Prices

June 15, 2023

HRC Futures Shift Into Rally Mode

Written by David Feldstein

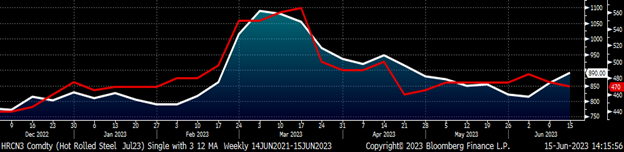

The July Midwest HRC future started February just below $800, rallied $325 in just over a month peaking at $1,115 on March 9. Over the next 81 days, the July future basically went full circle, falling $311 to just over $800 on June 1. Since the start of June, the July future has rallied almost $100 trading to an intraday high of $895 earlier today.

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. Rock provides customers attached to the steel industry with commodity price risk management services and market intelligence. RTA is registered with the National Futures Association as a Commodity Trade Advisor. David has over 20 years of professional trading experience and has been active in the ferrous derivatives space since 2012.

July CME Hot Rolled Coil Future $/st

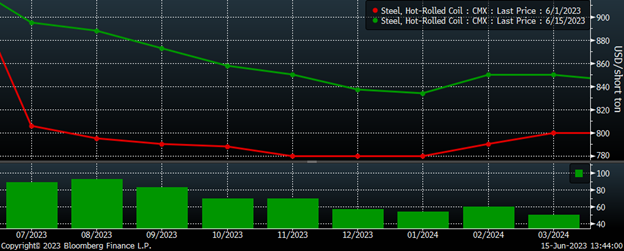

Trading in SGX iron ore futures appeared to have bottomed in early May, banged around in the $100-110 area throughout the month before starting its current rally in June. The motivation behind iron ore’s rally is a new round of stimulus ($140 billion) targeting infrastructure spending and China’s residential real estate market. This also appeared to be the driver of Midwest HRC’s move up, which started just after Beijing made headlines on June 2 that it was considering another stimulus package.

Rolling 2nd Month Iron Ore

Then, U.S. Steel announced a $50-increase to flat-rolled prices yesterday, which resulted in a $20-40 pop in the futures market today.

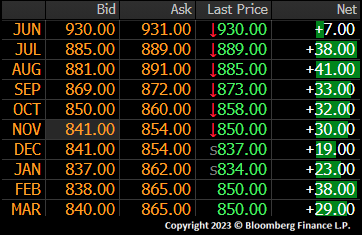

On June 1, the Midwest HRC futures curve was about flat, ranging between $780-800. Since then, the July future has rallied $83, August $91 and September $83. The October and November futures have gained $70 while the December and Q1’24 months gained somewhere between $50-60. Q3’s outperformance has steepened the futures curve somewhat, with the spread between July and December doubling to $52 from $26.

CME Hot Rolled Coil Futures Curve $/st

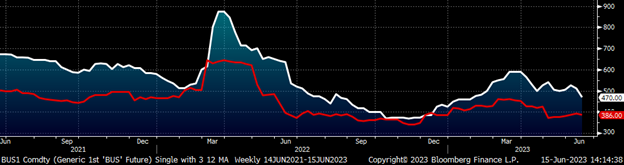

How much of June’s rally has been inspired by additional Chinese stimulus lifting all commodity boats, and how much was in anticipation of the rumored price increase announcements is up for debate. However, what I find most interesting is how the futures market largely ignored June’s much-worse-than-expected $56 decline in busheling.

Front Month Busheling $/lt (wh) & Turkish Scrap $/mt (red)

Taking this one step further was today’s surprise decline in July’s busheling future, while the July Midwest HRC future soared, resulting in a $400-425 metal spread in July through September. Which is going to give? Will busheling rally or will the rally in HRC be short lived?

July Midwest HRC $/st (white) & Busheling $/lt (red)

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.

By David Feldstein, Rock Trading Advisors