CRU

December 8, 2023

CRU: The 2024 US elections - What it means for policy

Written by Veronika Akhmadieva

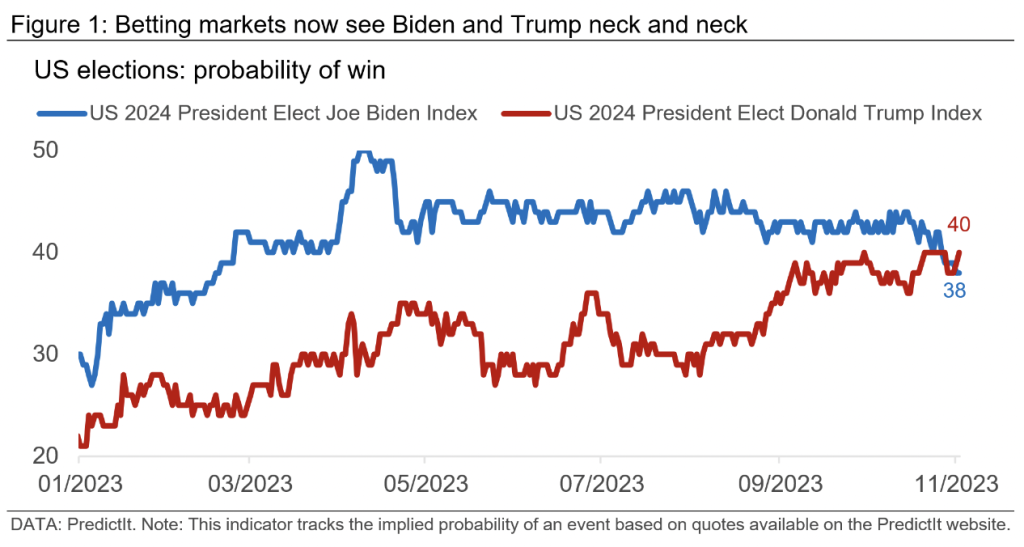

The US presidential elections will take place on Nov. 5, 2024. After lagging behind Biden throughout most of this year, polls in key swing states are now very close, and a Trump victory is now seen as an equally likely possibility by betting markets (Figure 1). In this Insight, we evaluate potential impacts of the US elections on key parts of the economy. Overall, although some policies might be rolled back or adjusted if a Republican was to replace Biden, 180-degree turns are unlikely in most areas. A White House that promotes either free trade or fiscal conservatism is very unlikely to emerge from these elections.

The single most important policy change under a Trump presidency might be the lack of predictability. Under Biden, the direction of US policy is relatively clear – use the US’s economic and political sway to try and contain Chinese power, while using subsidies, trade restrictions and regulation at home to decarbonize the economy and boost the industrial base. Having not participated in the debates and having given little indication of concrete policy proposals, it is highly unclear what direction a Trump White House would take on many issues.

Green transition: Progress might stagnate

One of Trump’s first acts as president in 2017 was to pull the US out of the Paris Agreement on climate change (, which Biden re-joined upon taking office). It is highly likely that Trump – or another Republican – would do the same were they to win in 2024. At minimum, this would be a huge symbolic blow to the decarbonization agenda worldwide and would weaken prospects for demand growth in the many commodities linked to the energy transition.

However, this would not automatically mean reversal of actual Federal policy. The president alone cannot reverse existing legislation such as the Inflation Reduction Act (IRA). New legislation to cancel or repurpose IRA funding would have to pass Congress. Moreover, according to the White House, about $337 billion of investment under the IRA will go on solar, wind, and storage projects located in the “red” states, and so Republicans in congress will have strong reasons to maintain much of the IRA incentives. A plausible outcome, however, might be that the IRA gets re-written and made somewhat less generous, and even more protectionist.

State-level policies pushing decarbonization – in particular, in California and other – would also probably continue under a Republican administration. These have been an important part of the policy picture in the US.

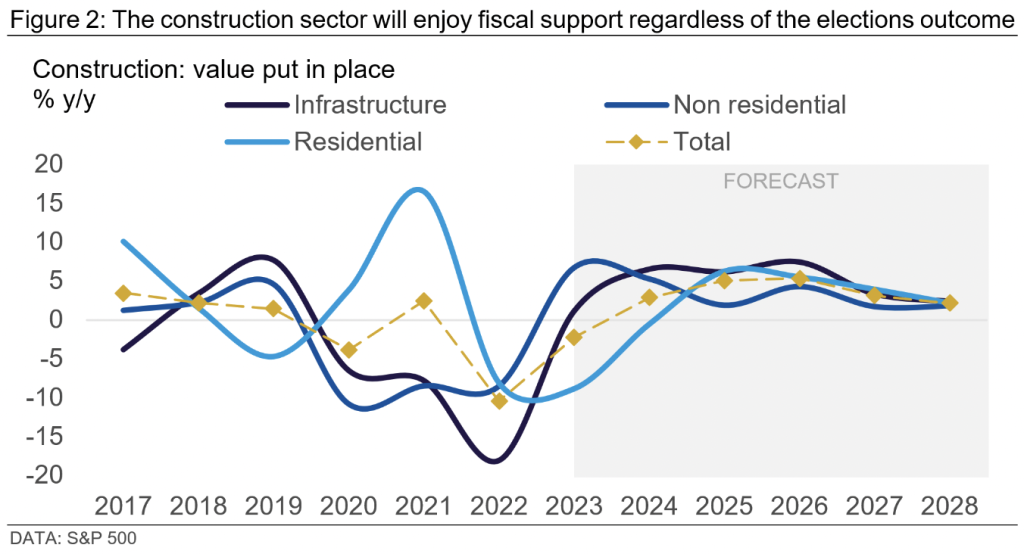

Construction: Demand is expected to strengthen regardless

The construction sector is likely to grow stronger over the next few years (Figure 2). The Infrastructure, Investment and Jobs Act was a bipartisan piece of legislation that is unlikely to be rolled back, and US manufacturing is investing heavily. A president might affect what is built but both a Republican and a Democrat will likely be pro construction.

Automotive: ICE cars might stay around for longer

In 2021, Biden signed an executive order stating a commitment to end sales of new internal combustion engine (ICE) vehicles by 2035. It is highly likely a Republican president will delay or overturn this. However, at least nine states plan to ban ICE sales separately from federal plans. Moreover, other factors are probably more important for the speed of the EV transition over the next few years. For example, Although US EV sales have grown at rapid rates (from a low base), to reach market share of around 7%, the next stage of moving from early-adopters to mass market is proving more difficult. Concerns over cost, financing and charging infrastructure (as well as the difficulties of trying to reduce China’s role in supply chains) are the most important factors holding back consumers. How policy tackles these – or doesn’t – will determine whether the US catches up with China and Europe in EV adoption.

Oil: Eyes will remain on OPEC and geopolitics

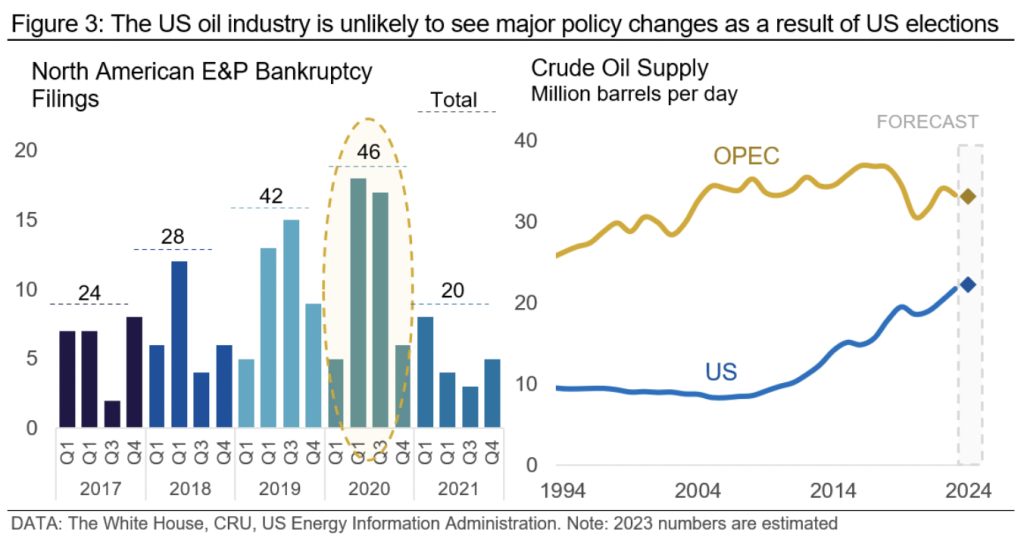

The US is now the world’s largest oil producer, with production of 20.3 million barrels per day (mbpd) (21% market share). During Trump’s term, oil production increased by almost 2.5 mbpd – the largest increase in any presidential term. However, it is also true that dozens of oil companies fell into bankruptcy under Trump’s watch (Figure 3, left-hand side).

Meanwhile, since the beginning of Biden’s term, he has green-lighted some projects and struck down others, but overall oil production continued growing since early 2021. While a president might influence US oil supply, given the dominance of OPEC (Figure 3, right-hand side), we believe it is OPEC and Saudi Arabia in particular that will be more important in influencing oil supply. Demand will also be important, for example in October the Brent Crude price dropped from nearly $100 /bbl to $77 /bbl and we expect oil prices to average $85 /bbl over 2024 as more major economies, including the US, slow down thereby reducing their demand for oil.

Regulation: Monitoring emissions might be less of a priority

The regulatory environment had tightened post the GFC under Obama, giving Trump an edge on the elections to win some support by promising to relax regulation, providing a boost to companies in terms of spurring investment. The markets responded very positively to his election for that reason, including commodity markets. However, there is no longer such a perception of a heavy regulatory environment in the US, and as for scrutiny on Chinese investment, US companies, by and large, approve of it. Hence, we expect the re-ordering of supply chains away from China (which has been underway since the pandemic) to continue, regardless of whoever is in the White House. However, the anti-trust push and moves to monitor emissions would likely be rolled back under a Republican president.

Geopolitics: China will continue to be seen as the key threat

Both parties agree that China poses a major threat to US interests and are willing to use trade policy as part of the toolkit to contain Chinese influence.

We do not expect this hawkish attitude to China to change under either party, but a détente could – counterintuitively – be more likely under a Trump presidency. In his first term, Trump pursued a more transactional approach to foreign policy, and may be tempted by the optics of striking a deal with Beijing. There would certainly be less focus on building multi-lateral alliances designed to contain China than under Biden.

The “Buy American” agenda that is gaining steam in the US, is to a large extent a “don’t buy China” agenda. The Buy American agenda is a leftover from the 1980s and was sidelined after NAFTA and the globalization of the 2000s. Recently it made a comeback as part of requirements for many projects funded by IRA. This is likely to continue under either party.

The protectionism trend will continue in either case

The tariffs imposed on China and some American allies by Trump in 2018 have been largely continued under Biden. For instance, in March 2022, 352 product exclusions from the US Section 301 tariffs – that were originally imposed under Trump – were reinstated. Section 232, the act that investigates the effects of imports of steel, is also still in place.

Nonetheless, there is probably a greater risk of protectionism and reshoring intensifying under Trump. Recently, Trump has proposed a new 10% blanket tariff on all imported goods. As with most Trump public policy announcements, there is no guarantee this would actually happen if he were to win – it may be a negotiating gambit. If it was to be introduced, such a tariff would almost certainly trigger retaliation from trading partners, and be a major blow to globalization.

Debt: Trillion dollar deficits will continue

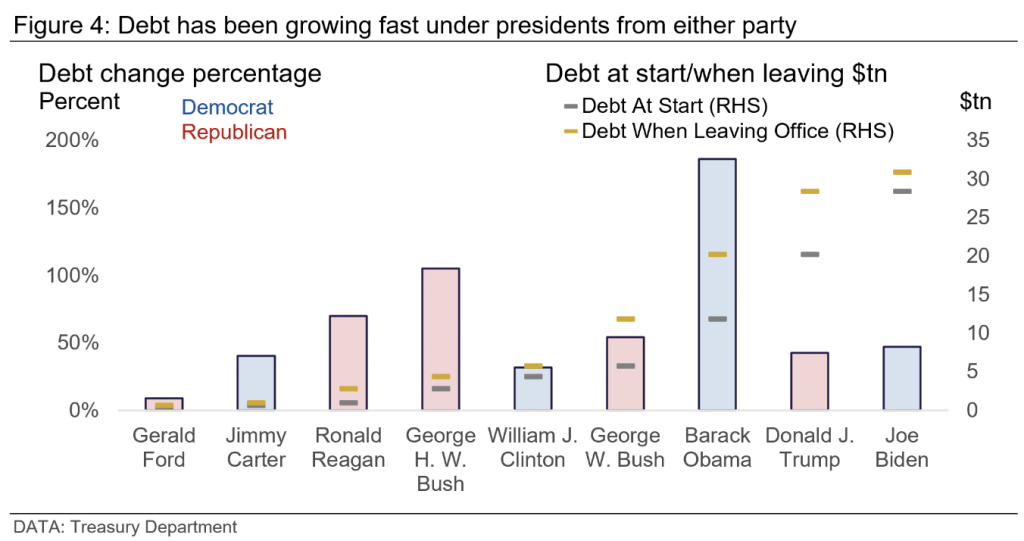

We expect the US to run a fiscal deficit of almost 7.5% in 2023 – a huge number considering the economy is close to or at full employment. US debt has been growing rapidly over the last few decades under both Republican and Democratic presidents (Figure 4), so we have little expectation that the US will copy Europe in attempting to bring down deficits. Perhaps the most likely scenario for fiscal consolidation would be if a more ‘traditional’ Republican wins, although given the extent of the increase in debt seen under George W. Bush shows even this cannot be counted on.

The Congressional Budget Office (CBO) estimated that cumulative deficits from next year to 2033 will come as high as $20.3 trillion, crowding out investment and weighing on growth; while interest costs are projected to expand from $476 billion in 2022 to $1.4 trillion by 2033. In 2023, spending on net interest costs outpaced spending on Medicaid and Income Security Programs. According to Peter G. Peterson Foundation, in 2022, 72% of Democrats, 74% of Independents and 86% of Republicans felt the mounting debt should be a top-three priority. Hence, it cannot be completely ignored by a president from either party.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com.