SMU price ranges: Sheet mixed as market awaits post-holiday direction

Sheet prices were mixed in SMU’s first assessment of the market in the New Year.

Sheet prices were mixed in SMU’s first assessment of the market in the New Year.

Nucor Corp. announced in a letter to customers on Friday, Dec. 29, that its plate mill group would hold prices unchanged for as-rolled discrete plate, normalized, and quenched-and-tempered plate with the opening of its plate mill order book for February.

After meeting with Nippon Steel, the United Steelworkers (USW) union remains weary of the company’s proposed acquisition of U.S. Steel.

Steel Market Update plans to take some time off for Christmas and the New Year holiday.

The end of one year is often both a time for reflection, and for looking ahead. You make sense of the ups and downs from January through December. Then you wipe off the old crystal ball, and try to make out what’s in store for the next 365 days.

Steel Market Update’s Steel Demand Index declined, falling back into contraction territory after a very short-lived gain just two weeks ago, according to our latest survey data.

We started 2023 with HRC spot pricing around $700 per ton and the third-month future (March ‘23) trading at $800/ton. That same future eventually settled at $1,059/ton - a $259/ton swing. Today, spot pricing is just shy of $1,100/ton for HRC, and the third-month future (March ‘24) settled at $1,091/ton. The clear takeaway: a lot can change over three months. And while future contracts are a valuable tool for hedging, they are a terrible predictor of price.

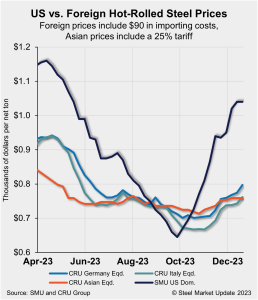

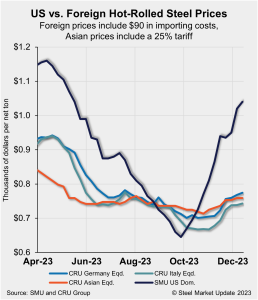

US hot-rolled coil (HRC) prices might have plateaued. But while prices for offshore product have increased in some regions, imports remain significantly cheaper that domestic material. All told, US prices are roughly 26% more expensive than imports, a premium that is down only slightly from last week.

All of the products SMU surveys notched an increase in the percentage of buyers saying mills were willing to negotiate spot pricing, with the exception of cold rolled, according to our most recent survey data.

SMU’s Current Buyers Sentiment Index inched up this week, while the future index edged down, based on our most recent survey data.

On Monday and Tuesday of this week, SMU polled steel buyers on a variety of subjects, including purchasing practices, steel sheet prices, scrap, and the future market. Rather than summarizing the comments we received, we are sharing some of them in each buyer’s own words.

As we look back at the scrap market for 2023, it basically followed its normal seasonal pattern. Most of the disruptive geopolitical events that riled ferrous raw materials occurred in 2022. So, with those things out of the way—or settling down at least for now—2023 resumed its normal pattern.

US hot-rolled coil (HRC) prices were unchanged week over week (WoW) following a string of mostly upward moves dating back to late September.

Over many years—even centuries—the wisdom and utility of tariffs as an instrument of government policy in peacetime have been debated. That incessant debate continues, and is likely to persist.

Pig iron prices rose month over month (MoM) for all major regions, driven by rising scrap prices.

The LME aluminum 3-month price is moving higher on the morning of Dec. 15 and was last seen trading at $2,258 /metric ton. This means the price is up 7% already since the new low for 2023 was reached on Wednesday at $2,109 /metric ton. The US Dollar reached its lowest level since early August […]

Steel Market Update’s Steel Demand Index has moved into growth territory, but barely, after recovering slightly from our reading in late November, according to our latest survey data.

Flat Rolled = 54.0 Shipping Days of Supply Plate = 61.7 Shipping Days of Supply Flat Rolled After three months of inventory cuts, US service center flat-rolled steel inventories grew in November as shipments slowed. At the end of November, service centers carried 54 shipping days of flat-rolled steel supply on an adjusted basis, up […]

Thursday felt eerily quiet after a frenzy of steel and financial market news on Wednesday.

U.S. Steel on Thursday afternoon said it expected lower earnings in the fourth quarter compared to the third. The Pittsburgh-based steelmaker predicted fourth-quarter adjusted earnings before interest, income taxes, depreciation, and amortization (Ebitda) of approximately $250 million, or $0.20-$0.25 per diluted share.

SMU’s Community Chat on Wednesday, Dec. 13, featured Bank of America SVP Ira Kreft.

US hot-rolled coil (HRC) prices continued their upward movement this week, distinctly outpacing increases for offshore product once again. Domestic tags are now 27% more expensive than imports - the widest pricing gap in nearly two years.

Lower prices and volumes will impact Nucor Corp.’s earnings in the current quarter, the steelmaker said in fourth-quarter earnings guidance on Thursday, Dec. 14.

Last week in Chicago, we hosted several metals companies for our bi-annual Metals Price Management Seminar (“MPMS”).

On Monday and Tuesday of this week, SMU polled steel buyers on a variety of subjects, including steel sheet prices, demand, inventory, imports, and what people are talking about in the market. Rather than summarizing the comments we received, we are sharing some of them in each buyer’s own words. We want to hear your […]

The spread between hot-rolled coil (HRC) and prime scrap prices widened slightly this month, according to SMU’s most recent pricing data.

Sheet prices increased again this week on the heels of higher costs for scrap, pig iron, and iron ore.

‘Twas two weeks before Christmas, and at our publication We kept logging steel price increases from across our fair nation.

A count of November license applications suggests steel imports were at their lowest monthly level in 33 months.

The US presidential elections will take place on Nov. 5, 2024.