Market Segment

August 3, 2023

Lead Times Reported To Be Mostly Sideways

Written by Laura Miller

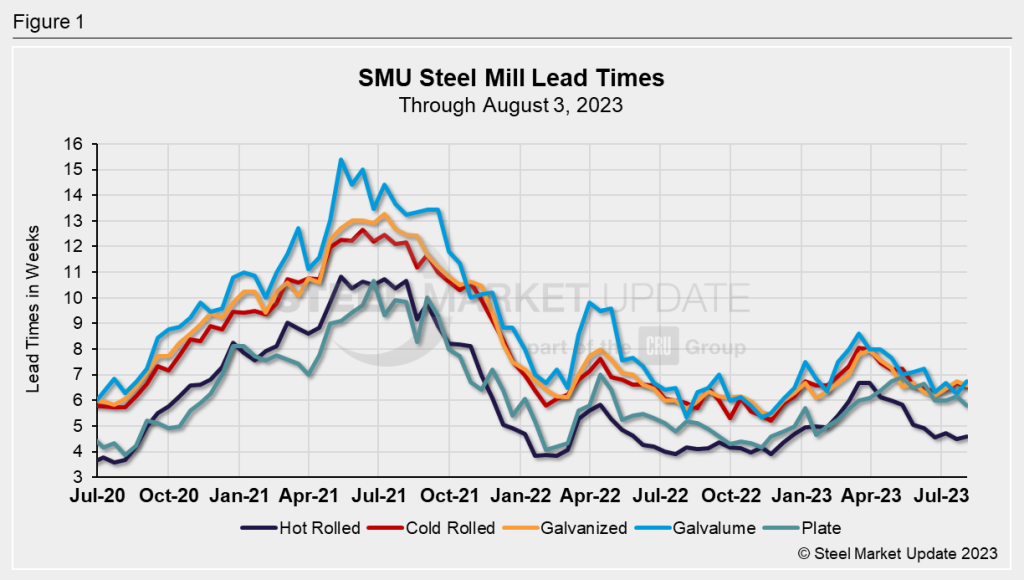

Movements in lead times were again mixed in SMU’s market check this week, with most products sideways compared to two weeks ago.

A clear pattern still has yet to emerge, as lead times have been bouncing up and down throughout the summer – something to be expected during the summer doldrums. Lead times are now mostly into September. The coming weeks should paint a clearer picture of their direction.

For hot-rolled sheet, steel buyers this week reported lead times ranging from 3 to 6 weeks, with an average of 4.58 weeks. That’s up just slightly from the 4.48-week average lead time reported in our market check two weeks ago. HR lead times have been below 5 weeks since the beginning of June.

Lead times ranging from 5 to 8 weeks were reported for cold-rolled sheet this week. This week’s average of 6.55 weeks is down slightly from 6.67 weeks in the last market check. CR sheet lead times have been below 7 weeks since the end of May.

For galvanized sheet, lead times were said to be between 5 and 9 weeks, with an average of 6.59 weeks. That’s a decrease of 0.15 weeks from the previous market check.

For Galvalume, lead times of 6 to 8 weeks were reported this week, with an average of 6.75 weeks. Galvalume was the only product to see an extension in lead times from the prior market check, increasing by 0.5 weeks.

Lead times for plate fell below the 6-week mark for the first time since early March. Buyers reported plate lead times this week to be between 3.5 and 8 weeks, with the average of 5.81 weeks pulling back by 0.36 weeks from two weeks ago.

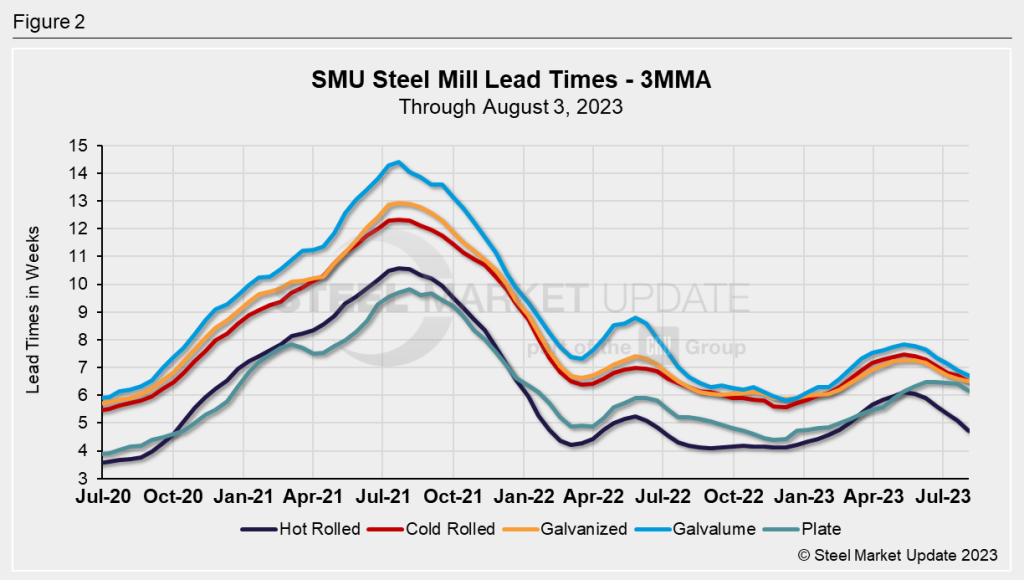

To smooth out the variability in SMU’s biweekly readings we can look at the three-month moving averages (3MMA) of lead times.

Lead times for sheet products have been trending downward since March, with the 3MMAs coming in at 4.7 weeks for hot rolled, 6.5 weeks for both cold rolled and galvanized, and 6.7 weeks for Galvalume.

Plate’s 3MMA declined for a second consecutive market check to 6.2 weeks, which is comparable to the 3MMA lead time at the beginning of May. Before May, plate’s 3MMA had been below 6 weeks since early 2022.

When asked how they would describe domestic mill lead times for new orders placed right now, 54% of surveyed buyers said they are “normal,” 35% said they are “shorter than normal,” and 8% characterized them as “extremely short.” The remainder believes they are ‘slightly longer than normal’.

Commenting on lead times, one manufacturer said, “Historically speaking, they certainly seem shorter than normal. But maybe we’re just used to the chaos now.”

Predicting where lead times will be two months from now, 68.6% of buyers expect them to be flat, while 18.6% believe they will contract and 12.8% anticipate an extension.

One buyer noted they are still quite worried about imports and new/restarted capacity.