Logistics

November 9, 2023

October Import Licenses Sideways, Flat Rolled Permits Decline

Written by David Schollaert

US steel imports continue to arrive at a steady pace, as total import licenses in October were about even with September’s import levels.

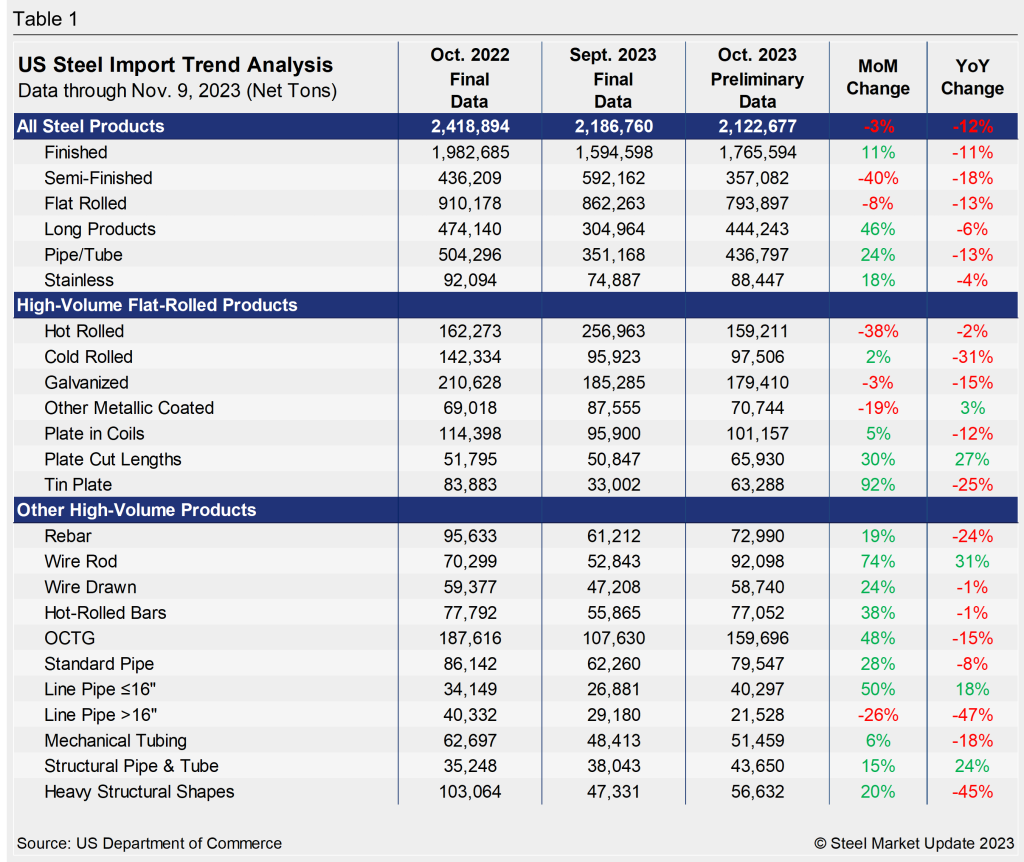

The latest data from the US Department of Commerce shows 2,122,677 net tons of import licenses for October. That’s down marginally from 2,186,760 tons in September but about 12% below October 2022’s imports of 2,418,894 tons.

Licenses to import semi-finished steel dipped again in October after rebounding the month prior. Slab licenses jumped, with Brazil outperforming September’s surge: 402,728 license tons in October vs. 328,944 tons of imports in September. October’s number is nearly four times as many slabs seen just two months prior in August.

Finished steel licenses, meanwhile, increased 11% month on month (MoM) but were down 11% year on year, with 1,765,694 tons of permits in October.

Licenses for flat-rolled steel, at 793,897 tons in October, were 8% lower than September imports, thanks to a decline in hot-rolled sheet imports. HR imports from South Korea fell from 85,613 tons in September to just 6,292 in October license tons.

Hot-dipped galvanized (HDG) sheet is one of the most imported sheet products. Total HDG imports were fairly steady during the summer months, but October licenses inched down 3% MoM to 179,410 tons. Canada is the top exporter of HDG to the US, and its shipments edged up 5.4% MoM to 76,221 tons of October licenses.

As SMU has been reporting, domestic hot-rolled coil (HRC) prices have surged, pulling away from imported material on the heels of mill price hikes. Because of this, an increase in imports is possible in the coming months. Should domestic demand drives continue to rise, US hot band could gain further momentum, and result in more attractive import offers soon.

Note that license counts can differ from preliminary and final figures, as import licenses are required to be obtained before actual importation.

We’ll take a deeper look at October imports when preliminary figures are released later this month.