Prices

August 17, 2017

Hot Rolled Futures: Price Consolidation

Written by Troy Rossi

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Troy Rossi of Crunch Risk LLC. Here is how Troy saw trading over the past week:

Steel

This week, HR futures markets continued to see price consolidation along the curve as HR futures prices have found some support and bounced off of last week’s lower levels. In part on higher scrap prices and mills announcing $30 price hikes.

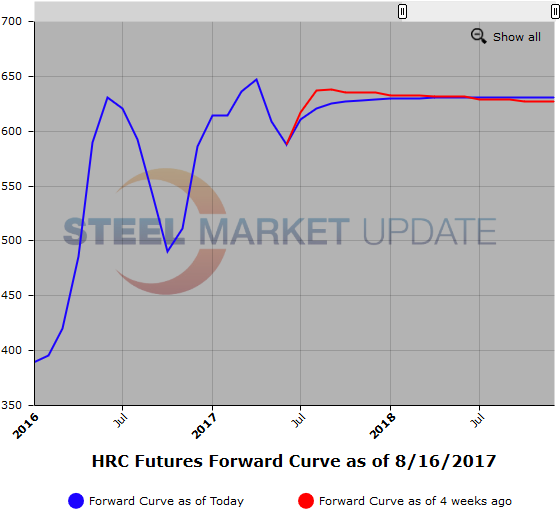

Volumes this week have been somewhat subdued, likely on seasonality and summertime holidays. With the flattish futures curve, hedgers can continue to buy forward futures at a small premium to spot. Have seen very modest change in the shape of the curve over the past week, slightly less contango on the forwards (spot to Q4 spread at $7 contango) and (Q4’17 to Q4’18 at $3 contango). Spot Index has seen limited movement the past two weeks (+$2/-$3) net $1 change. August Futures essentially trading in parity with spot index, with $6-$7 contango Aug. to Sep.

HR

Q4’17 628

Q1’18 630

Q2’18 631

Q3’18 631

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

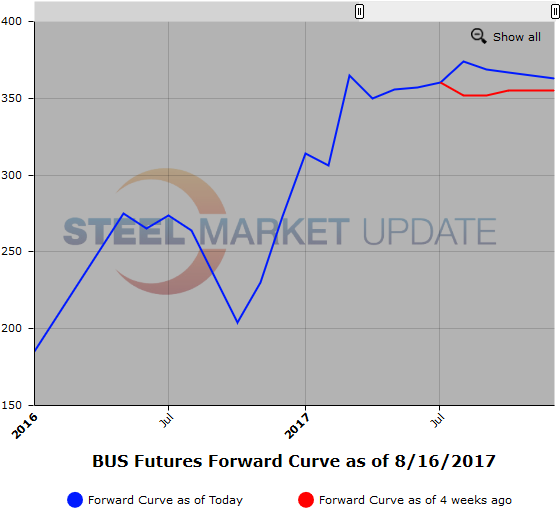

Scrap

Strong iron ore prices (which traded up about 5 percent overnight) continue to provide support to higher global steel production costs, which in turn are keeping raw material and export scrap prices very well bid. Specifically, Turkish demand continues to pull export scrap prices higher. Have seen limited scrap 80/20 export booking this week. One of note was said to have gone for $353 with expectations next booking will be higher, as having to reach in more places to find the scrap. Today, we had spot month SC (LME scrap) bid/offer at $345/$347/MT and Sept. at $352/$355, most volume trading $353 (which is down from last week’s high of $359, but up from this week’s low of $341). Basis the strong spot demand and higher priced cargos, the curve continues to be in a modest backwardation.

Focus around supplies of U.S. prime scrap continues to keep the BUS contract well bid. This week, Q4 BUS traded $365 on 700gt/m and Sep-Dec’17 traded @ $366 on 200gt/m.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.