Plate

December 12, 2023

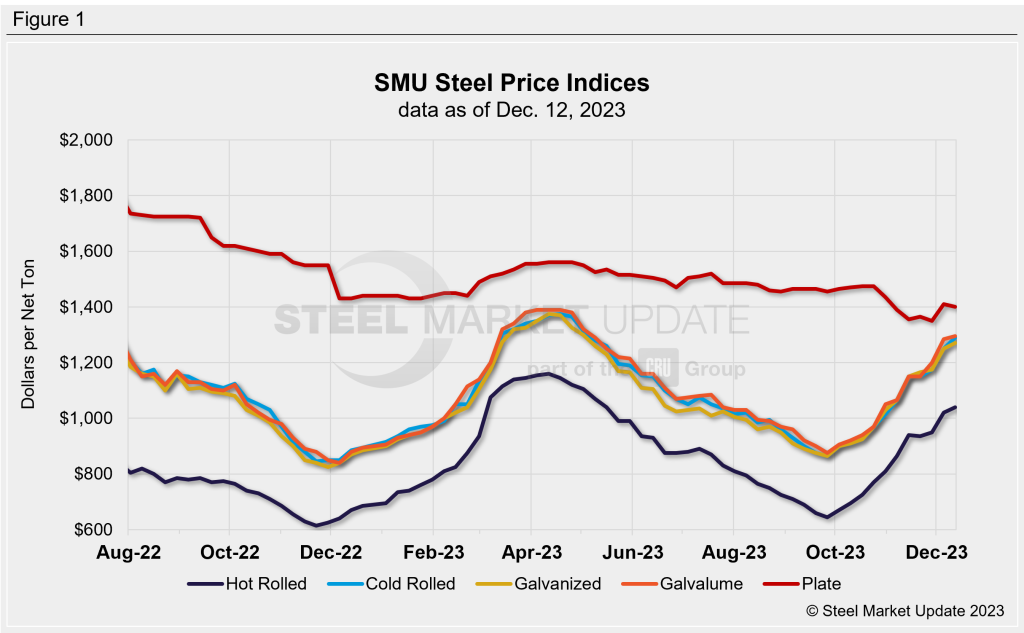

SMU Price Ranges: Sheet moves up again, plate holds steady

Written by David Schollaert & Michael Cowden

Sheet prices increased again this week on the heels of higher costs for scrap, pig iron, and iron ore.

The sharply higher raw materials costs have sparked chatter about whether US mills might roll out another round of price increases later this week or early next.

Weighing against that upward trend: hot-rolled coil lead times have slipped for the first time since September amid an uptick in the number of steel buyers reporting that mills are willing to negotiate lower prices.

What gives? Is the modest dip in HRC lead times and increased willingness to cut deals a reflection of the typically slower holiday period? Or are those trends early signals that the bull run steel has been on since September risks running out of steam in Q1?

We’ll see. In the meantime, SMU’s hot-rolled coil price averages $1,040 per ton ($52 per cwt), up $20 per ton from last week. Cold-rolled averages $1,290 per ton, up $40 per ton from a week ago. Galvanized stands at $1,270 per ton on average, up $20 per ton from last week. And Galvalume is at $1,295 per ton, up $10 per ton week over week.

SMU’s plate price averages $1,400 per ton, down $10 per ton from last week – but effectively unchanged given how high base price are.

Our sheet price momentum indicators continue to point upward. Our plate price momentum indicator remains in neutral.

Hot-Rolled Coil

The SMU price range is $980–1,100 per net ton ($49–55 per cwt), with an average of $1,040 per ton ($52 per cwt) FOB mill, east of the Rockies. The bottom end of our range increased $40 per ton vs. one week ago, while the top end of the range was unchanged. Our overall average is up $20 per ton week over week (WoW). Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 6–8 weeks

Cold-Rolled Coil

The SMU price range is $1,250–1,330 per net ton ($62.50–66.50 per cwt), with an average of $1,290 per ton ($64.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $50 per ton vs. the prior week, while the top end of our range was up $30 per ton. Thus, our overall average is up $40 per ton vs. the week prior. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 6–12 weeks

Galvanized Coil

The SMU price range is $1,240-1,300 per ton ($62–65 per cwt), with an average of $1,270 per ton ($63.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $40 per ton vs. the prior week, while the top end of our range was unchanged. Our overall average is up $20 per ton vs. the week prior. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,337–1,397 per ton with an average of $1,367 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-11 weeks

Galvalume Coil

The SMU price range is $1,250–1,340 per net ton ($62.50-67.00 per cwt), with an average of $1,295 per ton ($64.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $30 per ton vs. the prior week, while the top end of our range was down $10 per ton. Our overall average is up $10 per ton vs. the week prior. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,544–1,634 per ton with an average of $1,589 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-15 weeks

Plate

The SMU price range is $1,370–1,430 per net ton ($68.50–71.50 per cwt), with an average of $1,400 per ton ($70 per cwt) FOB mill. The lower end of our range was up $10 per ton WoW, while the top end of our range was $30 per ton lower. Our overall average is down $10 per ton vs. one week ago. Our price momentum indicator on steel plate shifted from neutral to higher, meaning SMU expects prices will increase over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert