Government/Policy

June 30, 2016

Steel Duties, Tariffs and the Status of Trade Cases

Written by John Packard

Steel Market Update received the following question from one of our new readers who has a specific project related to sourcing of hot rolled and cold rolled steels from outside of the United States. Based on our conversation with the reader we believe this question is being raised at this time due to the wide variance between domestic and foreign steel pricing which is squeezing a domestic manufacturing company’s margins or ability to do business here in the United States using domestically produced steel.

“I was searching through your site, a lot of interesting information, especially to a novice. We are looking to buy large quantities of cold or hot rolled steel, bring into US for [product removed] manufacturing. I have just started this research as this is new strategy for us and am finding it hard to get tariff/duties data per country, in a comprehensive format. Might you point me to a report on your site that might help?”

The United States does not charge duties or tariffs on semi-finished (slabs, billet, etc.) or finished steels (HR, CR, galvanized, plate, etc.) coming from countries outside of the United States.

Duties, voluntary restraint agreements and other restrictions come into play when the steel industry files a trade suit against countries deemed to be selling steel into the United States at prices less than what is considered “fair value” and in the process “injures” the domestic steel industry. These suits are called “antidumping” and many times you will see them referenced as “dumping suits” or with the initials AD. A country can also be blocked by the government due to political reasons such as the restrictions against trading with Iran that existed for many years.

A suit can also be filed if the foreign steel mill is believed to be receiving financial subsidies from their government which allows the mills there to export steel cheaper than they could if they were not subsidized. The specific wording used by the U.S. government is, “For the purpose of CVD investigations, a countervailable subsidy is financial assistance from a foreign government that benefits the production of goods from foreign companies and is limited to specific enterprises or industries, or is contingent either upon export performance or upon the use of domestic goods over imported goods.” These suits are called “countervailing duty” and are referenced with the initials CVD.

There are a number of steel products which have some sort of order against them which keeps them out of the United States. Both China and Russia have past orders against them that prevent them from shipping hot rolled coils to the U.S. These orders have nothing to do with the current round of antidumping (AD) and countervailing duty (CVD) cases before the U.S. Department of Commerce (DOC) and the International Trade Commission (ITC). SMU recommendation is that if a buyer has a question regarding a specific country that you speak with a reputable trading company here in the United States.

Status of CORE AD/CVD Suit (ITC Final)

In June 2015 a number of the U.S. based steel mills filed antidumping and countervailing duty complaints on corrosion resistant steels (CORE). Corrosion resistant steels include: galvanized, Galvalume, aluminized, galvannealed and other coated products.

The countries named in the CORE AD suit included: China, Taiwan, India, Italy and South Korea.

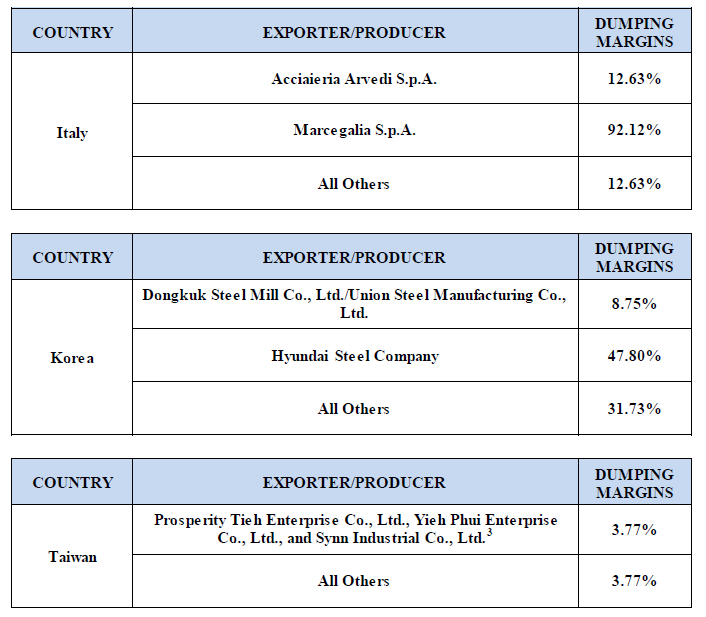

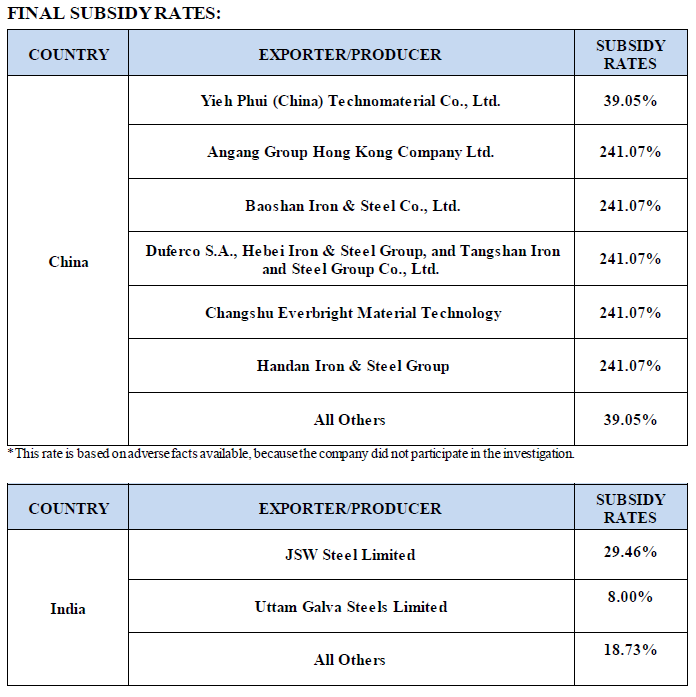

The steps of the process for the CORE AD/CVD suits have just been concluded with the Final Injury Ruling by the International Trade Commission. In that ruling, the ITC found dumping had occurred from the countries: China, India, Taiwan, Italy and South Korea. Countervailable subsidies occurred from China, Italy, India and South Korea. Taiwan was found to not have any countervailable subsidies.

The result of this ruling is that duties will be collected from the importer of record that is bringing in material from the countries named above. Below are the duty rates which were published by the U.S. Department of Commerce in their Final Determination ruling. The exact Final Duty is subject to some adjustments and should have been published in the Federal Register in late May/early June.

Cold Rolled AD/CVD Suit

On August 18, 2015, the U.S. Department of Commerce (DOC) announced the initiation of antidumping duty (AD) and countervailing duty (CVD) investigations of imports of certain cold-rolled steel flat products from Brazil, China, India, Korea, and Russia and AD investigations of imports of the same merchandise from Japan, the Netherlands, and the United Kingdom.

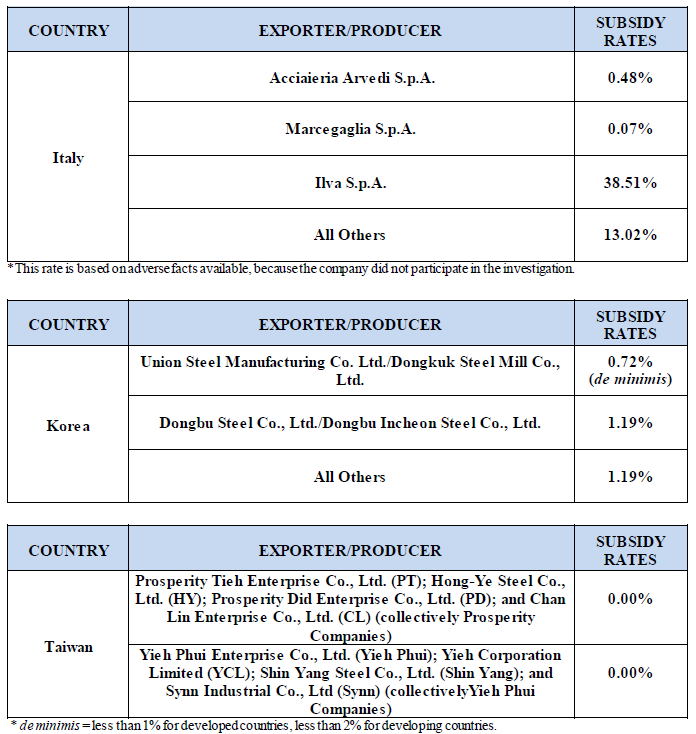

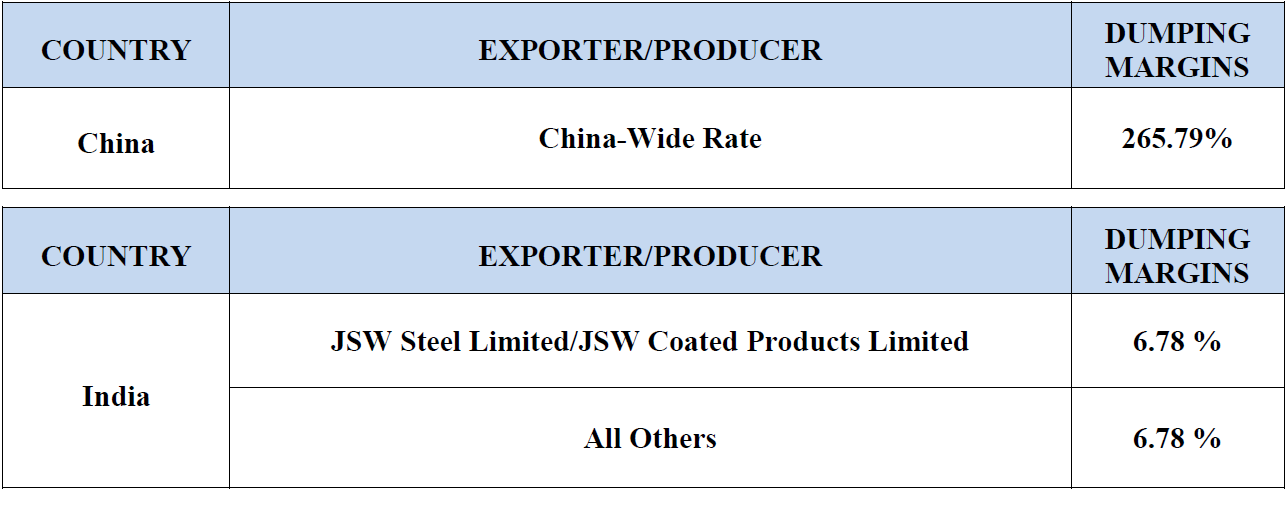

As the investigation proceeded, China and Japan were separated from the other countries as they refused to cooperate with the US DOC investigation. These two countries have been through the entire AD/CVD rulings and both were found to have dumped cold rolled steel here in the United States.

Here is a copy of the US DOC final determination duty rates for China and Japan:

Commerce’s final determinations in the investigations of cold-rolled steel from Brazil, India, Korea, Russia, and United Kingdom have been extended, and they are scheduled to be announced on or about July 13, 2016.

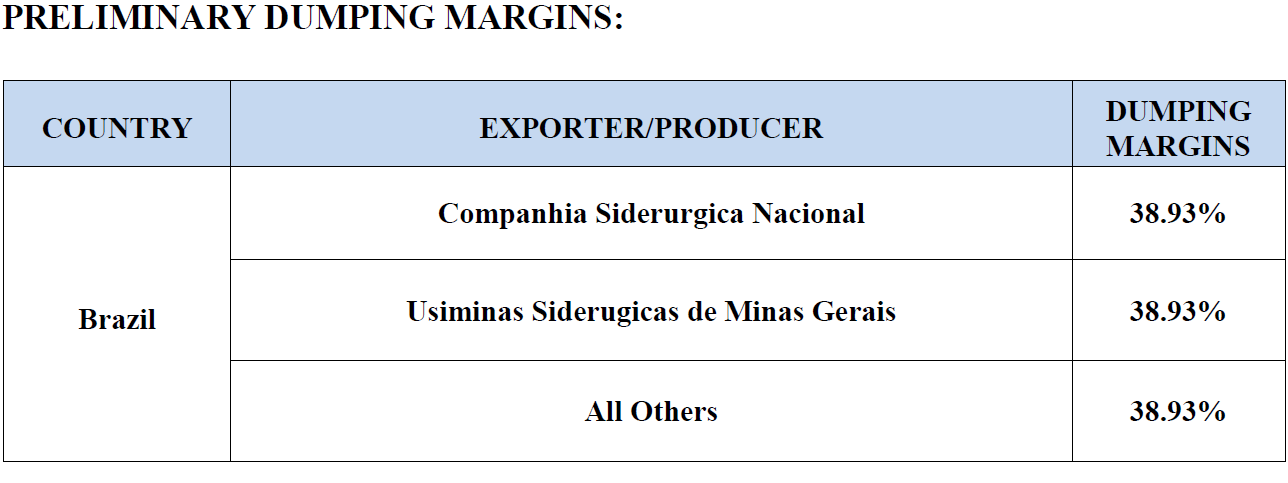

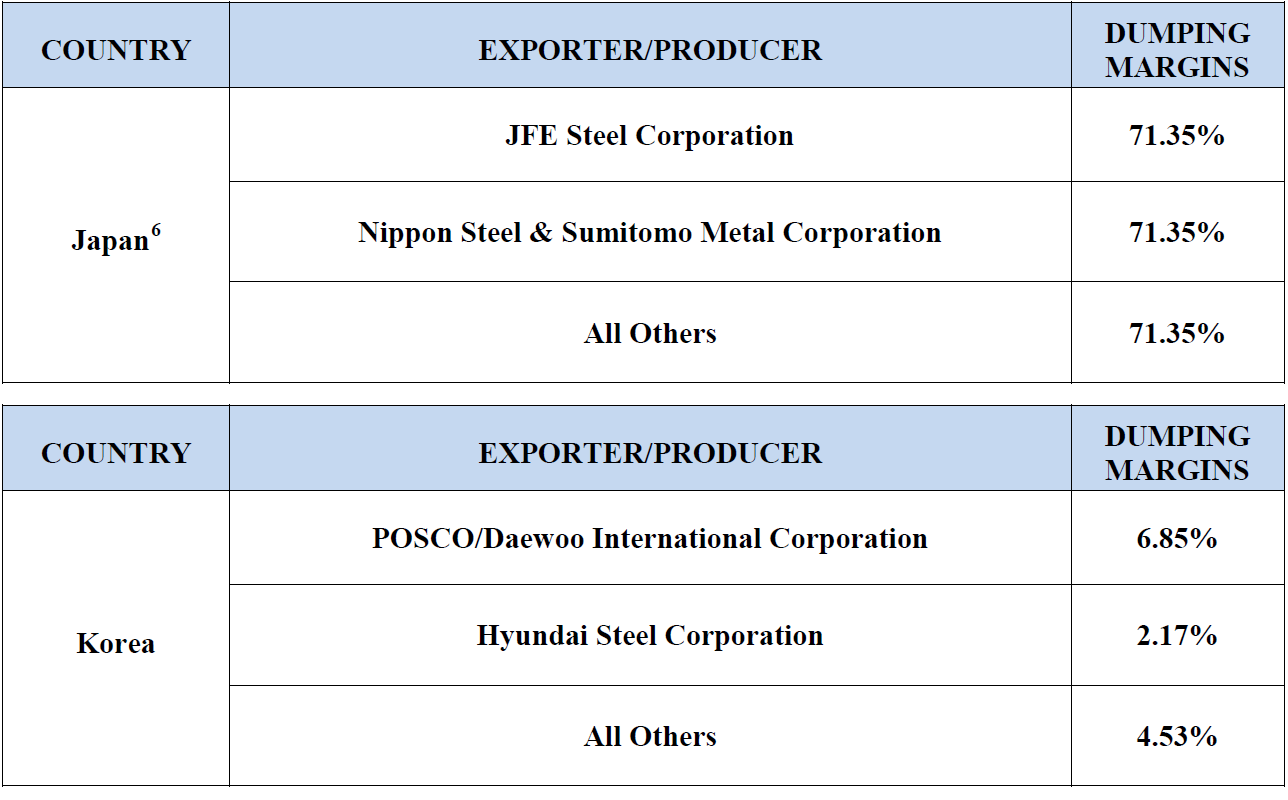

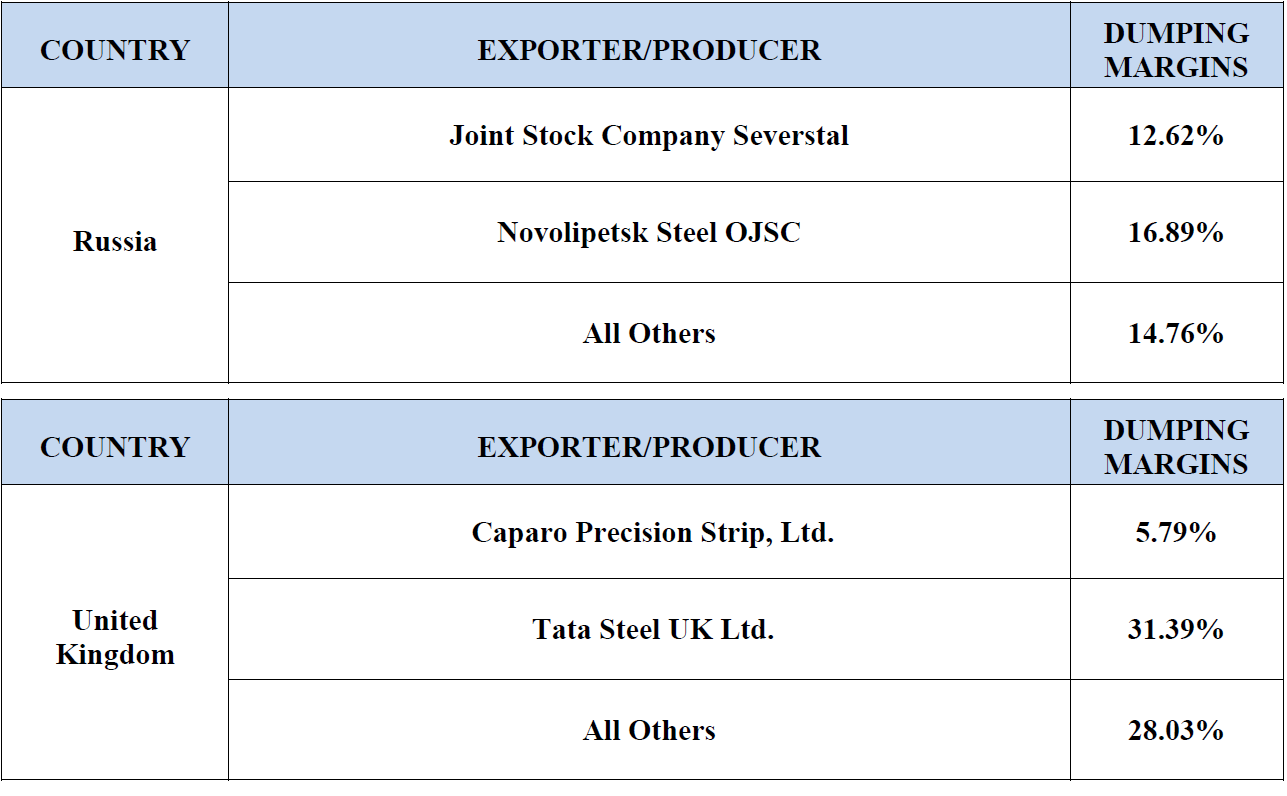

Until then we have the Preliminary Determinations which were presented on March 1, 2016 by the US Department of Commerce:

Hot Rolled AD/CVD Suit

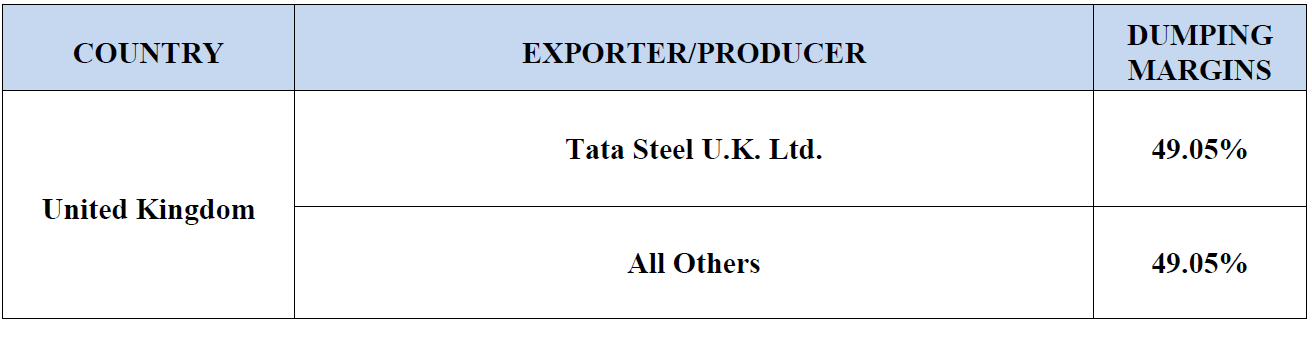

On September 1, 2015, the Department of Commerce (DOC) announced the initiation of antidumping duty (AD) and countervailing duty (CVD) investigations of imports of certain hot-rolled steel flat products from Brazil, the Republic of Korea (Korea), and the Republic of Turkey (Turkey) and antidumping duty investigations of imports of the same merchandise from Australia, Japan, the Netherlands, and the United Kingdom.

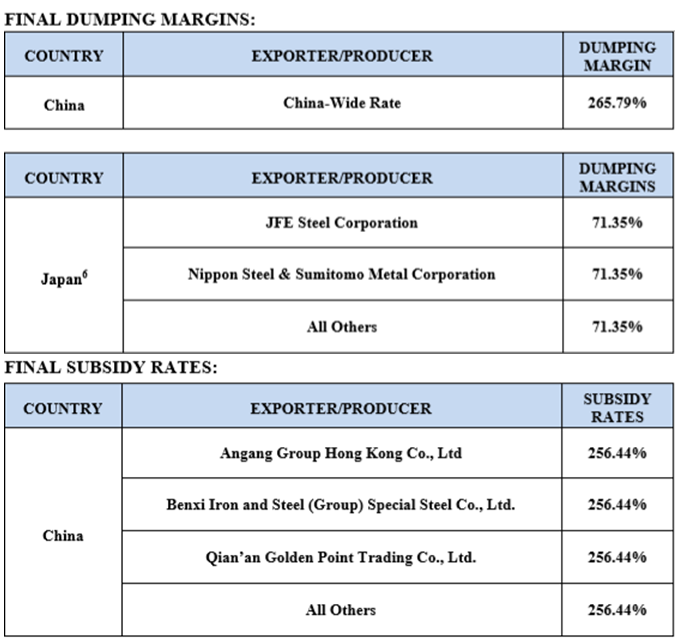

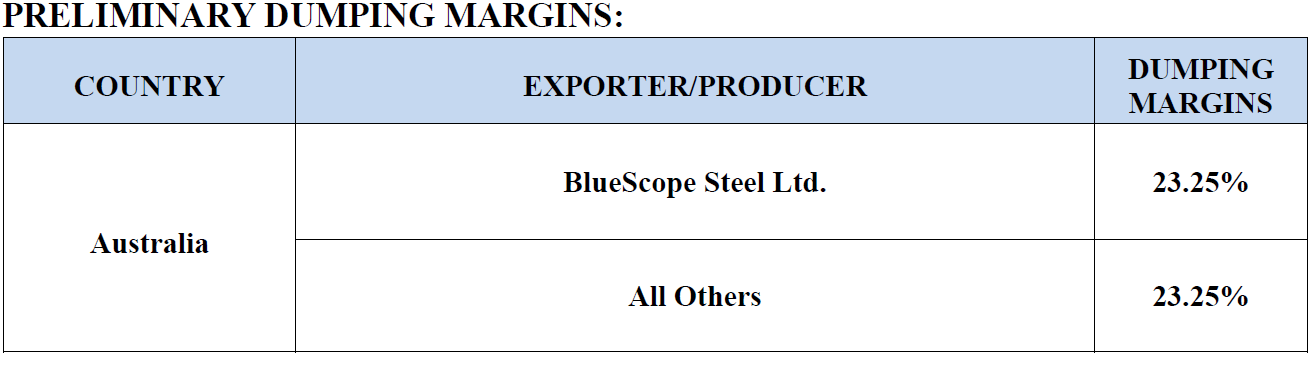

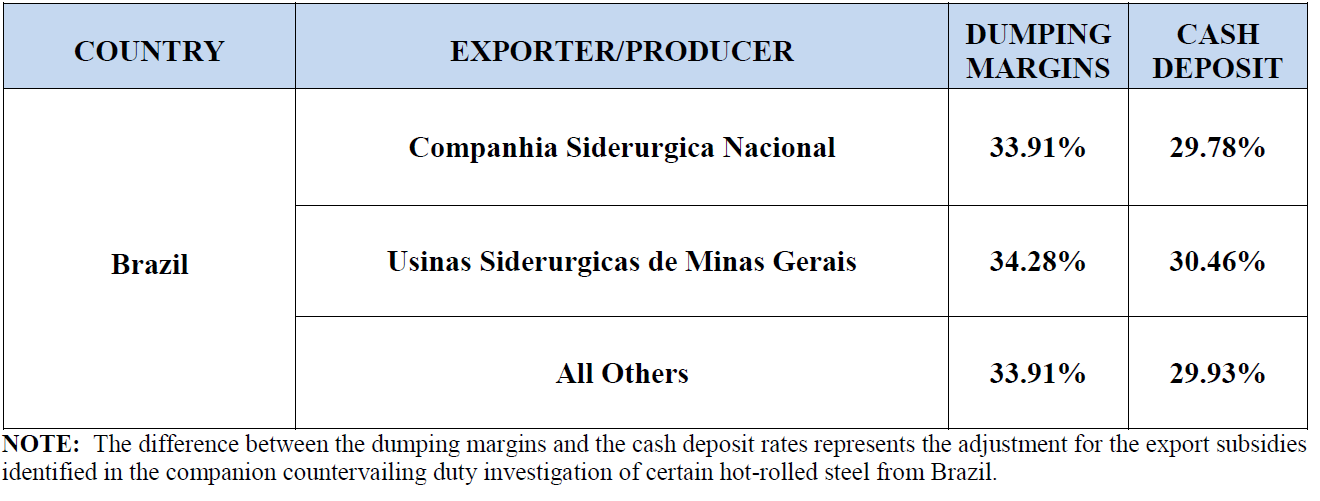

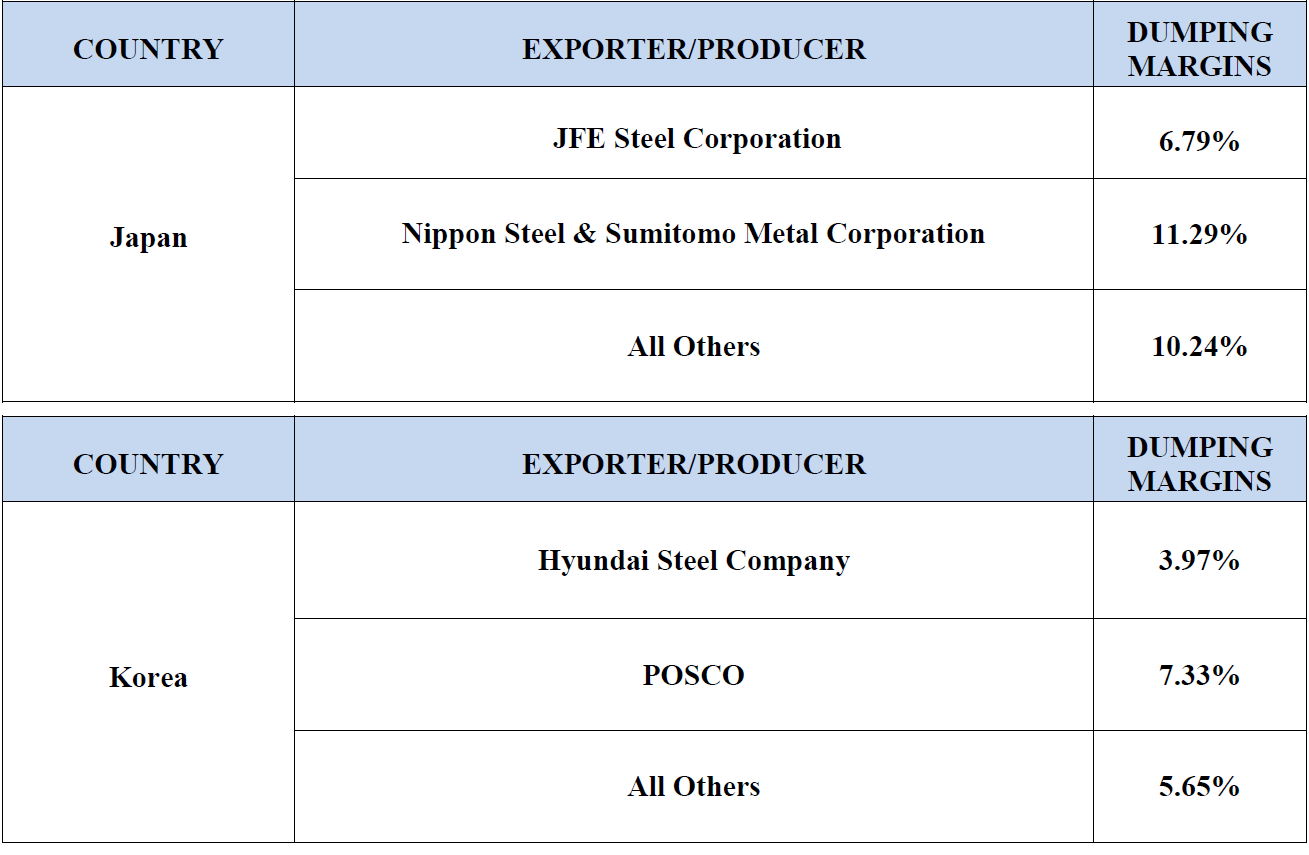

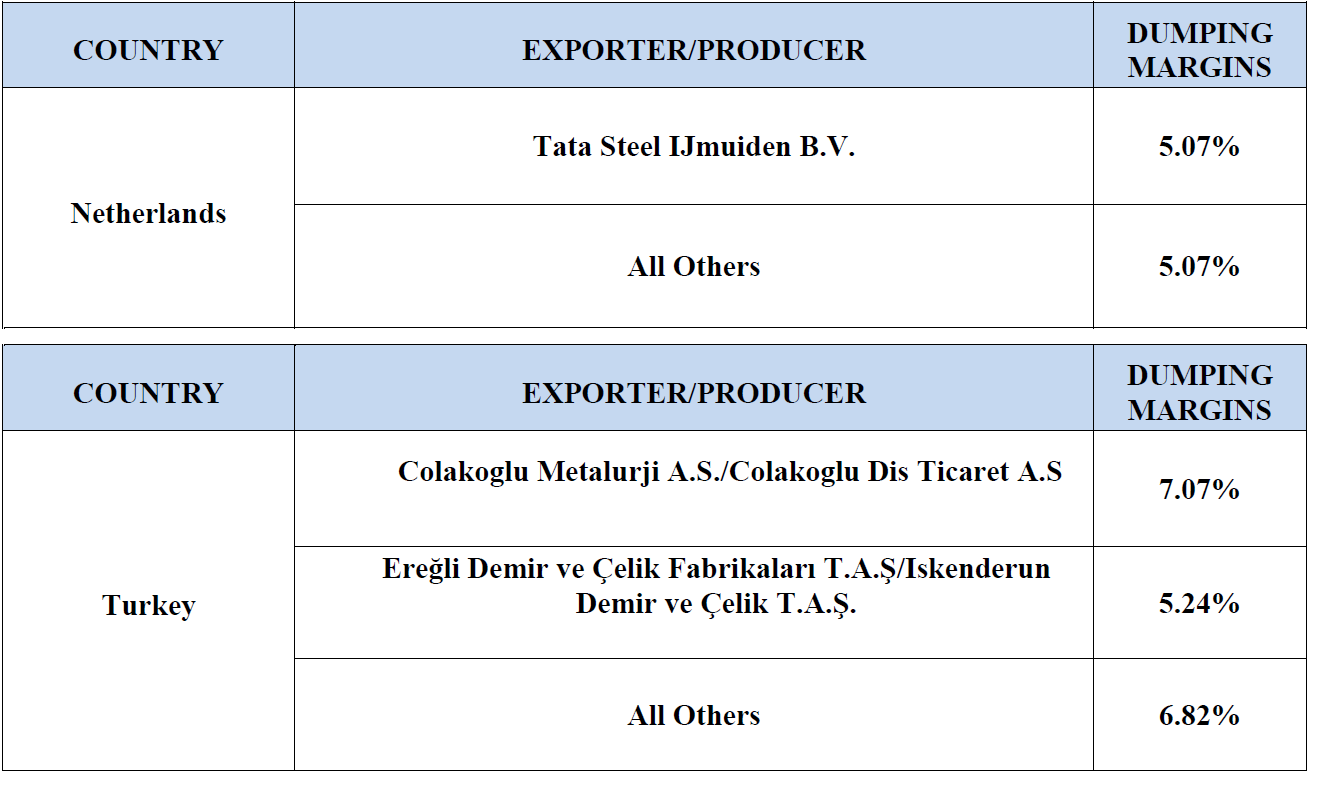

On March 15, 2016, the Department of Commerce (DOC) announced its affirmative preliminary determinations in the antidumping duty (AD) investigations of certain hot-rolled steel flat products from Australia, Brazil, Japan, Korea, the Netherlands, Turkey, and the United Kingdom.

The next step will be for the U.S. Department of Commerce to report their Final Determinations which are due on, or about, August 3, 2016. After that the ITC will rule sometime in September if these imports injured the domestic steel industry. At that point final duties will be assessed.

Here is what the Preliminary Determinations were on hot rolled:

If you would like to learn more about trade laws and the final status to all of these trade suits we will have a special program with trade attorney Lewis Leibowitz at this year’s Steel Summit Conference. His program will begin on Monday, August 29th at 3:30 PM at the Marriott Gateway Hotel at the Atlanta Airport. This is the host hotel for our 6th Steel Summit Conference which continues at the Georgia International Convention Center on Tuesday and Wednesday, August 30 & 31st. Details about our program, speakers, lodging and costs can be found on our website: www.SteelMarketUpdate.com. You can also register to attend through our website. If you have any questions please contact us at: 800-432-3475.