CRU

October 24, 2021

CRU: Zinc Price Fueled by Energy-Related Risks to Smelter Output

Written by Helen O’Cleary

By CRU Analyst Helen O’Cleary, from CRU’s Zinc Monitor

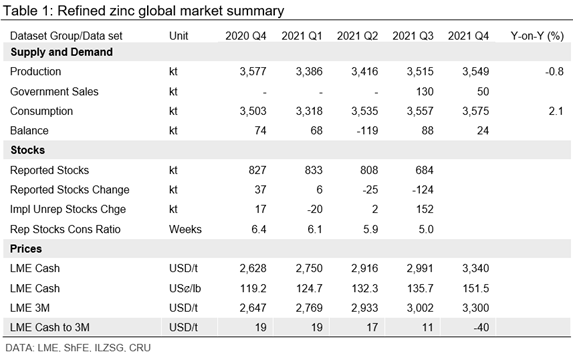

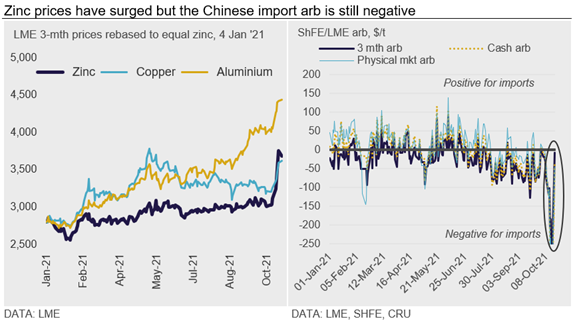

Zinc’s price started LME Week looking mildly bullish on short covering, with the 3-month official price settling at $3,246 /t on Oct. 12. By Oct. 15, it had reached $3,944 /t, turbocharged by news of smelter cutbacks in Europe due to soaring energy prices and the added burden of EU carbon emissions taxes.

The risk to smelter production spreading to other ex. China producers is now emerging, with countries such as India and Australia facing an energy crunch. Skeptics have commented that the timing of the cutbacks during LME Week looks like gamesmanship, but a dwindling ex. China refined metal surplus this year could switch to a deficit if significant cutbacks materialize.

The news that Young Poong’s Seakpho smelter in South Korea will close for 10 days in November due to the earlier pollution incident appears to have halted zinc’s decline of the past two days. Zinc is trading back above $3,600 /t at the time of this writing and has regained its losses against copper this year, although both are still lagging aluminum.

In China, SRB refined zinc stock releases have totaled 180,000 t to date but had done little more than stabilize zinc’s price on the SHFE prior to LME Week. Any hope of reducing speculative length in the market has now been dashed with the SHFE price tracking the LME higher to close at RMB27,690 /t on Oct. 18, even though Chinese market fundamentals have been weakening. Some Chinese end-users have been forced to curtail output alongside smelters, and current high prices are also dampening demand. The import arb remains closed and is not expected to reopen in the near to medium term.

Spot metal premia in Europe and the USA have been rising all year and the latest news has resulted in a sharp rise in European spot premia just as annual contract negotiations for next year are starting. U.S. premia are likely to find support too if metal units are rerouted from the USA to Europe. In Southeast Asia, premia are beginning to pick up following a lull in the last few months due to new Covid-19 restrictions, but remain lower than elsewhere. Normally, this might open up the possibility of exports from South East Asia to Europe and/or the USA, but freight rates remain prohibitively high, so the premium delta would need to be higher.

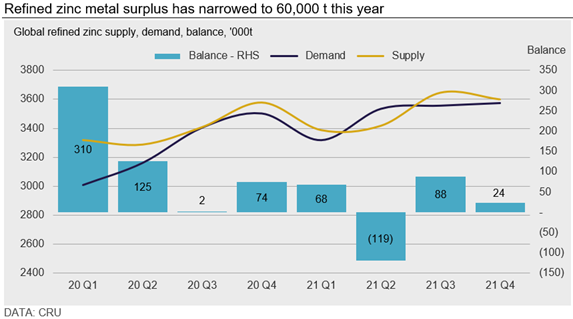

Refined Metal Market Surplus Could be Modest This Year

We have introduced a 110,000 t ex. China smelter disruption allowance for 2021 Q4 in light of the recent announcements around potential cutbacks. We have also put in a 20,000 t smelter disruption allowance for China in Q4 given the ongoing power-related issues there. This has helped to shrink the global refined metal surplus this year to 60,000 t. Taking into account our estimate of Chinese refined net imports of around 460,000 t this year, the Chinese market is in a surplus of 90,000 t and the world ex. China has switched to a deficit of 30,000 t.

Further SRB refined zinc stock releases are expected in November and December and, as we count SRB stock purchases as Chinese demand (on the basis that the metal is no longer available to the market), these will come back into our balance as Chinese supply. Further SRB stock releases are likely to lead to lower refined metal imports into China in the coming months, but these are already relatively low, so the Chinese refined surplus could increase in Q4.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com