Prices

December 8, 2022

HR Futures in Limbo as Risk Managers Await More Data Points

Written by Jack Marshall

The following article on the hot-rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Over the last month, HR index prices have continued to decline, but at a much slower pace. The most recent index for HR came in just under $620 per short ton (ST).

Between the decelerating spot price declines and a price increase by mills since our last piece, it might even be argued the spot physical market has found a floor, at least temporarily.

The question is will this hold and will HR prices push much higher? HR price momentum surveys are neutral, which is likely due to weak economic data reports.

Going into the end of the calendar year generally generates some buzz for the upcoming opening quarter for the new year. However, market sentiment has focused on weaker-than-expected demand, reflected in soft manufacturing data. The weak demand is shrinking forecasting horizons, creating further uncertainty.

For a point of reference, year-to-date 2022 the monthly index average for HR is a shade over $1,050/ST. Except for the prior year, which was the exception, the annual monthly average for 2018, 2019, and 2020 was $830/ST, $601/ST and $577/ST, respectively.

November open interest was only slightly higher than October, with the average volume day just under 18,000 ST/day. For the period Wednesday, Nov. 16, through Wednesday, Dec. 7, the HR spot index has declined $38/ST consecutively. With the mill price announced HR spot price increase, the street will be expecting a trend change in price.

The focus will be on whether the current market demand will support the full mill price increases and help push spot back up to $700/ST.

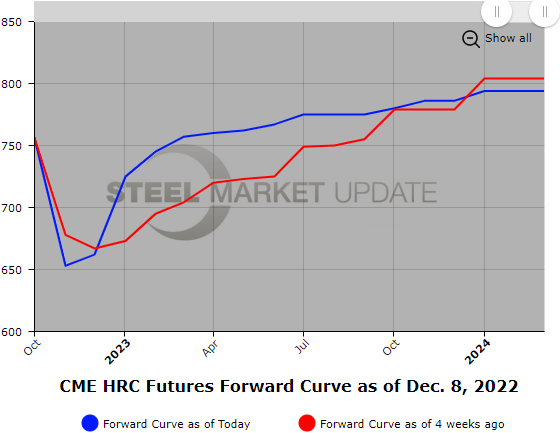

Over the last four Wednesdays the HR futures curve has become less steep for the Cal’23 futures period. Q1’23 average prices have pushed higher, and Q4’23 average prices have declined similar amounts. The Jan’23 to Dec’23 settlement price rise has decreased from +$96/ST ($704/ST to $800/ST) to +$67/ST ($713/ST to $780/ST).

Below is a graph showing the history of the CME Group HR futures forward curve. You will need to view the graph on our website to use its interactive features. You can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

A strong surge in 80/20 export scrap prices over the last few weeks on the order of $40/ton is reportedly behind strong demand for BUS going into the December settlement. Some regions have already reported, lending credence to the expectation that BUS prices will likely rise by $20/$30 per GT for December. November 2022 BUS settled at $359.62/GT.

Additional factors also helping to support higher prime prices include:

– Higher energy prices

– Reduced supply of obsolete grades

– Cyclical annual December-January push to build inventories for the new year.

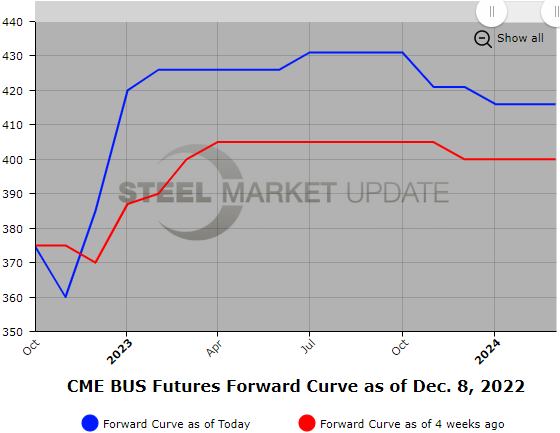

Settlement prices between Nov. 16 and Dec. 7 reflect a $24/GT increase in Q1’23 average BUS price, while the Q4’23 average price reflects a roughly $6/GT decline. The average price for Cal’23 BUS on a settlement basis is just $6/GT higher over the four Wednesdays.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features. You can do so by clicking here.

By Jack Marshall of Crunch Risk LLC