Prices

March 2, 2017

Hot Rolled Futures: Muted Week

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

HR futures trading has been very muted this week following last weeks high volumes that resulted from the mill price increase announcements and rising scrap prices. With the exception of a small trade in 2H’17 at $600/ST, futures trading has been absent perhaps due to more active physical trading.

There has been good two way futures interest but buyers are cautiously bidding well below current settlement values and sellers are offering slightly closer to the curve values on the topside. As an indicator of demand lead times have remained basically unchanged thus forcing market participants to wait for more clarity around domestic March scrap indexes and a stronger directional signal from physical spot prices.

The current offer in the balance of 2017 stands around $612/ST average ($635/ST offer Q2’17, $606/ST offer Q3’17 and $595/ST offer Q4’17) which coincidentally is roughly equivalent to the latest reported spot trade average. This is due to the $40 backwardation between Q2 and Q4’17. We expect futures trading to pick up on the back of a recent pickup in physical trading activity and rising production.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

Latest has bulk cargo trading in Europe at over $290/MT 80/20 CFR T. Recent established range has been 280/285 so $8 to $10 above. This should push the index, which has been at 283 the last few days, a bit higher. Have had a few folks in Europe looking for another small move up in the 10/15 range. Improving weather in Europe could spur additional demand from Turkey. Chinese Billet trading close to $500/MT could also improve demand from Turkey.

LME Scrap Snapshot

288/294 Mar’17

283/289 Apr’17

281/286 May’17

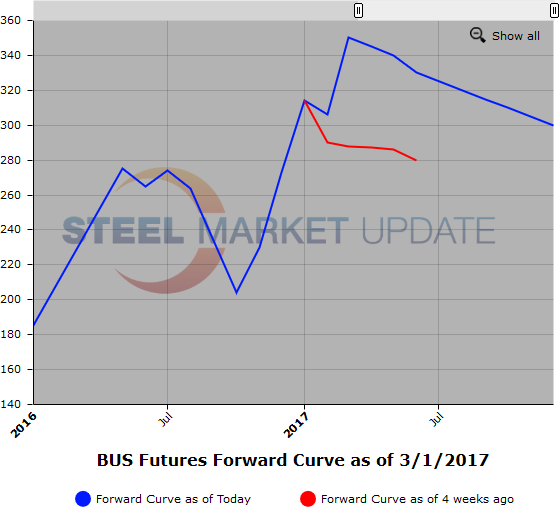

Market sentiment has domestic primes (BUS) up over $60/GT from last month. Have heard of a few outliar trades at $400/GT delivered. Probably including large freight expense. Also hearing shred expected up $40 per tonne. Question everyone is asking is how long can scrap prices remain at the current anticipated levels due to supply constraints and increased demand. Current BUS offers indicate there is some concern it might take a while before prices retreat.

BUS Scrap Snapshot

$345 bid indicated Mar’17

$350 offer Q2’17

$325 offer 2H’17

$315 offer Cal’18

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.