CRU

March 8, 2024

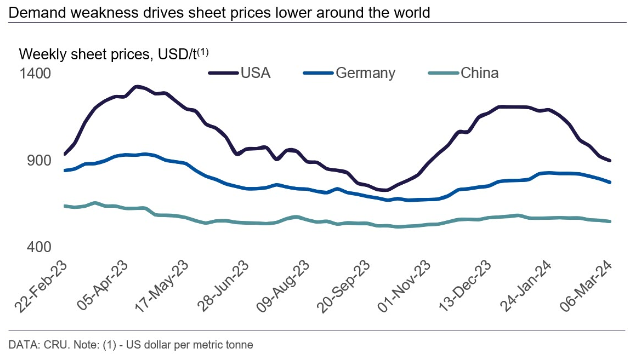

CRU: Low demand continues to weigh on global sheet prices

Written by Ryan McKinley

A weak start for sheet demand this year has continued to weigh on global prices.

European demand outside of the renewable energy sector was weak enough that market participants said mills are likely to cut output further after several furnace restarts earlier in the year.

In China, demand has also failed to pick up after recent holidays, and even government announcements of more stimulus measures during the country’s “Two Sessions” meetings failed to boost market confidence.

Price drops in China’s sheet market carried over into other areas of Asia, where demand also remains weak – including in India. The recent price drops in the US continued as supply availability remains high relative to a slow start to the year for demand.

US

Market participants continue to report that lower-priced deals are plentiful for high volume purchases, and that this is increasingly becoming the case for smaller sized deals as well. Lead times, as measured last week by Steel Market Update, fell below the five-week mark for HR coil for the first time since September 2023, and some buyers said they are able to get material within three weeks. Demand has softened, and combined with higher inventory levels and import arrivals, will likely keep sheet prices under pressure for the near term.

Europe

The downward trend in European sheet prices continued this week, with drops in both northern and southern Europe. Prices fell between €10–18 per metric ton (mt) week over week (w/w) in Germany, while in Italy they decreased by €11–13/mt w/w across all sheet products. German and Italian HR coil were assessed at €716/mt and €706/mt, respectively.

While mills are eager to secure orders, overall demand from distributors and end-users remains lackluster. Market sources indicate that only the renewable energy sector is performing well and, due to falling prices and weak demand, mills are considering further capacity reductions.

Several facilities came back online at the start of the new year, including Salzgitter BFA, Ijmuiden BF6, Zenica BF1, and Galati BF5. Coupled with a large number of imports that were customs-cleared at the start of this quota period, there is more visible supply available in Europe.

Imports from India for CR coil were offered into northern Europe at $735/mt FCA this week, while offers for HDG coil were at $794/mt FCA Europe. Lead times for these imports are for July arrival, while domestic material in Europe is available for March-April delivery.

China

Domestic Chinese sheet prices fell by RMB50-70/mt on demand pessimism over the past week. China started its Two Sessions meetings last Tuesday and the announced macroeconomic growth targets were largely in line with what the market had expected. The lack of further economic boost placed further worries on the extent of a market recovery in March, while tepid restocking and continuous declines in HR coil futures further dragged down spot sheet prices.

Nevertheless, there is some confidence in sheet demand in the manufacturing sector. Government-led measures for equipment and consumer goods (auto and appliance) replacement will be reintroduced to help lift demand for flat products. Some cities, such as Shanghai, already released policy guidelines to stimulate EV purchases and appliance replacements during this time last year. If more provinces/cities follow suit, sheet demand will rise, which aligns with our forecast in 2024. As market participants wait for more information from the government and hold back purchases, an ongoing rise in inventory levels has slowed. We still expect sheet prices to recover in March as more buyers look to restock.

Asia

Prices of imported sheet products in Asia remain under pressure from limited buying interest.

Following a sharp drop on China’s steel futures market, traders lowered their offer for HR coil SAE1006 grade to $580/mt CFR Vietnam even though there has been little change in offers form Chinese mills. Buyers remain out of the market as most of them expect prices to fall further because of weak demand for downstream products.

Last week, Hoa Phat also announced their new HR coil offer to domestic buyers in Vietnam, with a new price equivalent to $590-595/mt CFR Vietnam, a $10-12/mt drop from the previous month.

For commercial grade and pipe-making HR coil, offers for Chinese-origin material continued to trend down to ~$540/mt CFR Vietnam.

CRU assessed HR coil at $580/mt CFR Far East, down $5/mt w/w. CR coil and HDG coil prices decreased by $10/mt w/w to $720/mt and $740/mt, respectively.

India

Indian domestic sheet prices fell by INR300–500 ($4–6)/mt w/w despite relative stability in export prices and m/m price rollovers announced by major mills. Spot buying activity was muted because most buyers have restricted themselves to need-based purchasing, which kept mill and trade inventory levels elevated despite recent production cuts. For downstream products, D-grade CR coil was offered at a price premium of INR800–1000/mt ($10–12/mt) over base grade CR coil.

Indian sheet producers grew concerned about recent decreases in sheet export offer prices from China and Vietnam after their respective holidays and have been petitioning the government to impose stricter import restrictions as both domestic and export sales fell in the past month. Export orders from late-December/early-January were shipped during February and led to a 23.2% month-over-month rise to 975,000/mt in Indian finished steel exports, as per the provisional report of ministry of steel. However, export orders dropped from mid-January, which suggests that steelmakers have a higher exposure to the domestic market, where demand is subdued. CRU’s market contacts suggest that some mills are planning to reduce export offer prices in the coming weeks to compete better with Asian counterparts in the seaborne market.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com/analysis.