Prices

August 11, 2016

Hot Rolled Futures Trading More Briskly as Sellers Enter the Market

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

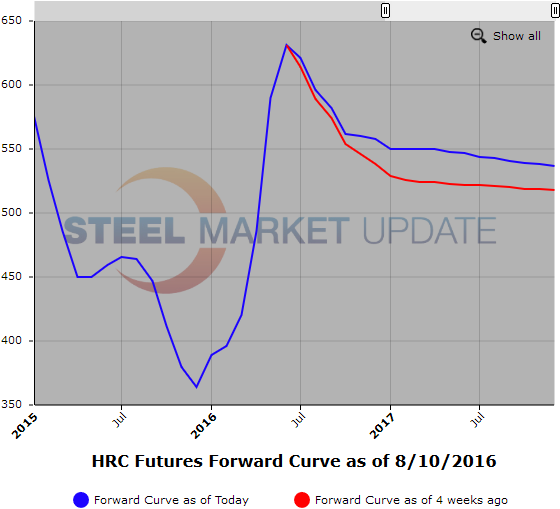

HR futures prices are down over $10/ST Sep’16/Dec’17 over the last week, roughly in line with the different indexes being reported. SMU reported HR down to $600 last. With the indexes continuing to drop, the futures are trading more briskly as sellers enter the market. The larger drop in the indexes appears to have given markets a strong enough signal to sell the curve. Activity has picked up with 23,500 ST trading in the last week. with the focus widening from Cal’17 to Sep’16,Q4’16,Q1’17, Q2/Q4’17, and Cal’17. Sep’16 traded at $582/ST on Tuesday and again today at $574/ST. Q4’16 traded @ $560 in 3,600 ST on both Friday and Monday. Q1’17 traded @ $547/ST average in 4,920 ST on Tuesday and today.

Open interest for HR futures is 376,920 ST or 18,846 contracts.

Scrap

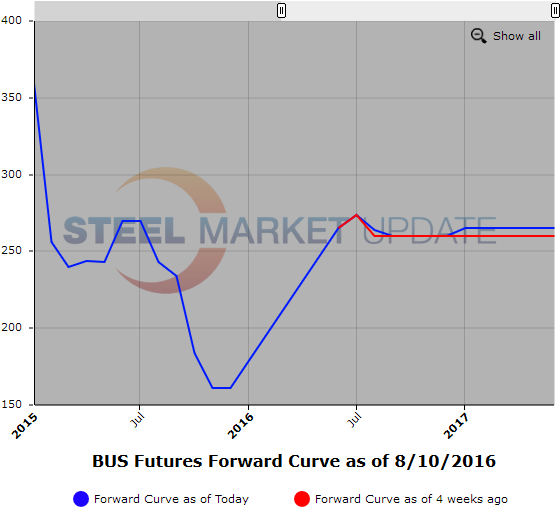

CFR Turkish scrap is holding steady at $229/MT due to robust demand. Higher Chinese Steel prices and Billet prices have kept this market well bid. Narrowing lead times for HR and tepid demand for scrap from mills saw BUS slip roughly $10 to $264 for August. Sep/Dec’16 traded $260/GT today. Market offers look to be coming in slighty in Q4’16. With Sep/Dec’16 bid today at 552.5 and Sep/Dec’16 sold in BUS the metal margin spread is running at roughly $292 which reflects a drop from $300 plus.

Below is a graph showing the history of the hot rolled and busheling scrap futures forward curve. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.