Analysis

October 26, 2023

SMU Survey: Mill Lead Times Push Out Further

Written by Laura Miller

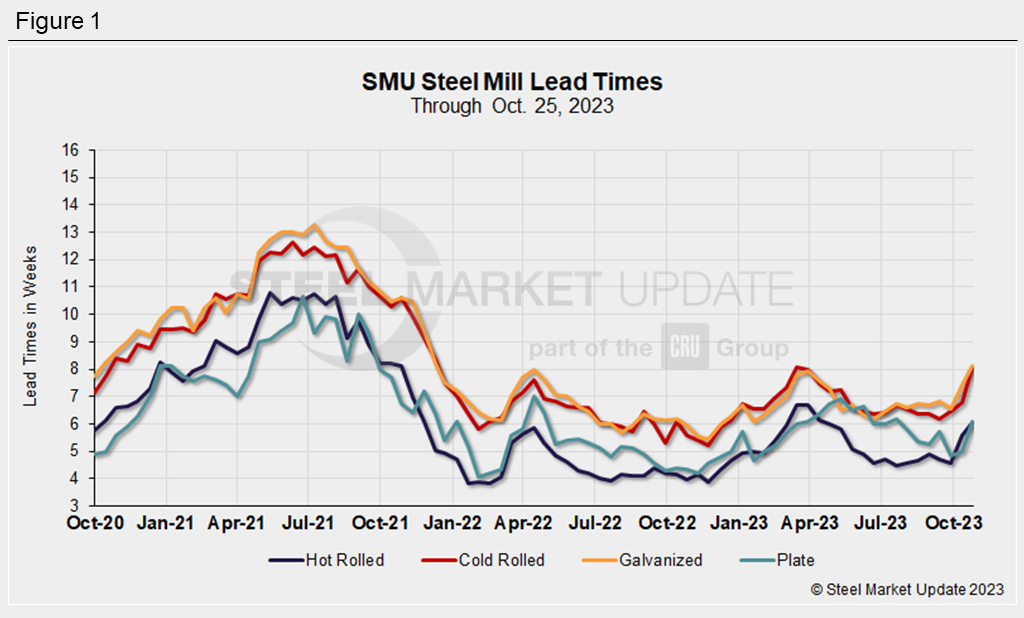

Mill lead times for flat-rolled products pushed out once again this week across the board, according to SMU’s steel buyers’ survey.

With extended lead times, no lack of demand, and an end in sight for the United Auto Workers’ (UAW) strike, mills have a strong hand to play. The current environment is supportive of recent sheet price increases, and more are likely to come, as evidenced by U.S. Steel’s $100-per-ton push announced today.

Lead times are now into late November and December for hot-rolled sheet, and mid-December to early-January for cold-rolled and coated sheet. Any plate orders made this week also won’t be ready for delivery until December.

Steel Mill Lead Times This Week

Buyers in SMU’s survey this week reported lead times for hot rolled to be between 4 and 8.5 weeks, with an average of 6.06 weeks. That’s an increase of nearly half a week from 5.59 weeks in our market check two weeks ago, and the first time hot rolled lead times have been above the 6-week mark since April.

Lead times for cold rolled were said to be between 6 and 10 weeks. The average of 8.06 weeks is an increase of 1.27 weeks from two weeks ago. The last time cold rolled lead times were this long was March.

Galvanized sheet lead times were reported by buyers this week to be between 6 and 10 weeks, with an average of 8.12 weeks. Galv lead times extended by 0.71 weeks from two weeks prior. The last time galvanized lead times were above the 8-week mark was April 2022.

Lead times for Galvalume averaged 9.0 weeks this week, with buyers reporting a range of 6 to 12 weeks. The average is 0.83 weeks longer than our check of the market during the week of Oct. 11. Again, we have to go back to April 2022 to see a longer lead time for Galvalume.

Note that our data for Galvalume is more volatile due to the smaller sample and market size. If you are a buyer of Galvalume and would like to share your lead time and pricing data with SMU, please contact david@steelmarketupdate.com.

Surveyed buyers reported lead times for plate ranging from 5 to 9 weeks. Plate lead times pushed out by 1.10 weeks from two weeks ago to an average of 6.10 weeks. July was the last time plate lead times were above 6 weeks.

SMU’s Survey Says

Just over half (51%) of surveyed manufacturers and service centers this week said lead times are currently ‘normal,’ while 38% categorized them as ‘slightly longer than normal.’ Just 5% of respondents said they are ‘highly extended,’ while another 5% said they are ‘shorter than normal’

Buyers were asked if lead times will be extending, flat, or contracting two months from now. More than half (55%) anticipate them to be flat, while 30% believe they will be extending, and almost 15% see them contracting.

A buyer commented that “imports, AHMSA, and still just ‘ok’ demand will lead to things coming back a bit.”

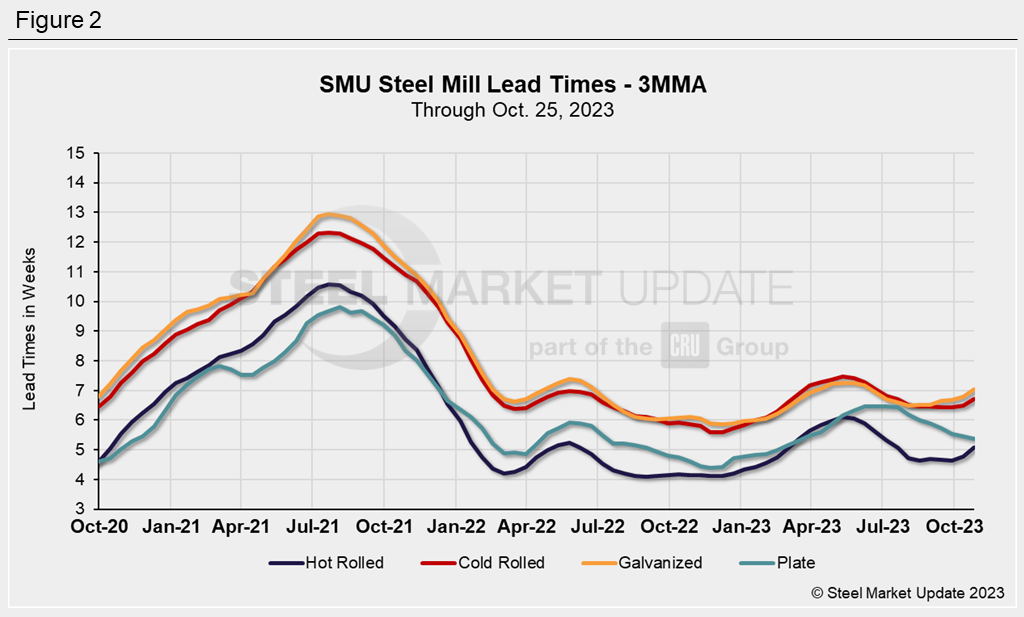

3MMA Lead Times

We can look at lead times on a three-month moving average (3MMA) basis to smooth out the variability in SMU’s weekly readings.

The 3MMAs for sheet product lead times ticked up after having flatlined during August and September.

Plate’s 3MMA of lead times, meanwhile, ticked down to 5.4 weeks, the lowest it has been since March.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website here. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.