Plate

September 28, 2023

Most Mills Still Willing To Negotiate Lower Sheet and Plate Prices: SMU Survey

Written by Ethan Bernard

The overall steel mill negotiation rate remained level this week vs. two weeks earlier, but plate’s rate fell by 15 percentage points, according to SMU’s most recent survey data.

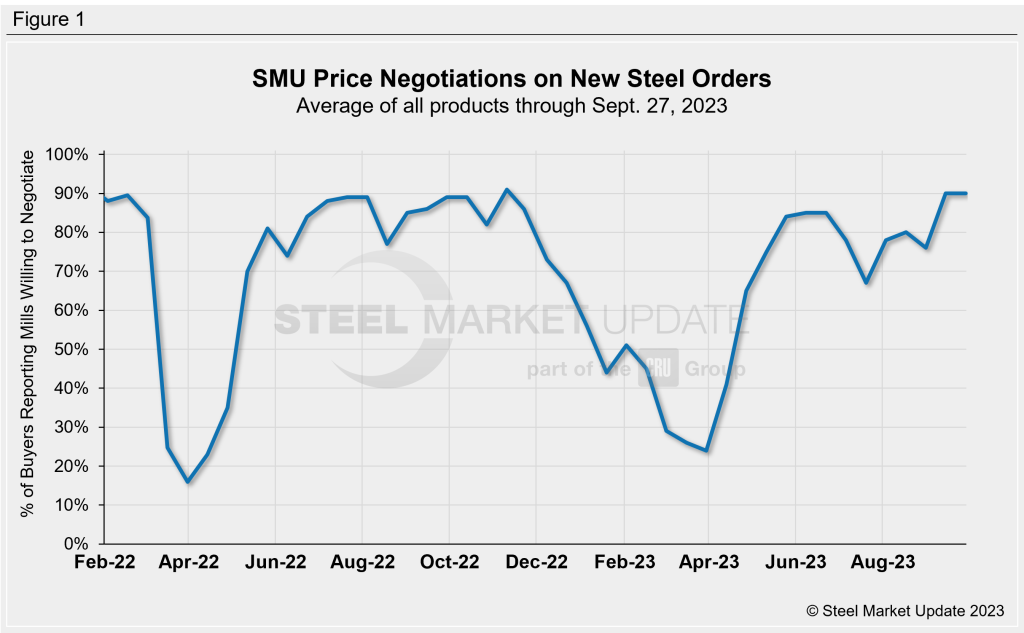

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 90% of participants surveyed by SMU reported mills were willing to negotiate price on new orders, the same as the previous market check (Figure 1). That’s a huge change from the end of the first quarter, when the rate stood at 24%.

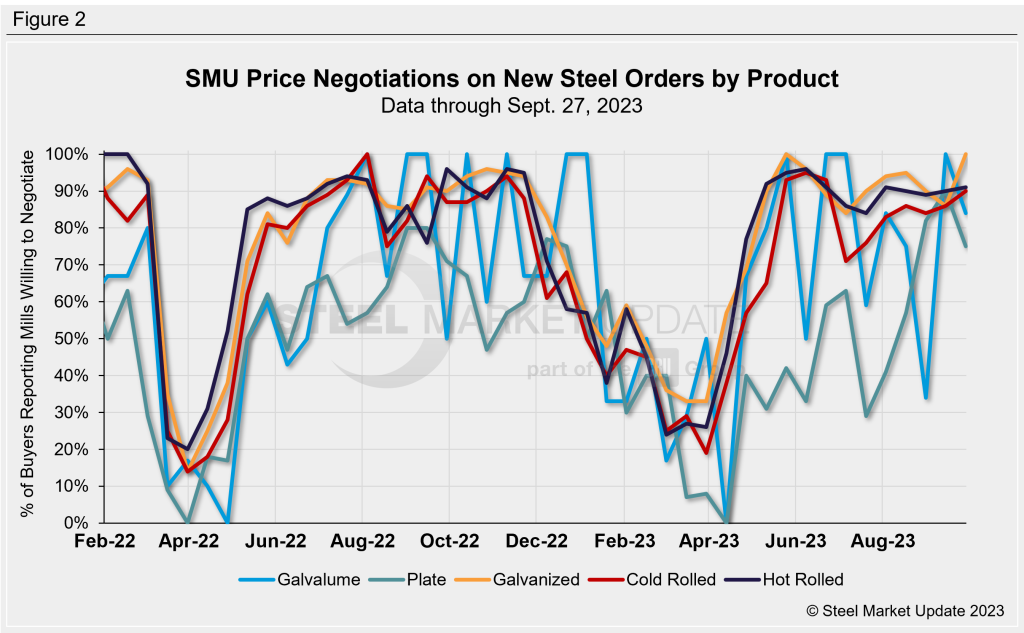

Figure 2 below shows negotiation rates by product. Hot rolled rose one percentage point from two weeks prior to 91% of buyers saying mills are willing to negotiate on pricing. Cold rolled stood at 90% (+4 pts), galvanized at 100% (+14), and Galvalume at 84% (-16 pts). Recall that Galvalume can be more volatile because we have fewer survey participants there.

Meanwhile, the percentage of steel buyers saying mills were willing to negotiate spot pricing on plate orders stood at 75%, down from 90% at the previous market check.

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.