Market Segment

October 5, 2023

HRC Futures: Hedgers Getting Off Sidelines

Written by Jack Marshall

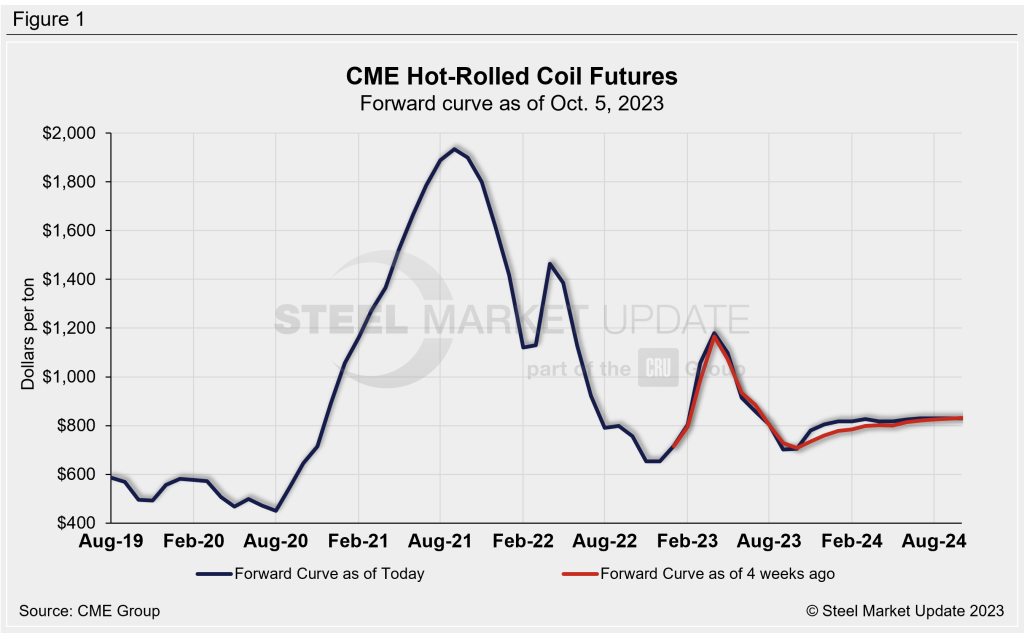

What happened after the August hot rolled (HR) settlement ($767 per short ton)? The HR index declined over $100/ST and sat in the low $660s as of last week’s activity. This was almost unchanged from the prior week.

Labor market data remains positive, albeit it is a lagging indicator. Interest rates remain unchanged, but Federal Reserve speak of late has been a touch more hawkish. The United Auto Workers (UAW) union has struck the Big 3 US auto companies. Cleveland-Cliffs has raised HR prices to $750/ST. Planned and unplanned HR production disruptions have moved lead times out significantly.

Much forecast uncertainty has kept hedgers on the sidelines until recently. HR volumes have picked up in the last week or so suggesting more folks are getting off the fence. Seems the participants sentiment is shifting as some concern about lower HR inventories and simultaneous production cuts, along with higher asking prices, could give HR prices some support.

In the last 12 trading days, daily trading volumes have averaged about 40,000 ST, with open interest moving up. Open interest as of the end of September was about 24,000 contracts, up from the prior month.

So the question is will the lower available supply be enough to offset actual demand going into Q4. For reference, the settlement change for Q4’23 from end-August to end-September is +$43/ST, but with some slippage in the first few trading days of October. Q1’24 HR settlements have changed by just shy of +$50/ST for the average settlements, up through today’s preliminary settlement. Cal’24 average settlement has risen $24/ST since the end of August.

Also of note, with the move up we have had increased hot rolled options contract interests. The 700 and 650 put strikes in the Q4’23 months have been the focus. There has been some chatter about a bottom forming in HR. But given all the uncertainty going into Q4’23, that might be a bit premature.

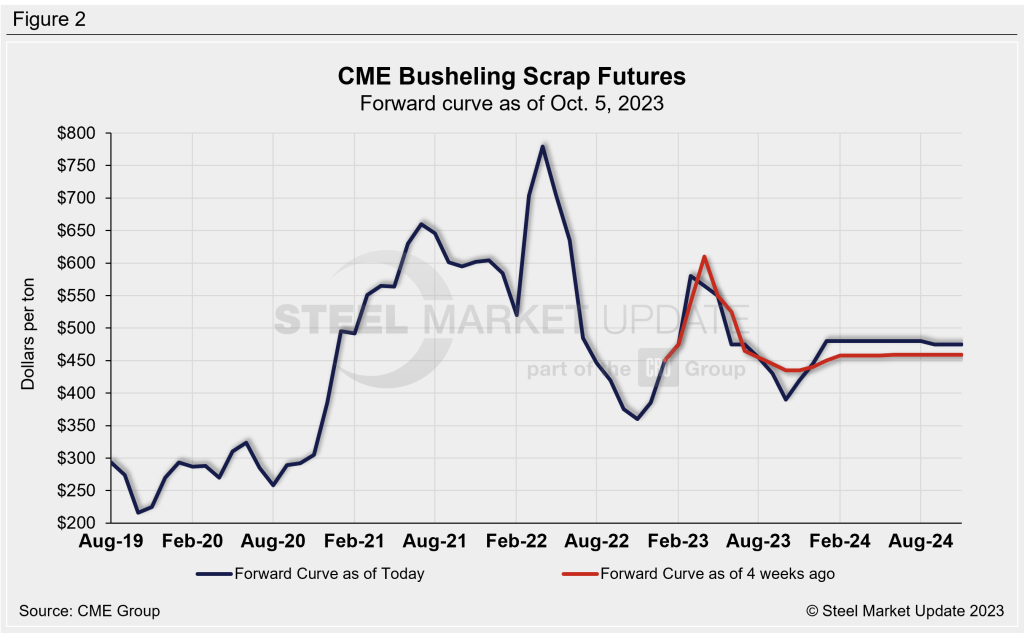

Timing is everything in BUS. Getting that right is difficult. Latest chatter had the Oct’23 BUS declining $10-20 per gross ton, which has been reflected in the $390/GT settlement in the Oct’23 future.

The BUS curve in Cal’24 remains pretty flat, albeit at slightly higher levels than at the end of August. The export scrap market has been a bit thin of late, with the latest 80/20 cargoes going for about $370/ton. Early word circulating is that shred will be down about $20/ton out of Detroit, with primes flat. Look for the composite prime scrap index to be down this month.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Crunch Risk should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.