Plate

August 20, 2024

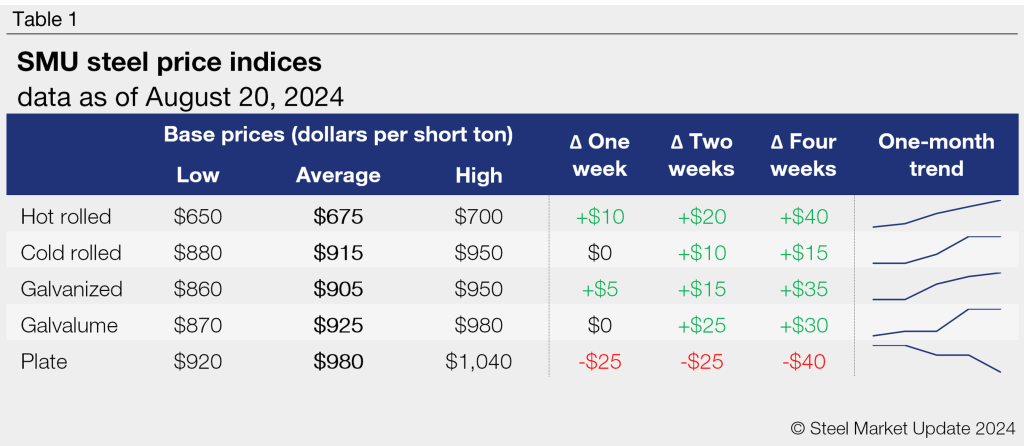

SMU price ranges: Sheet prices mixed, plate falls

Written by David Schollaert & Michael Cowden

Sheet prices trended sideways to modestly up this week in a market that appears to be in “wait-and-see” mode.

SMU’s hot-rolled (HR) coil price stands at $675 per short ton (st) on average, up $10/st from last week and up $40/st from late July.

The gains, however, appeared to result less from mill increases than from more limited discounting vs. last month. That’s when certain larger buyers, anticipating a bottom, stepped back in at low numbers.

Galvanized base prices also inched higher. They rose $5/st to $905/st on average. But cold-rolled prices were unchanged at $915/st on average while Galvalume was flat at $925/st on average.

Market participants were mixed on the future direction of prices. Some said upcoming and widespread fall maintenance outages should result in prices moving higher and lead times extending in the weeks ahead.

But others said that increased supply, steady/lackluster demand, and a well-inventoried supply chain could offset the outages and keep prices in a holding pattern. They also noted that a potentially soft scrap market next month might blunt any effort to significantly raise tags.

SMU’s sheet price momentum indicator remains pointed upward on predictions that mills will continue to try to push prices higher incrementally – or at least to enforce previously announced increases. But we also note that few expect prices to surge higher as they have in past cycles.

On the plate side, prices fell $25/st to $980/st on average on weak demand. Market participants said deep discounting below some mill list prices was widespread. Because of such feedback, our plate momentum indicator continues to point lower.

Hot-rolled coil

SMU’s price range for HR coil is $650-700/st, with an average of $675/st FOB mill, east of the Rockies. The lower end of our range is up by $30/st week over week (w/w), while the top end is unchanged. The overall average is up $10/st w/w. Our price momentum indicator for HR remains at higher, meaning we expect prices to increase over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.9 weeks as of our Aug. 14 market survey.

Cold-rolled coil

The SMU price range is $880–950/st, averaging $915/st FOB mill, east of the Rockies. The lower and top ends of our range were unchanged from last week. Our overall average is also flat w/w. Our price momentum indicator for CR remains at higher, meaning we expect prices to increase over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.6 weeks through our last survey.

Galvanized coil

The SMU price range is $860–950/st, with an average of $905/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is unchanged. Our overall average is up $5/st w/w. Our price momentum indicator for galvanized sheet remains pointing higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $947–1,047/st, averaging $997/st FOB mill, east of the Rockies.

Galvanized lead times range from 6-8 weeks, averaging 7.2 weeks through our last survey.

Galvalume coil

The SMU price range is $870–980/st, averaging $925/st FOB mill, east of the Rockies. The lower and top ends of our range were flat vs. last week. Our overall average is sideways w/w. Our price momentum indicator for Galvalume remains at higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,164–1,274/st, averaging $1,219/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $920–1,040/st, with an average of $980/st FOB mill. The lower end of our range is down $20/st w/w, while the top end is $30/st lower. Our overall average is down $25/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 4.2 weeks through our last survey.

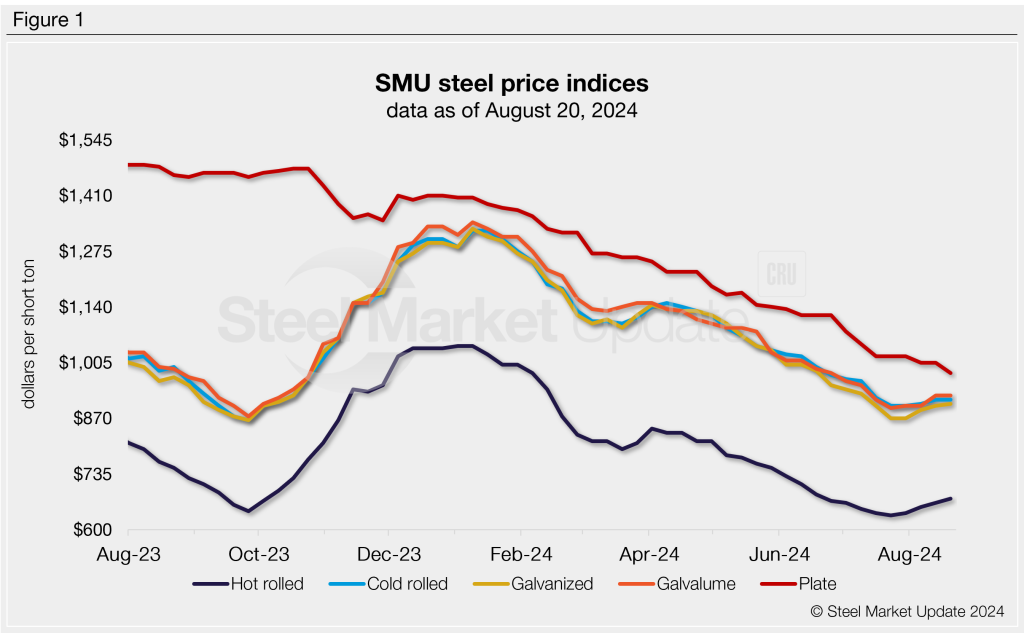

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert