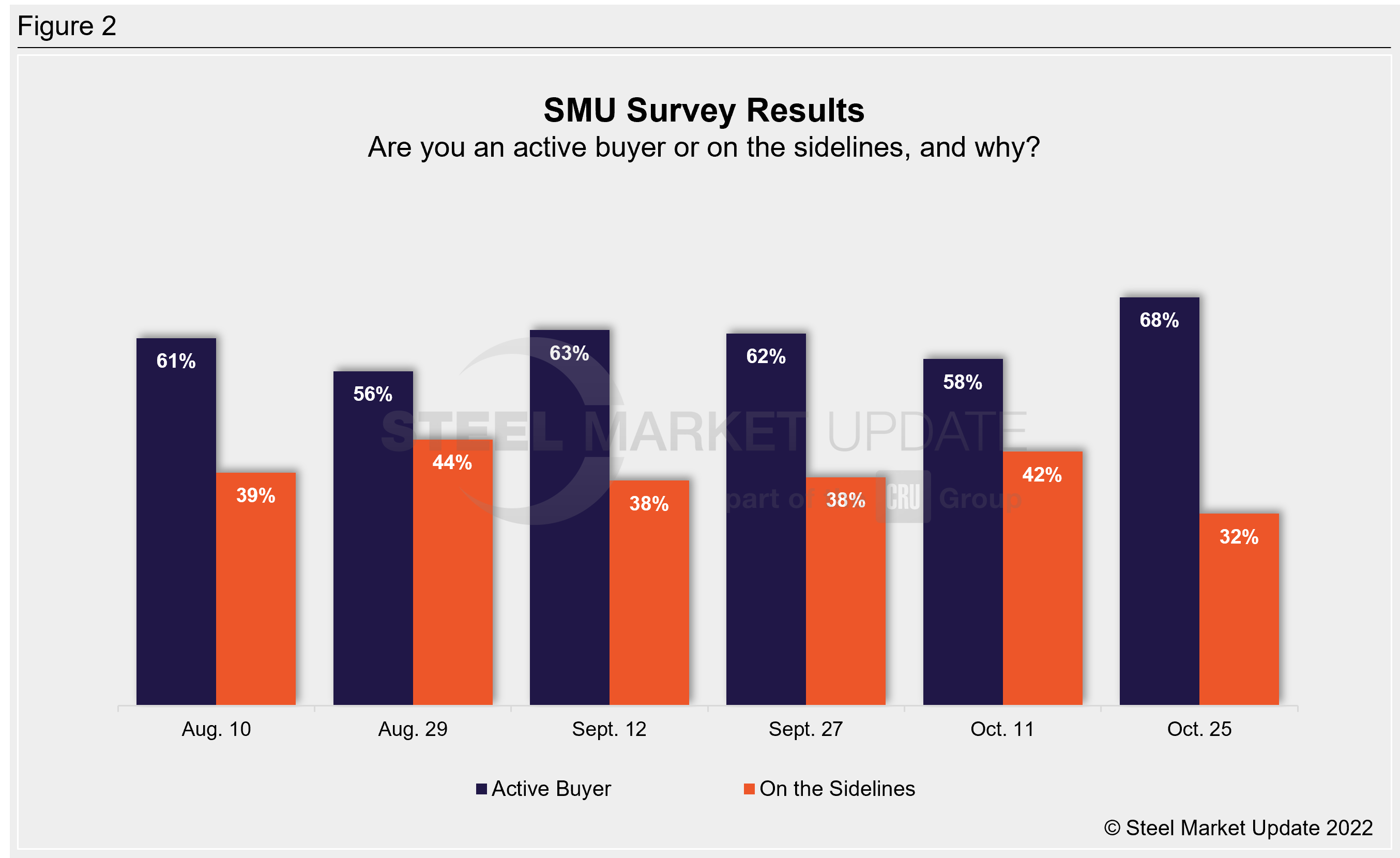

So, I was a bit surprised to see more survey respondents characterizing themselves as active buyers. Take a look at the chart below (Figure 2). Does it indicate that buying has picked up of late?

Nearly 70% of survey respondents now say that they are active buyers. But there’s more than meets the eye in this data, even as there was a solid 10 percentage-point gain in “active buyers” compared to our prior survey.

I did some digging and looked at what those who responded were saying, and although buying is taking place, few are restocking in a big way. Most are only buying to match confirmed sales. I then looked at what those same buyers were saying back in early/mid August, when 61% said they were active buyers. Not surprising, the tone is very different.

Here’s what some had to say back on Aug. 10:

“I purchased a large amount of both domestic and import over the past few weeks.”

“I’m optimistic about prospects.”

“I’m just maintaining current levels.”

“Stocks are getting low and pricing is still low or bottomed.”

“I’m buying excess and secondary daily.”

“Trying to time what they see as the low point in the market and buy out as far as they can.”

And comments have shifted from that to what’s below in our latest survey:

“[Buying] but only buying for orders in hand.”

“For orders with POs in hand. No speculating.”

“Buying smaller lot sizes more frequently.”

“Unfortunately, the old adage remains in play: Why buy today, when it’ll be cheaper tomorrow?”

“Buying only what is needed to fill contracts and holes.”

“On the sidelines, buying only for need as we expect further erosion of steel prices.”

“Active on back-to-back orders. If my customer [is a] buyer, I will buy for their needs only. No speculation.”

“Only buying contract tons.”

It’s clear buying continues. The sky is not falling. But just as mills are down-shifting when it comes to production, so service centers, manufacturers and OEMs are remaining conservative when it comes to buying patterns.

That opinion was echoed during SMU’s monthly call with HARDI members today. A common theme was that more price decreases were expected for the time being. But most anticipate 2023 to mirror demand in 2019 – which was a mostly profitable time for steel. But in the interim, sentiment is cautious – especially with many saying that mills are proactively trying to sell tons.

USS-USW Talks Carry On

Collective bargaining on a new labor contract between US Steel and the United Steelworkers (USW) union has made little progress since it began talks back in early July.

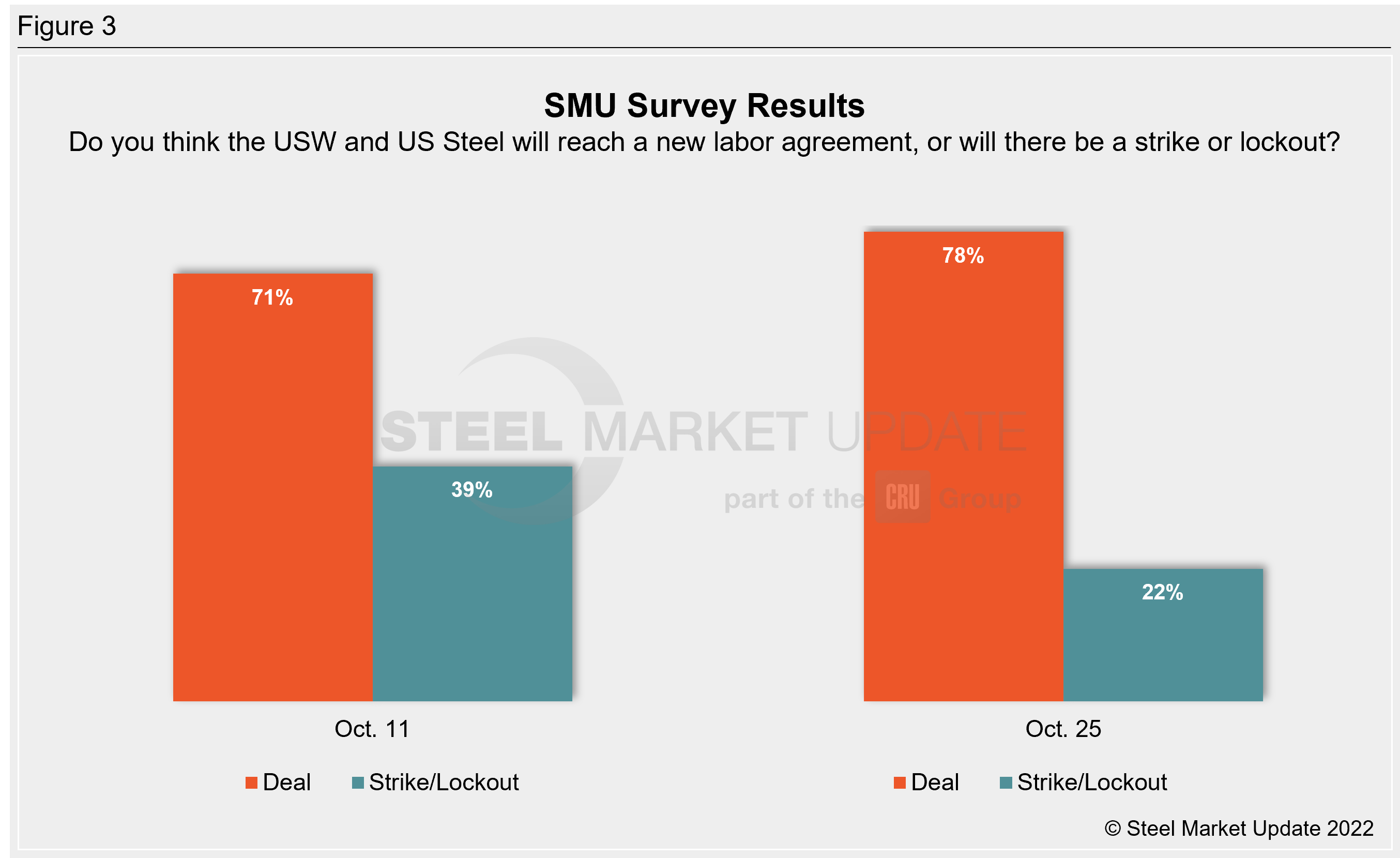

Recall that a prior agreement expired on Sept.1. Production has continued under an extension that could be terminated at any point with a 48-hour notice by either party. You could make a case that the chance of a strike or lockout increases the longer talks drag on. But that doesn’t seem to be something most in the market fear.

Negotiations are poised to trudge into their fifth month in November with little progress. But the lack of a new labor agreement has sparked little concern from the market.

Take a look at the chart below:

While the talks grind on, fewer survey respondents are concerned with the potential of a lockout or strike.

The union highlighted to its members that US Steel has spent roughly $1.6 billion in repurchased common stock and/or paying down outstanding debt last month, adding that the Pittsburgh-based steelmaker increased dividends by 400% last October.

“The company has done exceptionally well, and is rewarding executives and shareholders,” the union said in a text to members on Tuesday, Oct. 25. “They made huge profits because WE made the steel. It’s time for a Fair Deal, Burritt!”

When asked for comment, US Steel again said in an email to SMU today, that they “continue to negotiate and remain optimistic that we will reach an agreement that is best for all.”

With the union not yet making any noise regarding taking strike votes, nor US Steel marking any indication a lockout would be considered, one could look at the current impasse as somewhat par for the course when it comes to labor talks.

In this market, you could make the case that the odds of a lockout are higher than a strike. Because a lockout could in theory give US Steel the option to cut back on capacity while prices are still under pressure. That said, I think the more likely result is that talks drag on a bit more until concessions on both sides are made and a deal is struck.

SMU Events

Our Introduction to Steel Hedging Training Course will be running virtually on our customized platform on Nov. 30 – Dec. 1. This workshop is tailored for those looking to understand financial derivatives as an instrument to hedge price risk, protect margins, protect inventories, or offer long-term pricing to their customers. You can click here for more information.

Also, don’t forget to mark Feb. 5–7 on your calendar. That’s when SMU, together with the Port of Tampa Bay, will be hosting the Tampa Steel Conference. It’s a growing event, and a great reason to get out of the cold and catch up with hundreds of your closest friends in steel. You can register here.

As always, a big thank you from all of us at SMU for your business.

By David Schollaert, David@SteelMarketUpdate.com