Market Data

December 5, 2023

SMU price ranges: Sheet surge continues on limited spot availability

Written by David Schollaert & Michael Cowden

Sheet prices shot higher again this week on the heels of another round of mill price increases and on reports of production and supply chain issues at certain domestic producers.

Industry sources generally agreed that prices had nowhere to go but upward in the short term, especially should demand remain stable. In short, mills are in the driver’s seat. For how long is the question?

Some sources noted that spot volumes had slowed. That’s partly because of seasonality and heavy spot buying earlier in the fall. They said it’s also because buyers have been reluctant to purchase much outside of contract terms, given long lead times. Spot material ordered now might not be rolled until late January or February.

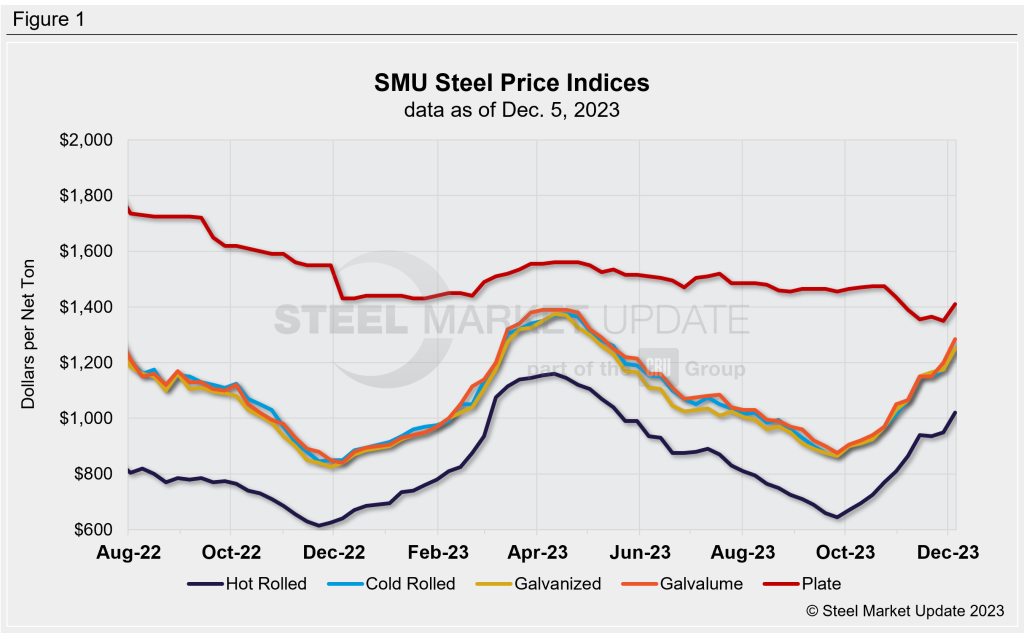

SMU’s hot-rolled coil price, in the meantime, stands at $1,020 per ton ($51 per cwt) on average, up $70 per ton from last week and up $375 per ton (or 58%) from a 2023 low of $645 per ton in late September. This marks the first time HRC prices have been above $1,000 per ton on average since mid-May, nearly seven months ago, according to SMU’s pricing tool.

Market participants said things were even tighter for cold-rolled and coated products. SMU’s cold rolled and galvanized base prices both stand at $1,250 per ton on average, up $75 per ton from last week. Galvalume is at $1,285 per ton on average, up $85 per ton from a week ago.

Plate prices are also rising following price increases announced by SSAB Americas and, more recently, by Nucor. Plate prices stand at $1,410 per ton on average, up $60 per ton from a week ago.

SMU’s sheet price momentum indicators continue to point upward. We have switched our plate price momentum indicator from neutral to upward following the price hikes noted above and on higher spot levels.

Hot-Rolled Coil

The SMU price range is $940–1,100 per net ton ($47–55 per cwt), with an average of $1,020 per ton ($51 per cwt) FOB mill, east of the Rockies. The bottom end of our range increased $40 per ton vs. one week ago, while the top end of the range was up $100 per ton. Our overall average is up $70 per ton week over week (WoW). Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 6–8 weeks

Cold-Rolled Coil

The SMU price range is $1,200–1,300 per net ton ($60–65 per cwt), with an average of $1,250 per ton ($62.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $50 per ton vs. the prior week, while the top end of our range was up $100 per ton. Thus, our overall average is up $75 per ton vs. the week prior. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 6–12 weeks

Galvanized Coil

The SMU price range is $1,200-1,300 per ton ($60–65 per cwt), with an average of $1,250 per ton ($62.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $50 per ton vs. the prior week, while the top end of our range was up $100 per ton. Our overall average is up $75 per ton vs. the week prior. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,297–1,397 per ton with an average of $1,347 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-11 weeks

Galvalume Coil

The SMU price range is $1,220–1,350 per net ton ($61-67.50 per cwt), with an average of $1,285 per ton ($64.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $70 per ton vs. the prior week, while the top end of our range was up $100 per ton. Our overall average is up $85 per ton vs. the week prior. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,514–1,644 per ton with an average of $1,579 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-15 weeks

Plate

The SMU price range is $1,360–1,460 per net ton ($68–73 per cwt), with an average of $1,410 per ton ($70.50 per cwt) FOB mill. The lower end of our range was up $50 per ton WoW, while the top end of our range was $70 per ton higher. Our overall average is up $60 per ton vs. one week ago. Our price momentum indicator on steel plate shifted from neutral to higher, meaning SMU expects prices will increase over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert