Analysis

July 26, 2024

CRU: Poor steel margins continue to push down raw material prices

Written by Anh Nghiem

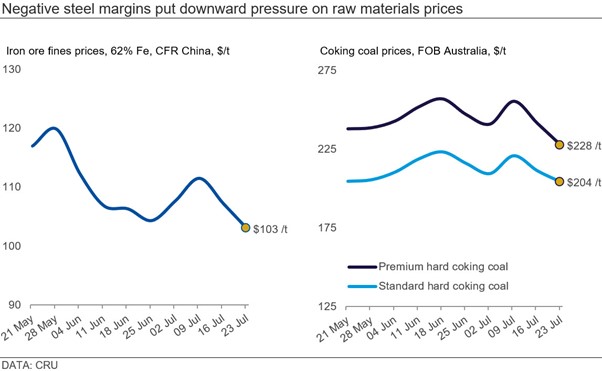

Both iron ore and coking coal prices fell last week because of resistance from buyers.

Iron ore

Iron ore prices have continued to fall throughout the past week, following sharp declines in steel prices in China, given no new policy announcement from the ‘Third Plenum’ meeting. Although the surveyed blast-furnace capacity utilization rate unexpectedly increased and is now over 89% again, spot transactions of iron ore were heard thin, as rapidly falling steel prices further worsen steel margins and make lossmaking steelmakers more cautious in raw materials booking. Iron ore port inventories have now exceeded 151 million metric tons (mt), while the vessel queue has expanded to 130, placing more downward pressure on iron ore prices.

CRU assessed the weekly 62% Fe fines price at $102.90/mt, a $4.30/mt decrease w/w.

Metallurgical coal

Offers for premium HCC were stable at $230/mt FOB Australia over the last week, but buying interest remains limited. A cargo of Premium Mid-Vol HCC was sold at $222/mt FOB Australia to a Chinese trading house for August shipment, indicating that Australia’s premium HCC has become competitive again relative to Chinese domestic alternatives. Having said that, demand concerns and supply improvement inside China mean potential decreases in Chinese domestic coking coal prices.

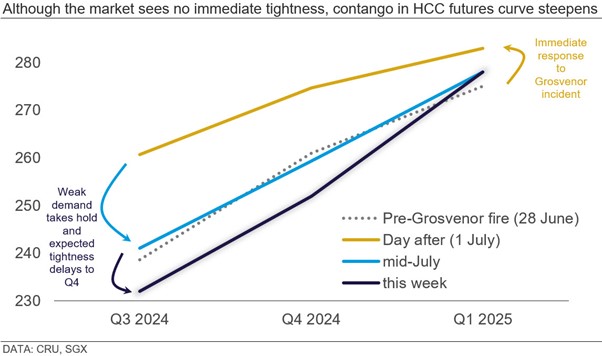

With ongoing weakness in steel demand, more steelmakers are trying to resell their contract volumes on the spot market. This will continue to put downward pressure on coking coal prices in the short term, as supply tightness due to the production disruption at Grosvenor mine will only impact Q4 deliveries onwards.

CRU assessed the weekly price for premium HCC, FOB Australia, at $227.50/mt, a $14/mt decrease w/w, while standard HCC, FOB Australia, was assessed at $204/mt, also a fall of $7.30/mt w/w.

This article was first published by CRU. To learn more about CRU’s services, visit www.crugroup.com.